In the realm of wire transfers, validating routing numbers is a critical step to ensure the accuracy and security of transactions. Developers face the challenge of finding a reliable and efficient method to validate routing numbers and obtain accurate bank information. In this article, we will delve into the significance of routing number validation, explore the challenges developers encounter, and discuss the best solution. A Validate Routing Number API revolutionizes the process of validating routing numbers in wire transfers.

The Problem: Importance Of Validating Routing Numbers

Validating routing numbers plays a vital role in the wire transfer process. Routing numbers are essential for directing funds accurately to the intended financial institutions. Errors in routing numbers can result in failed transactions, delays, and potential loss of funds. Additionally, incorrect routing numbers may expose transactions to the risk of fraud and unauthorized transfers. Developers need a robust solution that can efficiently validate routing numbers to prevent these complications and ensure secure and successful wire transfers.

The Solution: Validate Routing Number API

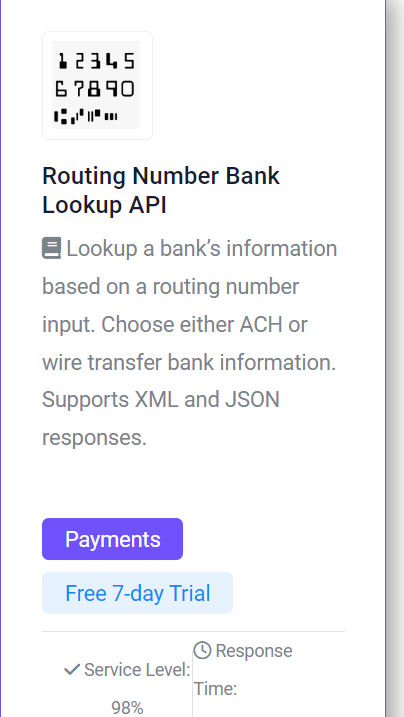

The Routing Number Bank Lookup API, hosted on the renowned Zyla API Hub, the marketplace for APIs, emerges as the ultimate solution for validating routing numbers in wire transfers. This powerful API empowers developers with a range of features and benefits that enhance the security, accuracy, and efficiency of bank transfers.

Benefits Of The Validate Routing Number API

Validating routing numbers is crucial in ensuring the accuracy, security, and success of wire transfers. With the Routing Number Bank Lookup API available at Zyla API Hub, developers have access to the best solution for validating routing numbers in wire transfers. By leveraging the powerful features and benefits of this API, developers can enhance the security and efficiency of their applications, streamline bank transfers, and provide a reliable and seamless user experience, such as:

Accurate Routing Number Validation

The API offers robust validation capabilities, enabling developers to instantly verify the authenticity and correctness of routing numbers. This ensures that transactions are securely directed to the intended financial institutions, minimizing the risk of errors and transaction failures.

Fraud Prevention Measures

With the API’s comprehensive database and advanced algorithms, developers can detect and prevent fraudulent activities associated with routing number misuse. By validating routing numbers, developers can safeguard the interests of businesses and individuals, enhancing the overall security of wire transfers.

Seamless Integration And User-Friendly Experience

Zyla API Hub provides a seamless integration process for developers, allowing them to easily incorporate the Routing Number Bank Lookup API into their applications. The user-friendly interface and detailed documentation further facilitate the implementation process, reducing development time and effort.

Getting Started: Validate Routing Number API

To access the Routing Number Bank Lookup API, developers need to visit www.zylalabs.com and register for an account on Zyla API Hub, the leading API marketplace. Registration is quick and straightforward, providing developers with instant access to a vast array of APIs.

Once registered, you can browse through the available APIs on Zyla API Hub. Select the Routing Number Bank Lookup API under the payment category, to unlock its powerful features and benefits for validating routing numbers in wire transfers.

Zyla API Hub offers a free 7-day trial for developers after registration. To test the capabilities of the Routing Number Bank Lookup API. During this trial period, developers can evaluate the API’s effectiveness, assess its impact on their wire transfer processes, and make an informed decision about choosing a subscription plan.

After the trial, developers can select a subscription plan that aligns with their requirements and usage. Subscribing to the Routing Number Bank Lookup API provides developers with an API key, which they can use to integrate the API into their applications seamlessly.

Example

Endpoint – Get Bank Information

INPUT

Format: JSON

Payment Type: Wire

Routing Number: 026009593

OUTPUT (API Response)

[

{

"status": "success",

"data": {

"routingNumber": "026009593",

"paymentType": "wire",

"name": "Bank Of America, N.a., Ny",

"telegraphicName": "BK AMER NYC",

"location": "New York, NY",

"city": "New York",

"state": "NY",

"fundsTransferEligible": "Eligible",

"bookEntrySecuritiesTransferEligible": "Ineligible",

"lastUpdated": "Jan 5, 2023"

}

}

]