In this post, you will find the best alternative to Trading Economics for Steel Prices.

Some commodities of relevance, such as steel, have seen dramatic drops in price since March of this year when they were at their greatest levels. Some analysts believe this is a precursor to the next economic collapse.

Even though they are still higher than before the epidemic began. Steel prices have dropped dramatically, falling from 1,647 dollars per ton at the end of March to 816 dollars per ton now, a drop of 50.45 percent, or half the price.

As for the reasons for this reduction, some experts believe it is related to the rise in interest rates in the United States, which makes requesting a loan more costly. A phenomenon that causes numerous businesses and sectors to curtail their investments, resulting in decreased demand and, eventually, a slowing of the economy. If you want to invest in this industry, you should stay updated about all the steel prices data. Trading Economics is one of the most important price sources in the world.

About Trading Economics

Trading Economics delivers reliable statistics for 196 nations, including historical data and projections for over 20 million economic variables, currency rates, stock indexes, government bond yields, and commodity prices. Your data comes from official sources rather than third-party data suppliers, and it is frequently reviewed for discrepancies.

This website is accessible in 200 countries. Investors, on the other hand, are now seeking an API that has more full documentation and works exclusively with metals to have more possibilities inside the sector and not dispersion.

But, What Is An API?

An API is a programming interface that allows you to distribute information between different devices. The programmers use the API to integrate the permanent updating of rates for metals such as steel into their sites. In this way, you do not have to update the information manually and you can work with various data that have to do with this industry.

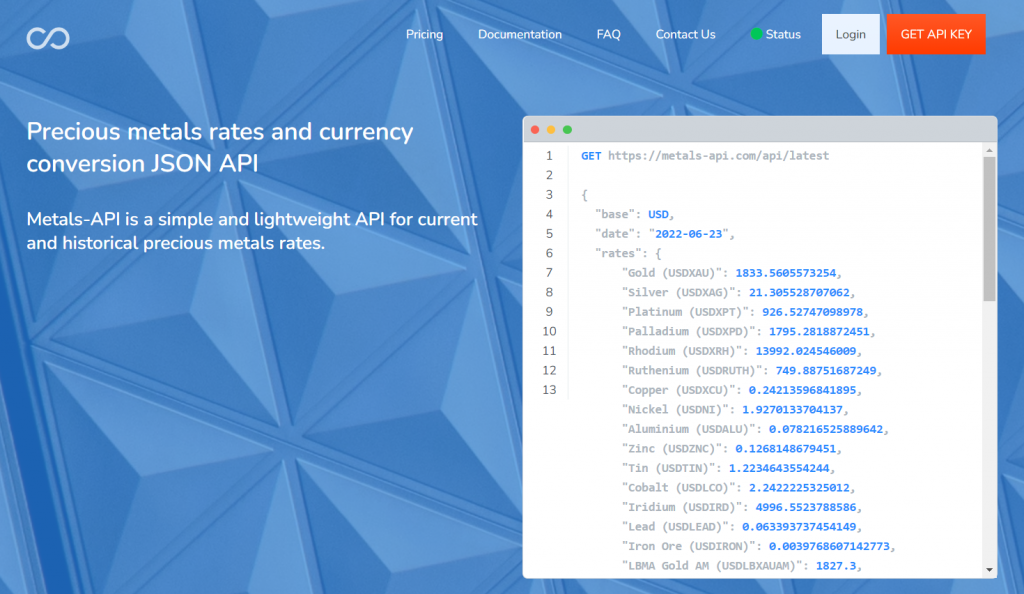

In this sense, our recommendation is going to be Metals-API, which is the most complete and famous on the market. You can sign up with basic plans and payments that depend on the number of requests you can generate per month. Programmers prefer it for its practicality and diversity of programming languages with which it works. You can use it in JSON, PHP, or Python.

Why Metals API?

With Metals-API you will be able to access the updated values of steel but also historical values. In this way, you will be able to compare the state of the market and understand what are similar situations to evaluate whether or not to invest or sell and when.

In this sense, you can also extract steel values from different important markets in the world, which is why it is said to be an LBMA rates API. You can also use the information on other metals and various international currencies to globally analyze the state of the metal market. You can access steel prices, nickel prices, lithium prices, or more.