In this article, we’ll see the benefits of using the VAT Validation API in 2022.

All member states of the European Union have a tax known as VAT or value-added tax. Virtually all products and services purchased and sold in Europe, whether for personal or business use, are subject to the VAT consumption tax.

It is categorized uniformly across all nations into three levels: general, reduced (for things like food and transportation), and super-reduced (foodstuffs, newspapers, books, etc.). However, each nation sets its application rates, and some have even done away with the super-reduced fee.

Other so-called special rates, such as the zero rate and the “parking” rate, are available in addition to the VAT rates stated above. When a customer is exempt from paying VAT but the business is allowed to do so since it paid it on the purchase, zero rates are applied.

Certain deliveries of goods and services that are not covered by the VAT Directive are subject to the “parking” rate, which is used in some nations (such as Portugal, Belgium, or Austria).

Knowing the European VAT legislation is required to make the most of any opportunity that presents itself, such as new European consumers, given the current state of business. The majority of the things you buy in Europe are subject to VAT, so you should be aware of that right away.

As a result, you will need to apply and accumulate VAT. However, other operations, such as exports outside the EU, are exempt from VAT since it is applied and accrued in the nation of importation.

The EU is putting in place a unique regime for imported goods; following this transition, the system of destination taxes will be implemented. This rule makes a distinction between distance sales within a community and sales of items imported from other nations; the latter will be subject to a new special regime in which the VAT exception for the import of low-value goods will be withdrawn.

Use An API

Many companies look for resources such as APIs to validate their VAT numbers, this has some benefits. First of all, being able to use an API for this means that you can process a large number of VAT numbers so you won’t waste time looking at each number one by one to check it. You also won’t spend money hiring a lot of people so that they can process that huge amount in less time.

On the other hand, having to be doing the same task all the time can be tiring and produce a higher margin of error. These involve losing sight of a number, misplaced numbers, and more. With an API you will have a smaller margin of error.

In addition, if you choose to check it with VAT Validation API particularly you will be able to get data such as the company name and location. Programmers count as one of its main benefits is the fact that it can be integrated with various programming languages.

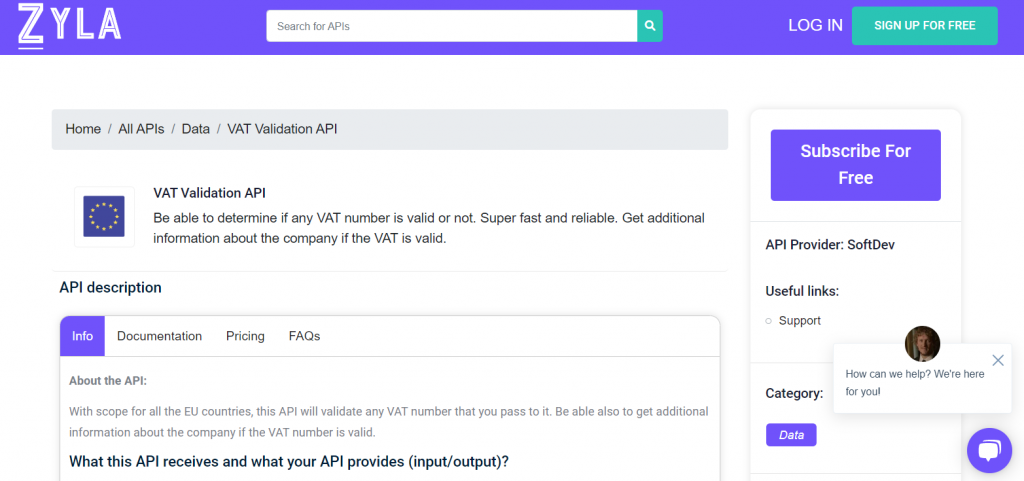

About VAT Validation API

VAT Validation API has come out in the technological world to help companies to show transparency in their accounts. Everyone prefers companies that are paying their taxes as any citizen should. That is why using this API will allow us to demonstrate this quickly. In addition, many government agencies also use it to check tax collection.