Utilizing technology to simplify processes is critical for success in today’s fast-paced and digitally driven company market. The Banking Information API is one such technology that has emerged as a game changer.

Financial data APIs may provide significant benefits to companies and people that wish to access and use financial data. Developers may use these APIs, for example, to construct apps and services that interface with financial systems, providing users with real-time data and improved functionality.

Financial information APIs may also assist firms in improving their operations by providing access to data that can assist them in making better decisions and managing their finances. Banks, for example, may use APIs to provide real-time information about their customers’ accounts and transactions, increasing transparency and customer service.

This journalistic piece investigates the several advantages that firms may enjoy by adopting a Banking Information API into their operations. These APIs are transforming the way organizations manage financial information, from increased efficiency and accuracy to greater risk mitigation and client experiences.

What Are The Benefits Of Using A Banking Information API For Your Business

Information that is accurate and up to date: A Banking Information API gives you access to up-to-date and accurate banking data. It allows you to get data such as bank names, branch information, account numbers, routing numbers, and other pertinent information. You may ensure that you have the most up-to-date and dependable financial information for your company transactions by utilizing this API.

Banking Information APIs are built to interface smoothly with your existing systems and applications. They provide defined endpoints and data formats, which makes it easier for developers to incorporate financial data into their processes. You may use this integration feature to automate procedures, decrease human data entry, and streamline operations.

Increased Efficiency and Productivity: A Banking Information API allows you to automate time-consuming operations like manually checking bank account data. You may drastically eliminate human error and save time by obtaining and confirming financial information programmatically. This allows your staff to concentrate on more important business operations, increasing overall productivity.

Risk Mitigation and Compliance: In the financial business, compliance with rules is critical. By giving access to correct financial data, a financial Information API may help you limit risk and maintain compliance. It enables you to validate bank accounts, conduct anti-money laundering (AML) checks, and meet Know Your Customer (KYC) regulations. You may improve data integrity and safeguard against fraudulent activity by exploiting the API’s built-in security capabilities.

Customer Experience Enhancement: Integrating a Banking Information API into your customer-facing apps or platforms helps improve the user experience. When clients enter their bank account information, for example, the API can check the information in real time, reducing mistakes and guaranteeing a seamless transaction process. This boosts client trust, increases transaction success rates, and increases overall satisfaction.

Scalability and adaptability: Banking Information APIs are built to handle large quantities of queries and scale as your organization grows. The API can fit your demands whether you need to authenticate a few bank accounts or handle thousands of transactions. It also gives flexibility, allowing you to get certain data points or tailor the API connectivity to your individual business needs.

Savings: By utilizing a Banking Information API, you may save money on operational expenditures such as manual data entry, data maintenance, and customer assistance. The API’s automation and accuracy lead to cost savings, allowing you to manage resources more efficiently and concentrate on essential company tasks.

Which Routing Bank Checker API Provides The Best Service?

We can certainly state that, after thoroughly researching various market alternatives, we have selected one that, owing to its functionality and ease of use, is among the greatest current possibilities.

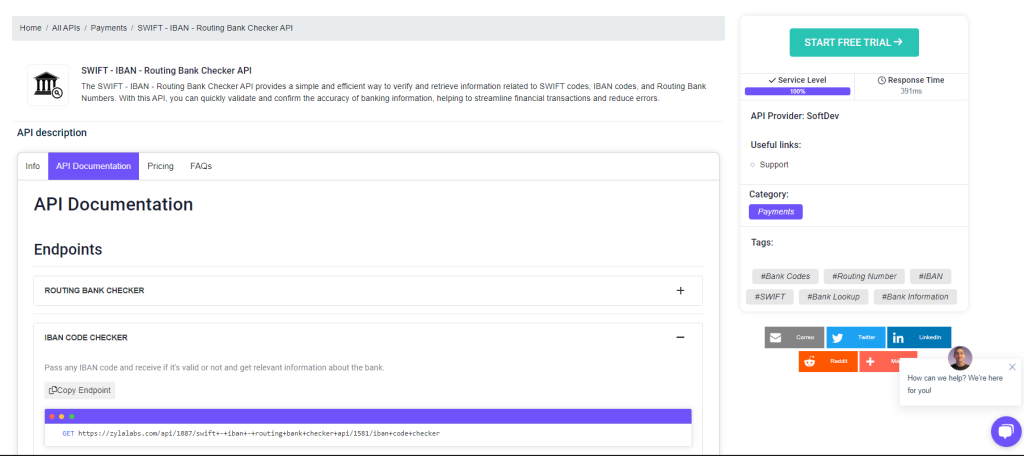

As previously said, we picked the Zylalabs SWIFT – IBAN – Routing Bank Checker API since it has served us well and is easy to use even if you are unfamiliar with it.

Use a routing number, IBAN code, or SWIFT code to look up a bank’s information. Choose whether to utilize ACH or wire transfer banking information. It takes XML or JSON responses.

For example, if you enter the IBAN code “PT50000101231234567890192” into the endpoint “IBAN CODE CHECKER,” you will receive the following response:

{

"status": 200,

"success": true,

"message": "PT50000101231234567890192 is a valid IBAN",

"data": {

"iban": "PT50000101231234567890192",

"country": "Portugal [PT]",

"sepa_country": "Yes",

"checksum": "50",

"bban": "000101231234567890192",

"bank_code": "0001",

"branch_code": "0123",

"account_number": "12345678901",

"check_digit": "92",

"bank_details": {

"swift_code": "BGALPTTGXXX",

"bank_name": "BANCO DE PORTUGAL",

"branch": "SISTEMAS DE PAGAMENTOS",

"address": "AV. ALMIRANTE REIS, 71 EDIFICIO PORTUGAL",

"city": "LISBON",

"zip": "1150-012"

}

}

}

Where Do I Find SWIFT-IBAN-Routing Bank Checker API?

- Begin by going to SWIFT-IBAN-Routing Bank Checker API and clicking the “START FREE TRIAL” button.

- After joining Zyla API Hub, you will be able to utilize the API!

- Make use of the chosen API endpoint.

- When you’ve reached your endpoint, make an API call by clicking the “test endpoint” button and seeing the results on your screen.

Related Post: Why An API Is The Best Answer To International Transactions