Data-driven insights and analytics are crucial in strategic decision-making in today’s ever-changing financial landscape. A Banking Information API is a precious tool for gaining access to critical fiscal information.

APIs for fiscal data may offer substantial benefits to companies and people seeking to pierce and use fiscal data. These APIs may be used by inventors to make apps and services that connect to fiscal systems and give consumers real- time data and increased functionality.

Fiscal details APIs may also help enterprises ameliorate their operations by giving them access to data that can help them make better opinions and manage their budgets. Banks, for illustration, may use APIs to give real- time information on their guest’s accounts and deals, thus boosting translucency and client service.

This detailed paper lodgings into how businesses may use a Banking Information API to drive fiscal analytics, gain practicable perceptivity, and make informed opinions that power their fiscal success.

What Are The Benefits Of Using A Banking Information API?

Access to dependable and comprehensive fiscal information is critical for making educated judgments in the complicated and data-driven world of investment analysis. A Banking Information API is an important instrument that can transfigure investment exploration. This composition discusses the several advantages that businesses and investors may get by exercising a Banking Information API for investment analysis.

- Validate the authenticity of SWIFT codes

- Gain access to IBAN codes and verify them

- Validation of Routing Bank Numbers

- Reduce the risk of errors and ensure that transactions are processed quickly and accurately

- Easy integration into your existing financial systems (large financial institutions and small businesses alike)

- Streamline transactions

- Reduce the risk of penalties and legal issues

- Limit the possibility of fraud and mistakes

Which Banking Information API Provides The Most Reliable Data?

We can certainly state that, after thoroughly researching various market alternatives, we have selected one that, owing to its functionality and ease of use, is among the greatest current possibilities.

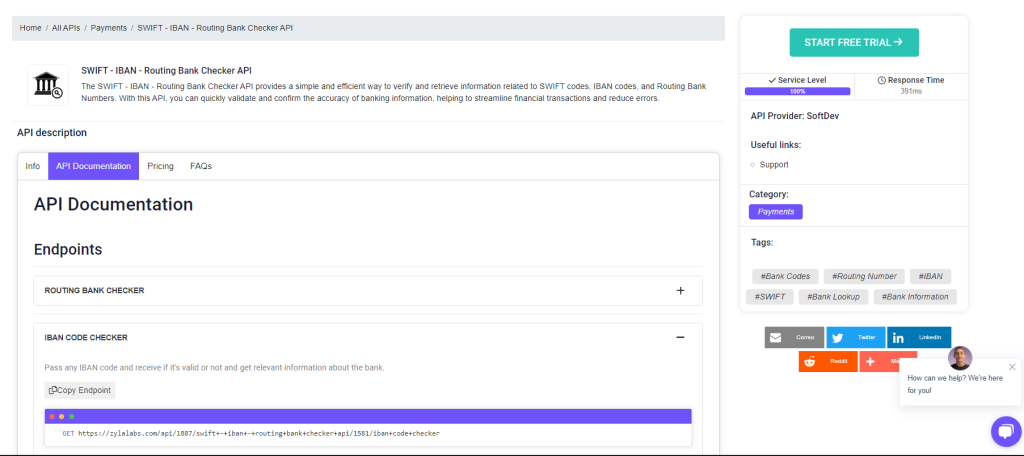

The Zylalabs SWIFT – IBAN – Routing Bank Checker API was chosen because it has served us well and is straightforward to use even if you are unfamiliar with it.

Use a routing number, IBAN code, or SWIFT code to look up a bank’s information. Choose whether to utilize ACH or wire transfer banking information. It takes XML or JSON responses.

For example, if you input “121000248” into the endpoint “ROUTING BANK CHECKER” you will get the following response:

{

"status": 200,

"success": true,

"message": "Routing Bank 121000248 is valid",

"data": {

"routing_number": "121000248",

"date_of_revision": "091012",

"new_routing_number": "",

"bank": "WELLS FARGO BANK, NA",

"address": "255 2ND AVE SOUTH",

"city": "MINNEAPOLIS",

"state": "MN",

"zip": "55479",

"phone": "(800) 745-2426"

}

}

Where Can I Get The SWIFT-IBAN-Routing Bank Checker API?

- To begin, go to SWIFT-IBAN-Routing Bank Checker API and click the “START FREE TRIAL” button.

- After joining Zyla API Hub, you will be able to utilize the API!

- Use the API endpoint you’ve chosen.

- When you’ve arrived at your destination, perform an API call by clicking the “test endpoint” button and seeing the results appear on your screen.

Related Post: Complete Guide On Using A Banking Information API For Financial Analytics