In today’s digital age, small and medium enterprises (SMEs) are facing many transformational challenges. One of such is managing the financial operations efficiently ensuring accuracy and security. One key aspect of financial management is verifying bank routing numbers. Which play a crucial role in ensuring seamless transactions and avoiding costly errors. Bank Routing Number Verification API can optimize SMEs’ transactions streamlining their operations and offering a range of advantages.

Accurate And Reliable Data Verification

A Bank Routing Number Verification API enables SMEs to validate the accuracy of bank routing numbers associated with their transactions. This accuracy minimizes the risk of errors and ensures smooth transaction processing.

Cost and Time Savings

Manually verifying bank routing numbers can be a time-consuming process, especially for SMEs handling numerous transactions. SMEs can automate the verification process, saving valuable time and reducing operational costs. The API swiftly validates the routing numbers, eliminating the need for manual checks and minimizing the potential for errors or delays.

Fraud Prevention and Risk Mitigation

Fraudulent activities pose a significant threat to SMEs. By utilizing a Bank Routing Number Verification API, SMEs can enhance their security measures and mitigate the risk of fraudulent transactions. The API verifies the legitimacy of the bank routing numbers. Ensure that the payments are directed to the right destination. Reduces the likelihood of financial losses due to fraudulent activities.

Improved Payment Accuracy

Accurate payment processing is vital for SMEs to maintain strong relationships with their suppliers, vendors, and customers. By utilizing the Banking Information API, SMEs can enhance their security measures and mitigate the risk of fraudulent transactions. Additionally, the API validates bank routing numbers, ensuring that payments are directed to the correct accounts. This active approach significantly reduces the likelihood of financial losses caused by fraudulent activities This enhances payment accuracy, strengthens business relationships, and instills trust among stakeholders.

Seamless Integration and Scalability

Routing Number lookup API is specifically designed to be seamlessly integrated into the existing software of SMEs. These APIs actively facilitate smooth integration, allowing for efficient data exchange and communication between different systems. By actively integrating with the existing infrastructure, these APIs enhance operational efficiency, streamline processes, and optimize the overall functionality of the system. SMEs can leverage the power of these APIs to achieve a higher level of integration and maximize the benefits of their existing systems. These APIs offer flexible integration options, allowing SMEs to incorporate the verification process into their payment workflows without disrupting their operations. Additionally, as SMEs grow and expand, the API can scale effortlessly to accommodate increasing transaction volumes and evolving business needs.

Enhanced Customer Experience

For SMEs, providing a seamless and positive customer experience is essential for building loyalty and gaining a competitive edge. A Bank Routing Number Verification API facilitates smooth payment processes, ensuring that customers’ transactions are processed accurately and efficiently. This, in turn, enhances customer satisfaction and helps establish SMEs as reliable and trustworthy partners.

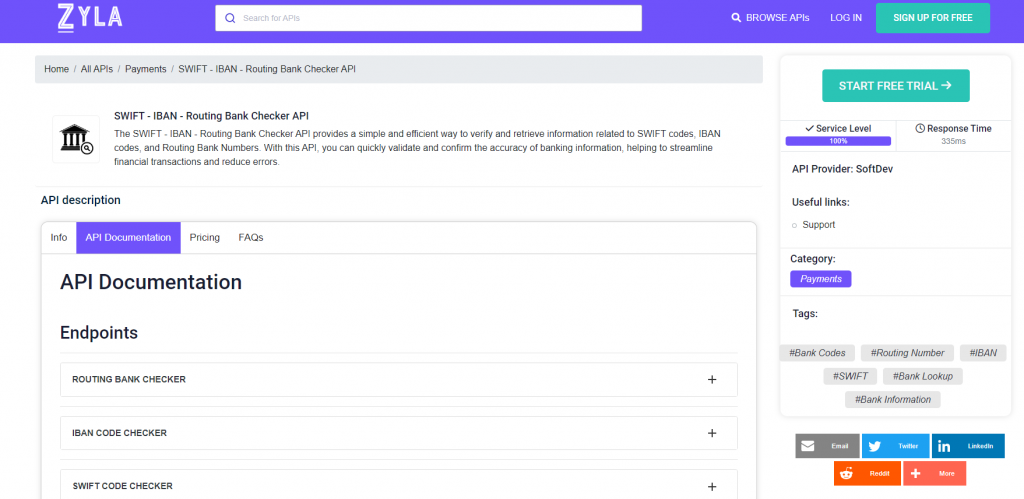

Unleash The Power Of The Ultimate Banking Information API

A Bank Routing Number Verification API offers numerous benefits to SMEs, ranging from accurate data verification and cost savings to fraud prevention and improved payment accuracy. By leveraging the power of SWIFT – IBAN – Routing Bank Checker API for your next SMEs project. You can streamline their financial operations, enhance security measures, and deliver exceptional customer experiences. Whether it’s for validating routing numbers, preventing errors, or mitigating risks, integrating a Bank Routing Number Verification API into the operations of SMEs can significantly contribute to their success and growth in the ever-evolving business landscape.

To explore the API, visit www.zylalabs.com and navigate to the Categories menu, select the Payments option. This will take you to the page featuring the Best Payment APIs, where this API is located. By clicking on the API, you will be directed to the API’s dedicated page. Here you can access detailed information and documentation. This documentation provides a list of available endpoints.

To get started, take advantage of the free 7-day trial, allowing you to experience the API’s functionality. Additionally, you can choose a suitable plan based on your monthly call requirements from the available options.

How To Use Bank Routing Number Verification API?

To start using SWIFT – IBAN – Routing Bank Checker API you need to navigate to the API dedicated page as described above. Then by clicking on the start free trial option on the upper right side of the screen, you can start your free trial. You can send API requests using different endpoints based on your interest. Once you selected your needed endpoint, make the API call by pressing the button “run” and get the API response.

Example

Routing Number (INPUT) – 121000248

Below is the API response (OUTPUT)

{

"status": 200,

"success": true,

"message": "Routing Bank 121000248 is valid",

"data": {

"routing_number": "121000248",

"date_of_revision": "091012",

"new_routing_number": "",

"bank": "WELLS FARGO BANK, NA",

"address": "255 2ND AVE SOUTH",

"city": "MINNEAPOLIS",

"state": "MN",

"zip": "55479",

"phone": "(800) 745-2426"

}

}