You can find the actual closing Iron price very easily. With an API like the one we propose here, you can do it.

Most companies depend heavily on steel. Humans use it for building work in addition to the production of several various tools and mechanical parts. The chemical elements that are ductile and malleable inside steel, or its constitution, impact the material’s properties.

In a variety of ways, iron may be found nearly everywhere in our everyday lives. They use this metal to produce items like automobiles, farm machinery, heavy weaponry, and technology. In addition, there is the framework for ships, railroads, armored cars, and railways.

Iron Scenario International

By the close of 2022, iron ore costs might reach their lowest level in three to four years. Next year, they will likely stall once again since China and Europe are decreasing their steel production while fresh market pressure builds up.

Predicted rates for the necessary element of steel range from about $90 per tonne to a high of $115 by the end of this year. Year-end values haven’t been at this level since the 2019 number of $93 per tonne, which was also at the far lower 2018 level of $72.60.

Global prices for iron headed for China, which makes roughly half of the steel produced worldwide, have fallen by around 40%. This is based on their March 2018 top of moreover $160. Limited supply and liquidity problems are two problems it faces. It is because it abides by the stringent restrictions set forth by Covid-19 for the property industry.

Australia, the biggest manufacturer of the product in the globe, forecasts a 0.6% reduction in world industrial production this year to 1.947 million tonnes, which will be accounted for by declines of 2% and 7.1% in China and the European Union, respectively.

Australia supplies about two-thirds of China’s iron ore by sea imports. The Ukraine conflict is still having an impact on steel Europe’s production as ore inventories are running out and energy costs are rising. China, in contrast to the trend of global tightening, is attempting to boost its economy with stimulative measures.

Nearly two-thirds of the seaborne iron ore that China imports come from Australia. The effects of the crisis in Ukraine continue to harm markets as ore supplies fall and industrial output in Europe has problems by mounting energy shortages. Contrary to the global tightening trend, China is seeking to support its economy through fiscal stimulus.

To Determine The Iron Closing Price, Use An API

Because the iron industry serves as the foundation for several crucial businesses, numerous individuals want to learn about its dynamics. Because of this, you may check the current value if you’re a trader or help a few others make money by investing in this material.

In this manner, if you keep an eye on the price of this metal, you can easily identify its peaks and valleys and decide when it is the ideal moment to buy. Below, we hope to assist you with using state-of-the-art technologies when placing a wager on creating an excellent investment at the ideal time.

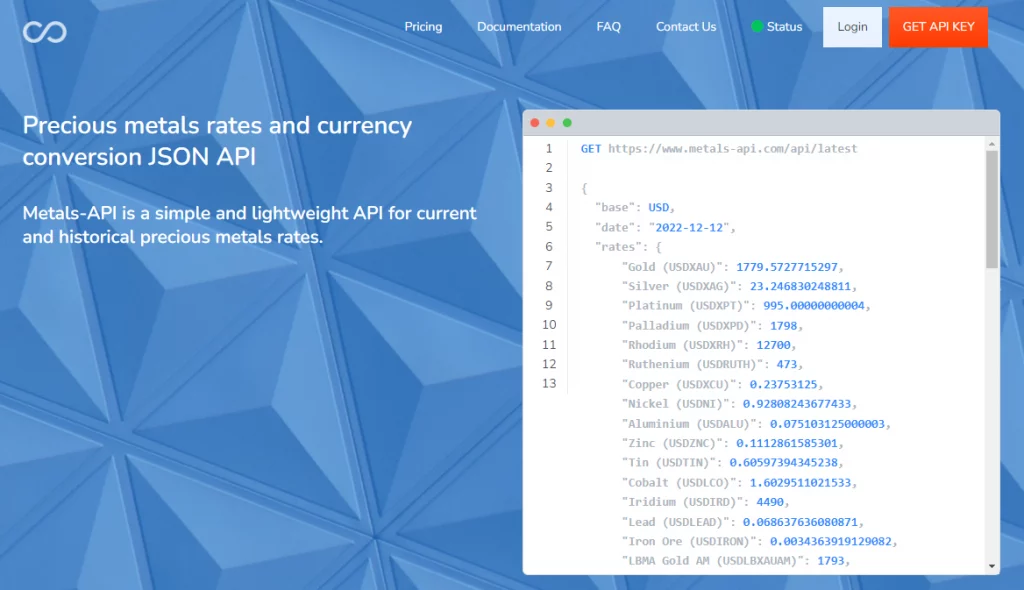

Putting in a lot of effort comparing costs, looking for current pricing, and other activities can be time-consuming. Therefore, using Metals-API, we will simplify things here for you. You can get all the most recent information from the most significant metal monetary regulators using it. Below is an example of a standard API reply:

Why Metals-API?

Coders choose Metals-API because it can quickly access a large amount of data. You may integrate it using the programming language of your choice into your apps and websites. You may compare many pieces of information, including previous prices, present costs, and statistics on fluctuations.

It also allows you to display prices in other currencies and contrast them to those of other metals. Market analysis and studies that are supported by reliable data may then be produced.