Do you want to incorporate a metals API immediately into your website? Here we propose the best one and thanks to its plugin you will integrate it!

The worldwide economy for precious metals is rising as a result of investors’ growing desire to conserve money and follow advances in precious metals’ worth. Additionally, it has to do with shifting lifestyle preferences and the need for greater disposable income. China, India, and other South Asian nations have a prominent role jewelry play in wedding customs.

In the Asia-Pacific region, it currently has the largest customer base. It will do so, at least until 2028. Some of the developing giants in the area include China, Japan, and India.

The economic effects of these on the precious metals industry are most pronounced in China. As of 2021, the country is the largest user of PGM and gold. The country’s strong domestic industrial sector is one important component driving consumption.

Furthermore, the second-fastest CAGR regarding volume is predicted for North America. Due to easy access to silver resources in Mexico and the existence of significant industrial centers in the US and Canada, the region’s precious metals sector may expand. As a result, the Asia-Pacific region can hold the largest market share in the future years.

The Effects Of The Military Conflict On The Metal Industry

We must take into account that the pre-war era is principally responsible for the current greater extent of metal prices. Due to COVID-19, its price saw a sharp drop before making a spectacular rebound.

Take into account how the cost of copper, the main metal essential for the weight-based energy shift, grew from 5,000 dollars/t during the pandemic to almost 11,000 dollars/t in 2021.

If we explicitly look at the Russian scenario, palladium prices show a similar pattern when compared to pre-conflict levels. Russia tops all manufacturers internationally with a 40% market share.

South Africa closely monitors it since it may substitute with certain supply concerns. But since palladium and platinum have repeatedly been shown to be relatively convertible, the market is testing both approaches to lessen the effects of potential supply limitations. Its primary use in vintage automobiles as a critical part of reducing the pollution will be what slows down cost in the medium term because it serves in hybrid cars.

With Metals Information, An API Is Available For Use

An API is a user interface with computer language rules. Since it governs how a program transfers data from one area of the software to another function, its code is very adaptable. Thanks to API standards, programs may interact with each other.

The API essentially gives a program the ability to access data or files that are already existent in a certain software system. The developers will utilize them after they move to a new software module or level.

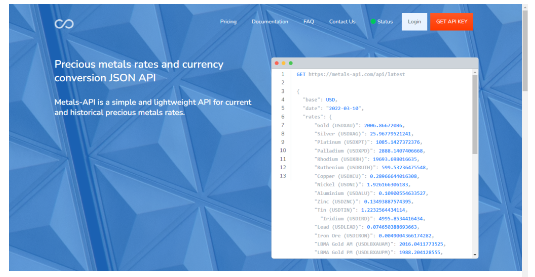

These technology protocols can create operating systems, online platforms, or databases in the future. In this case, we recommend Metals-API. The following are possible responses from the API:

Why Metals-API?

Your data on the metals industry will be updated second by second by the Metals-API. You will be able to view the metal prices in the desired currency. It may be integrated with any programming language you choose as well as using straightforward plugins.

You may examine all the elements affecting the metals market using this API. By doing so, you will develop your skills as an investor and gain the ability to counsel others. Your clients will value that you are sharing all of this important information. You can use it to determine when to make investments.