Did you know that you can get tax rates from a program? If you didn’t, you’re in the right place!

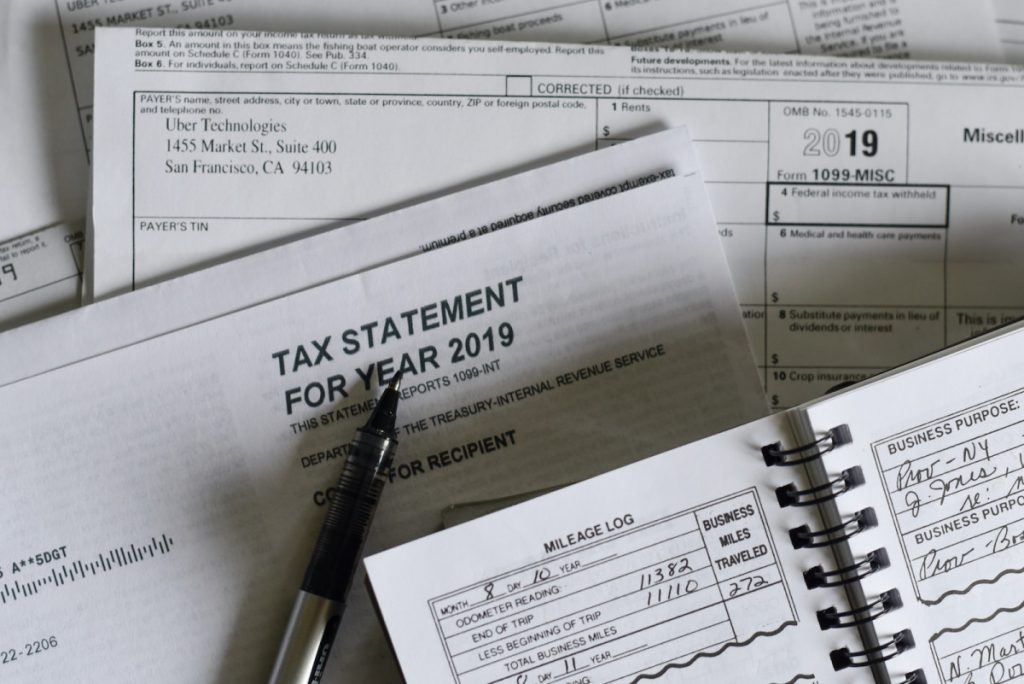

Taxes are a part of life for most people. We pay taxes on the money we earn, the goods we buy, and even the value of our property. But how much do you really know about taxes? Do you know how much tax you pay on your income? Or how much tax your employer pays on the wages they pay you?

What Are Taxes?

Taxes are one of the ways that governments raise money to pay for public services like education and healthcare. Taxes can be paid by both individuals and businesses. The money collected through taxes is used to fund public projects like road repairs and new schools.

There are many different types of taxes. Income tax is one of the most common types of taxes. Income tax is paid on earnings from employment or self-employment. Property tax is another common type of tax. Property tax is paid on the value of real estate such as houses and apartments. Sales tax is another common type of tax. Sales tax is paid on purchases made in retail stores.

How Do Taxes Work?

When you make a purchase or earn income, part of that money goes to taxes. This money is used by governments to pay for public services such as roads, schools, and healthcare. In return, governments provide us with services like police and fire protection, national defense, and public transportation.

Why Are Taxes Important?

In general, taxes are important because they help fund government programs that benefit society as a whole.

But there are also some specific reasons why taxes are important:

They help fund important social programs like education and healthcare.

They help pay for infrastructure like roads and bridges that help us get around more easily.

They help fund public safety programs like police and fire departments that keep us safe.

They help fund national defense programs like our military which keep us safe from foreign threats.

What API Is The Best

Because there are so many APIs available online, deciding which one is ideal for you can be difficult. However, if you want a precise and dependable API, we propose using The Taxes API, which is the best Taxes Calculator API accessible in 2024.

This online application is great for both organizations and individuals that need to quickly and conveniently calculate taxes. This is because The Taxes API operates in a straightforward style that is simple to comprehend and utilize.

Simply input the name of the goods or service, followed by the cost in USD. The remainder will be handled by our tax calculator API, which will supply you with all relevant tax information in a matter of minutes.

Endpoint

- TAX CALCULATOR

So, if you select the TAX CALCULATOR endpoint, you will obtain the following results:

The TaxesAPI enables you to execute real-time tax calculations for transactions in a wide range of jurisdictions worldwide. You can instantly identify the proper tax rate and guidelines for each location with this clever tool, allowing you to perform transactions fast and accurately.

How Can You Apply This API In Your Business?

You

1- Go to The Taxes API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.