Businesses are continuously looking for new solutions to simplify their operations and improve their bottom line in today’s quickly expanding digital market. Taxation is one sector that has experienced tremendous change, notably with the introduction of APIs that ease tax-related activities. In this blog article, we’ll look at one of these APIs, A VAT number API, and how it might help businesses.

The Challenge: Making VAT Compliance Easier

VAT compliance may be a difficult and time-consuming procedure for firms, especially those who operate across borders. It might be difficult to ensure that VAT numbers are genuine and up to date and that transactions are in accordance with applicable tax rules. This is where an API for VAT numbers comes in.

VAT Validation API From Zyla API Hub Is The Solution

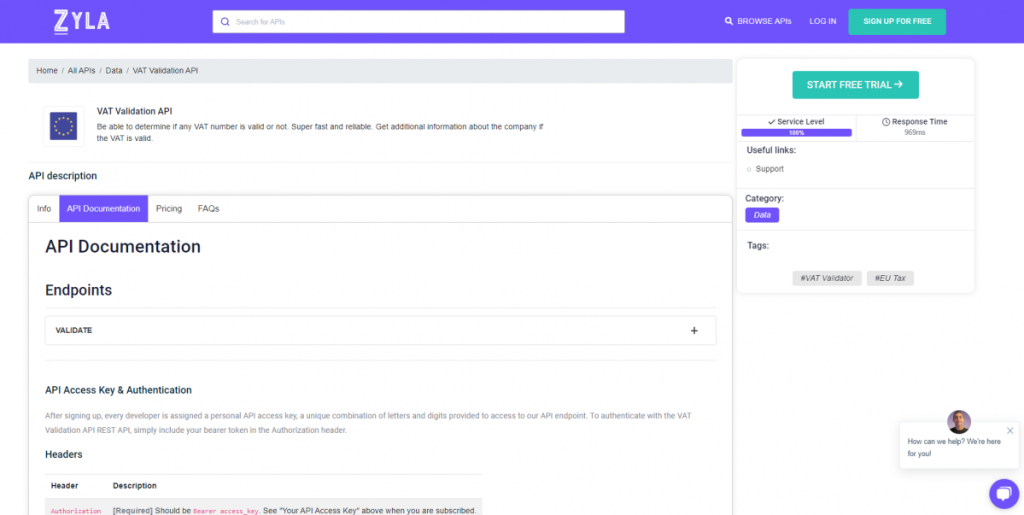

The VAT Validation API, hosted at Zyla API Hub, provides a dependable and effective solution to the VAT compliance difficulty. This API enables organizations to rapidly and easily validate VAT numbers, assuring tax compliance and enabling lawful transactions.

VAT Validation API Features And Benefits

The VAT Validation API has a number of characteristics that make it appealing to organizations looking to streamline their VAT compliance operations. These are some examples:

- Fast and dependable validation: The API immediately confirms the authenticity of VAT numbers, allowing businesses to perform transactions with confidence and with little delay.

- Additional information about the company: If the VAT number is genuine, the API gives further information on the firm linked with it in addition to checking its legitimacy.

- Simple integration: The API is meant to be simple to integrate with current systems, allowing organizations to smoothly integrate it into their operations.

In this section, we’ll show you how it works using an example. The API endpoint “VALIDATE” will be used. Enter the VAT number and the country code to have access to VAT-related information. That simple! This is how it works:

{

"valid": true,

"countryCode": "GB",

"vatNumber": "947785557",

"companyName": "BLUECLIFFE SERVICES LTD",

"companyAddress": "58-60 COLNEY ROAD",

"companyCity": "DARTFORD",

"companyPostCode": "DA1 1UH"

}Using The VAT Validation API For The First Time

It’s easy to get started with the VAT Validation API. Developers are issued a personal API access key after joining up, which they may use to access the API endpoint. For authentication, the API employs a bearer token, which is supplied in the Authorization header of requests.

- Sign up here: Begin by creating an account on the Zyla API Hub. The VAT Validation API and associated resources are now live.

- The API documentation is as follows: Examine the Zyla API Hub API docs in its entirety. Here you may find more information on integration rules, endpoints, and parameters.

- Create a unique API key that will be used as your authentication credential while doing API queries.

- Use the integration principles to link the API to your systems. Use sample code snippets and tutorials to ensure a seamless integration process.

- Testing and implementation: Extensive testing should be performed prior to installation in a production setting to ensure flawless functioning.

Finally, the VAT Validation API at Zyla API Hub is an effective solution for organizations looking to streamline their VAT compliance operations. This API is definitely worth considering for any firm functioning in today’s digital world, thanks to its rapid and trustworthy validation, extra corporate information, and simple integration.

Related Post: API Magic: The Guide To A Seamless VAT Validation For UK