Would you like your company to comply with tax laws and regulations correctly? Well, in that case, using the Tax Calculator API is the best option for your needs! It is a tool that will allow you to calculate taxes accurately and safely. If you want to know more info, read this post.

Compliance with tax laws is crucial for businesses to avoid penalties and legal consequences. Non-compliance risks audits and fines. Following regulations ensures fair tax contributions. It maintains a positive reputation and trust. Complying prevents business disruptions and lawsuits. It helps government funding for public services. Violations harm the brand image and customer loyalty.

Tax evasion can lead to criminal charges. It supports the economy and infrastructure development. Meeting requirements foster a stable business environment. Transparent practices build investor confidence. Complying reduces the likelihood of investigations. It promotes financial accountability and ethical standards. Businesses must fulfill their civic duty. Adherence upholds the rule of law and social responsibility. Overall, compliance with tax laws is non-negotiable for responsible and successful businesses.

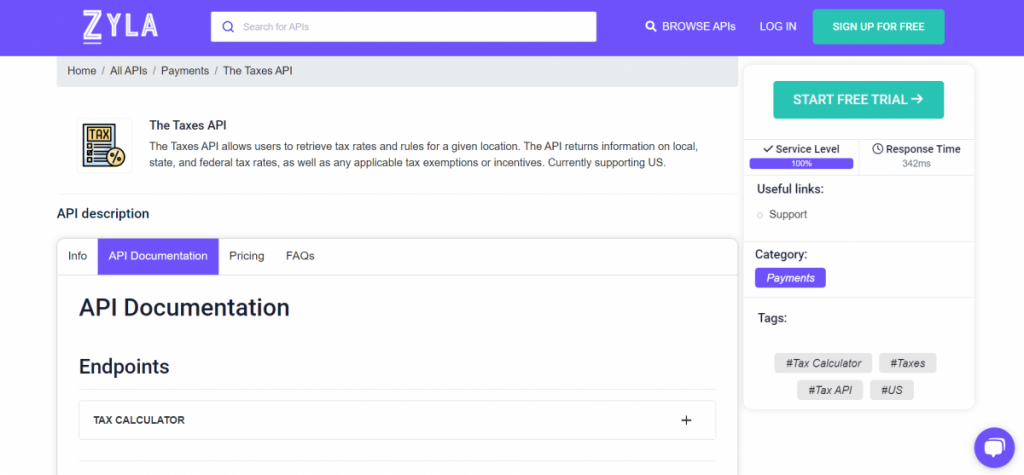

However, successfully complying with Tax Laws and Regulations is not an easy task. It is necessary to carry out many calculations to obtain the taxes. Fortunately, it is now possible to use The Taxes API to calculate taxes correctly and easily. This tool is available on the Zyla API Hub (it is an API marketplace).

Businesses Can Comply With Tax Laws And Regulations By Using The Taxes API

Tax laws and regulations can be complex and ever-changing, making it difficult for businesses to stay compliant. The Taxes API is a tool that can help businesses automate tax compliance and ensure that they are always up-to-date with the latest regulations. This tool provides access to a wide range of tax data, including sales tax rates, VAT rates, and import duties. Businesses can use this data to calculate the correct amount of tax for their transactions and to generate tax reports that meet regulatory requirements.

The Taxes API is also integrated with a number of other APIs, such as the Shipping API and the Payments API. This allows businesses to automate their entire checkout process, from calculating taxes to shipping products to collecting payments. As a result, this platform can help businesses to save time and money and to reduce the risk of non-compliance.

Here are some examples of how businesses can use The Taxes API:

-An online retailer can calculate the correct amount of sales tax for each transaction.

-A shipping company can calculate the import duties for shipments that are crossing borders.

-A software company can generate tax reports that meet regulatory requirements.

In this video we will teach you how to use this API correctly:

The Taxes API is a powerful tool that can help businesses to comply with tax laws and regulations. If you are a business that needs to automate your tax compliance, then this platform is a valuable resource.

Read this interesting post: Best Free Tax Calculator API For Tax Preparation Software Integration