Businesses in today’s fast-paced digital environment are continuously looking for creative solutions to simplify their processes and improve their accuracy. APIs, which may automate and streamline numerous corporate operations, are one such approach. VAT number APIs are such type of API that has recently gained popularity.

The Test

VAT is a tax charged on products and services purchased inside the European Union (EU) and other countries that have implemented a VAT system. Businesses in these locations must register for a VAT number, which is used to identify them for tax reasons. However, checking the legitimacy of these VAT numbers can be difficult, particularly when dealing with cross-border transactions.

The Solution: VAT Validation API

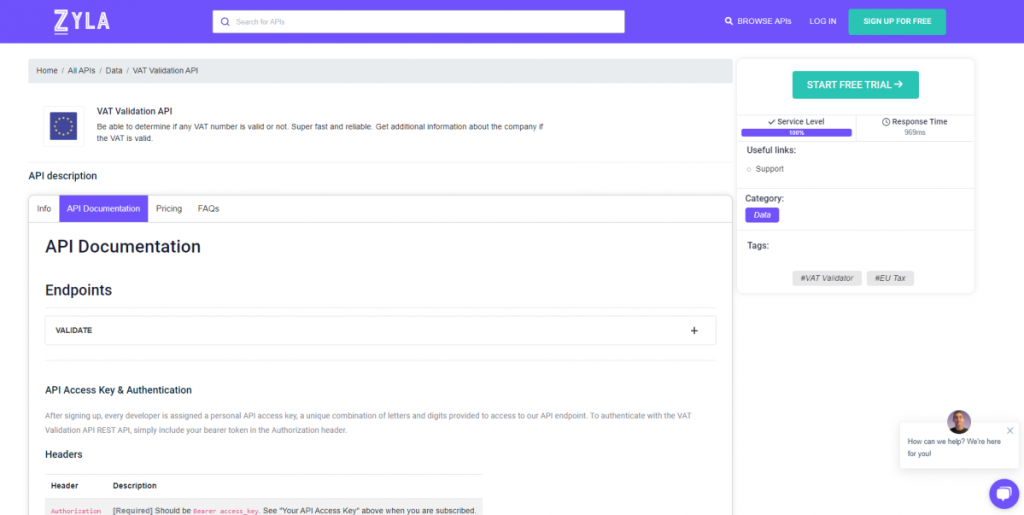

Zyla API Hub provides a robust answer to this problem: the VAT Validation API. This API validates VAT numbers quickly, assisting businesses in certifying tax compliance and assuring legal transactions.

Features And Benefits

The VAT Validation API has a number of features and benefits that can help organizations improve their accuracy. Some examples are:

- Swift verification: The API confirms the legitimacy and validity of VAT numbers in a matter of seconds, saving businesses time and effort.

- Increased accuracy: By checking VAT numbers, businesses can guarantee they are dealing with real firms, lowering the risk of fraud.

- Ease of use: Because the API is simple to connect to current systems, it is available to organizations of all sizes.

In this section, we’ll show you how it works using an example. The API endpoint “VALIDATE” will be used. Enter the VAT number and the country code to have access to VAT-related information. That simple! This is how it works:

{

"valid": true,

"countryCode": "GB",

"vatNumber": "947785557",

"companyName": "BLUECLIFFE SERVICES LTD",

"companyAddress": "58-60 COLNEY ROAD",

"companyCity": "DARTFORD",

"companyPostCode": "DA1 1UH"

}Getting Started With VAT Validation API

It’s easy to get started with the VAT Validation API. Developers are granted a personal API access key when joining up with Zyla API Hub, which is used to authenticate with the REST API. The API documentation includes thorough instructions on how to use the various endpoints to check VAT numbers and receive more company information.

- Sign up here: Begin by creating an account on the Zyla API Hub. The VAT Validation API and associated resources are now live.

- The API documentation is as follows: Examine the Zyla API Hub API docs in its entirety. Here is further information about integration rules, endpoints, and parameters.

- Create a unique API key that will be used as your authentication credential while doing API queries.

- Use the integration principles to link the API to your systems. Use sample code snippets and tutorials to ensure a seamless integration process.

- Testing and implementation: Extensive testing should be performed prior to installation in a production environment to ensure perfect performance.

Finally, the VAT Validation API is a valuable tool that may help organizations improve their accuracy by quickly checking VAT values. It’s no surprise that more and more firms are turning to this unique solution, given its ease of use and various benefits.

Related Post: Streamline Taxation: The Key To Success With A VAT Number API