In the era of globalized trade and business, the ability to seamlessly process international transactions is paramount. However, ensuring the accuracy and validity of banking information can be a complex and time-consuming task, as conducting cross-border transactions presents unique challenges due to varying banking systems, regulatory requirements, and language barriers. Verifying the accuracy of beneficiary account information manually can be a cumbersome and error-prone process, leading to potential payment delays, financial losses, and compliance risks. These challenges can hinder the growth of international trade and strain business relationships.

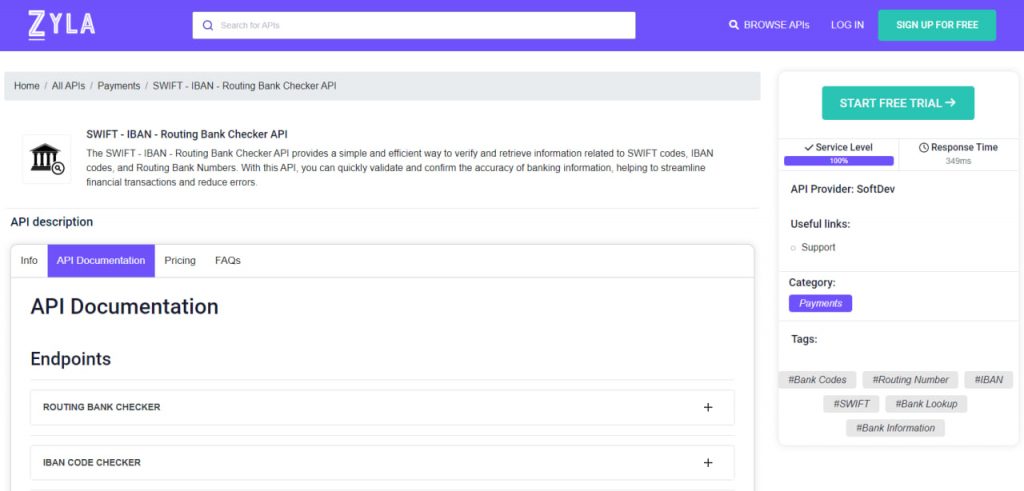

This is where an Application Programming Interface (API) for validating banking information comes to the forefront. By leveraging an API, businesses can automate the verification of bank account numbers, SWIFT codes, and other essential details, reducing manual errors and ensuring compliance with regulatory standards. We recommend Zyla’s SWIFT – IBAN – Routing Bank Checker API because it’s able to connect directly with SWIFT’s vast network, accessing real-time data and leveraging SWIFT’s extensive validation mechanisms to verify the accuracy of banking information.

The Importance of SWIFT And APIs for International Trade

SWIFT, since its foundation in 1973, has become the global standard for securely exchanging financial messages between banks and other financial institutions. With over 11,000 participating institutions from 200 countries, SWIFT provides a standardized and secure messaging network that ensures the smooth flow of information and funds across borders.

For international trade, SWIFT plays a pivotal role in facilitating transactions by providing a secure channel for banks to communicate and verify the accuracy of banking information. It enables businesses to exchange critical financial data, such as account numbers, beneficiary details, and transaction codes, with their international partners, ensuring a seamless and error-free payment process. Validating SWIFT codes is essential for international trade on any scale, and APIs are today’s answer to the challenge.

The Benefits of SWIFT – IBAN – Routing Bank Checker API for International Transactions:

- Enhanced Efficiency: With an API for international transactions like SWIFT – IBAN – Routing Bank Checker API, businesses can automate the validation process, significantly reducing the time and effort required to verify banking information. This automation enables faster and smoother cross-border transactions, enhancing business efficiency.

- Improved Accuracy: Manual data entry is prone to errors, but SWIFT – IBAN – Routing Bank Checker API eliminates this risk by automatically validating banking information against SWIFT’s extensive database. This improves accuracy and minimizes the chances of erroneous transactions.

- Regulatory Compliance: The API ensures compliance with regulatory requirements by validating banking details according to global standards. This mitigates the risks of non-compliance and associated penalties.

- Seamless Integration: This API can be seamlessly integrated into existing systems, allowing businesses to incorporate international transaction validation into their workflows without disrupting their operations.

- Cost Savings: By reducing manual efforts and eliminating payment errors, businesses can save valuable time and resources. Moreover, the streamlined process minimizes potential financial losses due to incorrect transactions.

How Does This API Work?

This state-of-the-art API works by accessing reliable databases, and then cross-referencing the information, providing real-time validation results, giving businesses peace of mind that their operations adhere to legal requirements, and thus avoiding potential fraud and failed operations.

SWIFT – IBAN – Routing Bank Checker API is designed to be easy to use. With simple API requests, you can quickly retrieve information about SWIFT codes, IBAN codes, and routing bank numbers.

To provide an example of this API in action, here’s the endpoint resulting from a call to the API where a SWIFT code is provided to be validated:

{

"status": 200,

"success": true,

"message": "SWIFT code ADTVBRDF is valid",

"data": {

"swift_code": "ADTVBRDF",

"bank": "ACLA BANK",

"city": "BRASILIA",

"branch": "",

"address": "Q SHCN CL QUADRA BLOCO E, 316,316",

"post_code": "70775-550",

"country": "Brazil",

"country_code": "BR",

"breakdown": {

"swift_code": "ADTVBRDF or ADTVBRDFXXX",

"bank_code": "ADTV - code assigned to ACLA BANK",

"country_code": "BR - code belongs to Brazil",

"location_code": "DF - represents location, second digit 'F' means active code",

"code_status": "Active",

"branch_code": "XXX or not assigned, indicating this is a head office"

}

}

}How Can I Get This API?

In an interconnected global economy, efficient and secure cross-border transactions are essential for businesses of all sizes. The integration of an API for international transactions like SWIFT – IBAN – Routing Bank Checker API, revolutionizes the way enterprises conduct global trade. By automating the validation of banking information, this API streamlines the payment process, enhances efficiency, and ensures accuracy, while enabling businesses to remain compliant with regulatory standards. As international trade continues to grow, leveraging the power of this API for international transactions becomes an indispensable tool. You can try SWIFT – IBAN – Routing Bank Checker API by following these instructions:

- 1- Go to “SWIFT – IBAN – Routing Bank Checker API” and click on the button “Start Free Trial” to start using the API.

- 2- Employ the different API endpoints depending on what you are looking for.

- 3- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.