Do you need to stay on the metals trend in 2023? Then you just try using this API that we recommend here.

Analysts are outlining their forecasts for the metals markets in the upcoming months, with demand for iron ore being impacted by declining Chinese consumption and the European energy crisis. The performance of iron ore prices this year has been adversely impacted. It’s cause was the confluence of declining Chinese demand and the potential for a worldwide economic crisis.

The European energy crisis, decreasing global GDP, rising inflation globally, and issues with supply networks around the globe are all factors contributing to the iron ore market’s continued volatility in the short- and medium-term forecast.

This quarter, European steel production will decrease. This is because the margins of the manufacturing facilities will continue to decline in the upcoming months. It’s due to the decline in demand and the high prices of inputs.

The war impacted in the metal’s market. If we look at how these metals’ prices have changed since the commencement of the conflict in Ukraine, we can see that nickel, aluminum, and copper have been the most impacted. And since that time, iron ore prices have dropped 33%.

While there is little question that the Russian invasion of Ukraine directly contributed to the price shock for nickel, the same cannot be said for iron ore. It has declined in value as a result of decreased demand from China.

Additionally, compared to the same quarter in 2021, worldwide marine iron ore flows (measured by ships departing ports) decreased by 3% in the third quarter of this year. Lessened shipments of iron ore are to blame for this decline. India and Ukraine, with respective percentages of 44% and 88% during that time.

Around 1.5% of the world’s iron ore exports last year came from Ukraine. Despite significant logistical challenges brought on by the war and the suspension of production at the plants in 2022, the nation shipped 438,000 tons of the metal in September, a massive increase (132%) over the same month the year before.

In the meantime, a new 50% government tax on all shipments of iron ore from India was to blame for the dramatic drop in maritime exports. The three biggest exporters’ exports in the last quarter—Australia, Brazil, and South Africa—were essentially constant from 2021; Australia’s heavier-than-expected rainfall appears to have been the sole outlier.

China purchased 69% of the world’s iron ore exports in terms of imports last year. However, market observers point out that these numbers are far lower than the Asian superpower had anticipated. Moreover, China’s domestic steel demand has been sluggish due to structural issues in the real estate industry and the upholding of stringent anti-corruption efforts. Covid-19. regulations

Use An API

As you will see, the metal production and consumption scenario this year has become increasingly complex. Many factors influence the metals market. And also many economic sectors that influence it, both those that produce metals and those that buy them to convert them into chips for household appliances, for example.

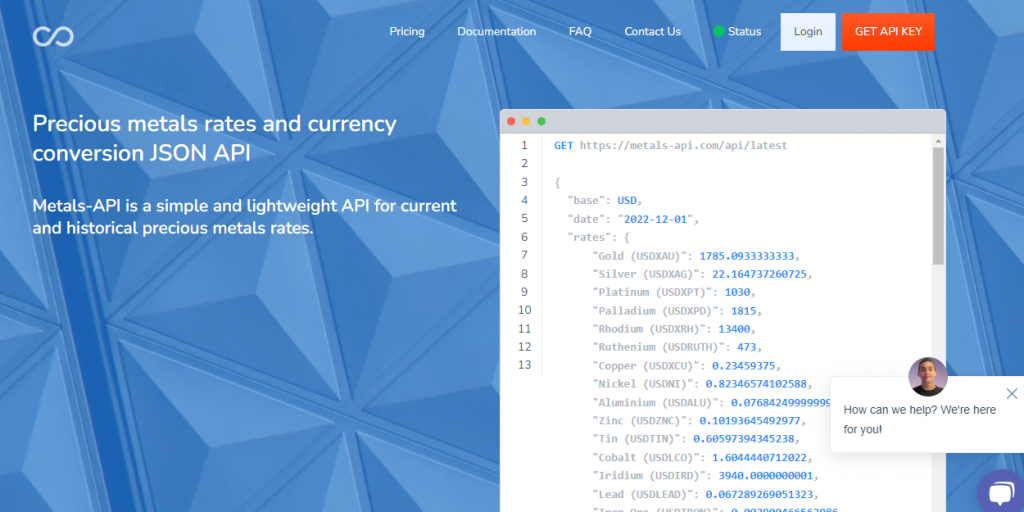

That is why they have such global importance. In this framework, if you participate in this business, you must be updated with the prices of metals. That is why here we recommend Metals-API so that you do not waste time searching and checking prices around the world. An API response type would look like this:

{

"success": true,

"timestamp": 1519296206,

"base": "USD",

"date": "2018-09-10",

"rates": {

"GBP": 0.72007,

"JPY": 107.346001,

"EUR": 0.813399,

}

}

Why Metals-API?

Metals-API is preferred among programmers. It has extensive documentation to incorporate into websites and applications in the programming language that suits you best. In addition, it incorporates data from the most important financial markets in the world. It includes the World Bank and LBMA. You will have metal data updated in real-time in the currency that interests you the most and you will also be able to compare it with historical data and price fluctuations.