The S&P 500 Price API is a powerful tool designed for traders who need accurate and real-time market data. With its ability to provide timely updates on stock prices, this API enhances trading strategies, making it easier to make informed decisions.

How to Use the S&P 500 Price API

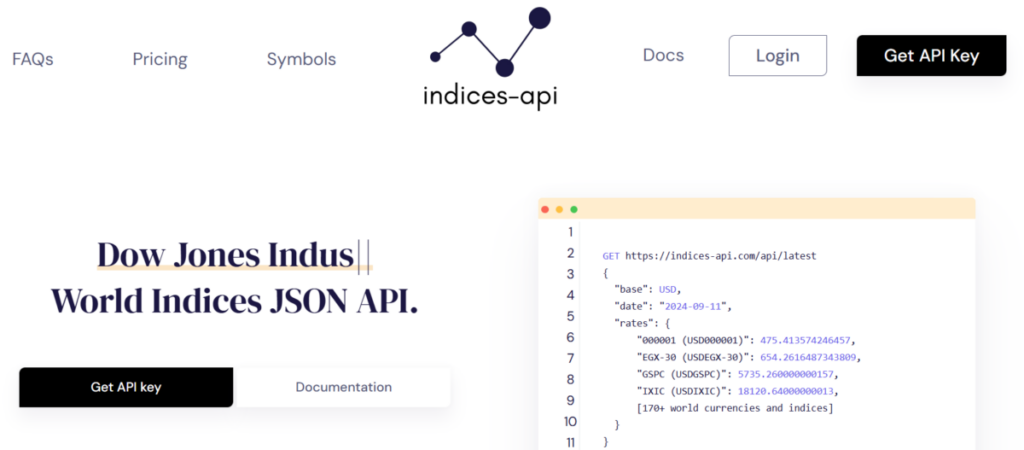

Using the S&P 500 Price API is straightforward. First, traders need to sign up for access, which usually involves creating an account with a service provider. Once registered, users receive an API key that allows them to make requests. Traders can then pull data directly into their applications or trading platforms.

To retrieve real-time prices, users send a simple HTTP request to the API endpoint, including the stock symbol they wish to track. The API responds with up-to-date pricing information, including the current price, opening price, and market changes. This data can be integrated into custom dashboards or used for algorithmic trading strategies.

Importance of Real-Time Market Data for Traders

Real-time market data is crucial for traders aiming to capitalize on market movements. In a fast-paced environment like stock trading, every second counts. Prices can fluctuate rapidly, and having access to live data allows traders to react immediately to changing conditions.

With the S&P 500 Price API, traders can stay ahead of the curve. For example, if a trader notices a sudden drop in the S&P 500 index, they can quickly decide whether to sell or hold their positions. This level of responsiveness can significantly impact overall profitability.

Benefits of the S&P 500 Price API

One of the standout features of the S&P 500 Price API is its accuracy. The API pulls data from reliable sources, ensuring that traders receive the most precise information available. This accuracy is vital for making strategic decisions, as outdated or incorrect data can lead to costly mistakes.

Another benefit is the API’s speed. In trading, latency can be a game-changer. The S&P 500 Price API is designed to deliver data with minimal delay, allowing traders to make split-second decisions based on the latest market information.

Additionally, the API is user-friendly, making it accessible for traders of all skill levels. Whether you’re a seasoned investor or just starting out, integrating the API into your trading strategy is a straightforward process.

Enhanced Trading Strategies with the S&P 500 Price APIs

Incorporating the S&P 500 Price API into trading strategies can significantly enhance a trader’s ability to analyze market trends. For instance, by combining real-time price data with historical data, traders can identify patterns and make more informed predictions.

Many traders use this API to develop algorithms that automatically execute trades based on specific market conditions. By setting parameters for buying and selling, traders can take advantage of price movements without needing to monitor the market constantly.

Moreover, the API’s data can support backtesting strategies. Traders can analyze past performance using real-time data to refine their approaches. This analytical capability allows traders to adjust their strategies based on what has historically worked or failed.

Conclusion

The S&P 500 Price APIs is an essential tool for traders who want to thrive in the stock market. With its real-time data, accuracy, and user-friendly interface, the API empowers traders to make well-informed decisions. Whether you’re developing sophisticated trading algorithms or simply keeping track of stock prices, this API can be a game-changer. By leveraging the power of accurate indices, traders can refine their strategies and enhance their overall performance.