Are you looking for a way to make your transactions more secure? Then you’ve come to the right place!

There are several benefits associated with using the BIN Checker. First, it allows you to verify the legitimacy of a bank account. Second, it allows you to determine whether a bank account number is valid or not. Third, it allows you to determine the type of bank account that has been used for a transaction. This information is critical when it comes to preventing fraud and ensuring that your transactions are secure. It is the ideal tool for performing these checks, as it is both accurate and reliable.

With an API, fraudulent transactions can be avoided in a variety of ways. Utilizing a Online Payment Security API is one approach to confirm the legitimacy of each transaction before processing it. This can aid in making sure that only valid transactions are carried out. Utilizing an API to track activities in real-time and spot any questionable activity is another option. By doing this, fraudulent transactions may be detected before being processed.

Every credit or debit card has a BIN number. Debit cards, credit cards, charge cards, gift cards, electronic benefit cards, and other payment cards are all issued a set of four to six numbers at random.

The card’s front features an embossed number that is also printed below it in print. The major industry identifier is specified by the first digit. The issuing organization or bank is identified by the numbers that come after. For instance, Visa credit cards, which begin with a four and fall under the banking and finance category, have four digits.

BIN IP Checker

Webmasters that want to carefully review credit/debit card transactions that occur on their websites should use this API, which has been created just for them. It gives a crystal-clear example of how risky the transactions are. Anyone is free to use this API anyway they see fit on any platform, with their own set of limits.

What applications does this API have? The user will enter their credit/debit card’s BIN (Bank Identification Number) or IIN (Issuer Identification Number) in order to get as much information as possible. Additionally, it will compute the transaction risk score, match the BIN information to the IP information, and return details on the IP address if the request contains one. Making informed selections for clients is advantageous for online retailers.

The BIN IP Checker API cannot be used until you register. To start the risk-free trial, click “START FREE TRIAL”. After that, you may begin running API queries. Select “test endpoint” to dial the endpoint after entering the BIN number. The response will include all pertinent details regarding that number. You can use it for development now that you know how to use it!

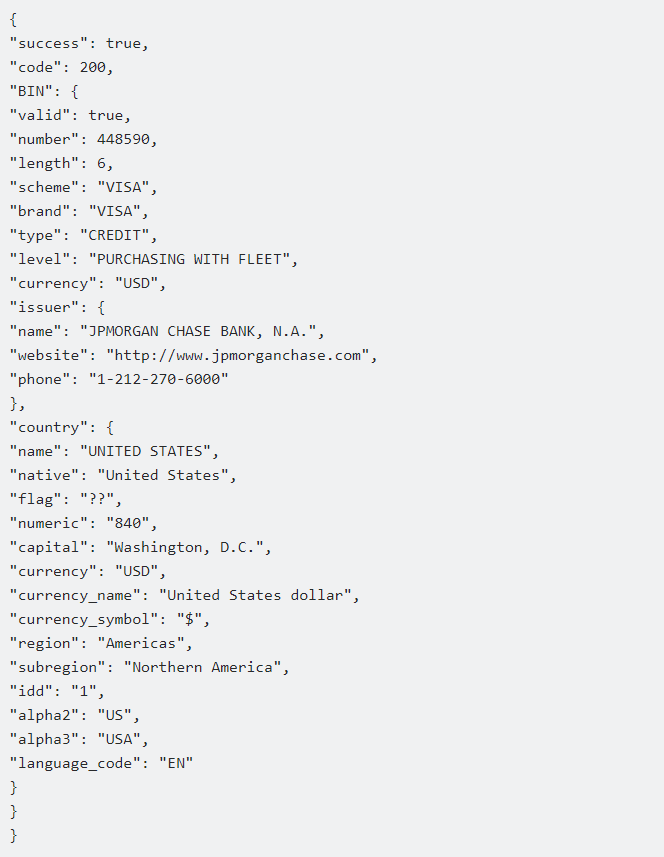

This endpoint will validate the card BIN, which is the first six to eleven digits of each credit card, and return a complete JSON answer. You can avoid losing money on fraudulent transactions by using this API. Your call will receive a response from this API that resembles something like this:

If the user only provides the BIN number, they will be given access to all of the BIN’s information. If the user gives both the BIN and the IP address of his client, the system will return the complete data of the BIN and IP address together with a risk score.