Are you trying to find a more effective approach to make payments? If so, you’ve arrived at the ideal location.

By checking BIN numbers, businesses can ensure that cards are not counterfeit and that transactions are legitimate. They can also use this number to retrieve information about the issuing bank and the account holder’s information, such as their name and address.

E-commerce is expanding in today’s globally interconnected world. In 2020, it is predicted that global e-commerce revenues would amount to $2.3 trillion. Because of this, many companies are emphasizing e-commerce. However, there are difficulties specific to this expanding industry. The processing of payments is one of the major difficulties. If you are careless, you could have a poor customer experience and possibly lose clients. This is why having a reliable payment processing system in place is crucial. Using a Payment Gateway Integration APIs is one of the greatest methods to ensure that your payment processing system is functioning properly.

A BIN number is present on every credit or debit card. A set of four to six numbers, chosen at random, is issued for all payment cards, including debit cards, credit cards, charge cards, gift cards, electronic benefit cards, and other payment cards.

An embossed number that is also printed below it is on the front of the card. The first digit designates the primary industry identity. The numbers that follow serve to identify the issuing institution or bank. For instance, Visa credit cards, which have four digits and start with a four, are classified as belonging to the banking and finance industry. When a customer requests a transaction, the issuer receives an authorization request to check the validity of the card and account as well as the availability of the purchase amount.

BIN IP Checker

This API was made specifically for webmasters who want to closely examine credit/debit card transactions that take place on their websites. It is a glaring illustration of just how hazardous the transactions are. With their own set of restrictions, anyone is free to utilize this API anyway they see fit on any platform.

What uses does this API serve? In order to obtain as much information as possible, the user will enter their credit/debit card’s BIN (Bank Identification Number) or IIN (Issuer Identification Number). Additionally, if the request includes an IP address, it will compute the transaction risk score, compare the BIN information to the IP information, and return information on the IP address. Online retailers benefit from letting customers make educated decisions.

You must first register in order to use the BIN IP Checker API. Click “START FREE TRIAL” to begin the risk-free trial. You may then start executing API queries after that. After entering the BIN number, choose “test endpoint” to call the endpoint. All relevant information pertaining to that number will be included in the response. Now that you know how to utilize it, you can use it for development!

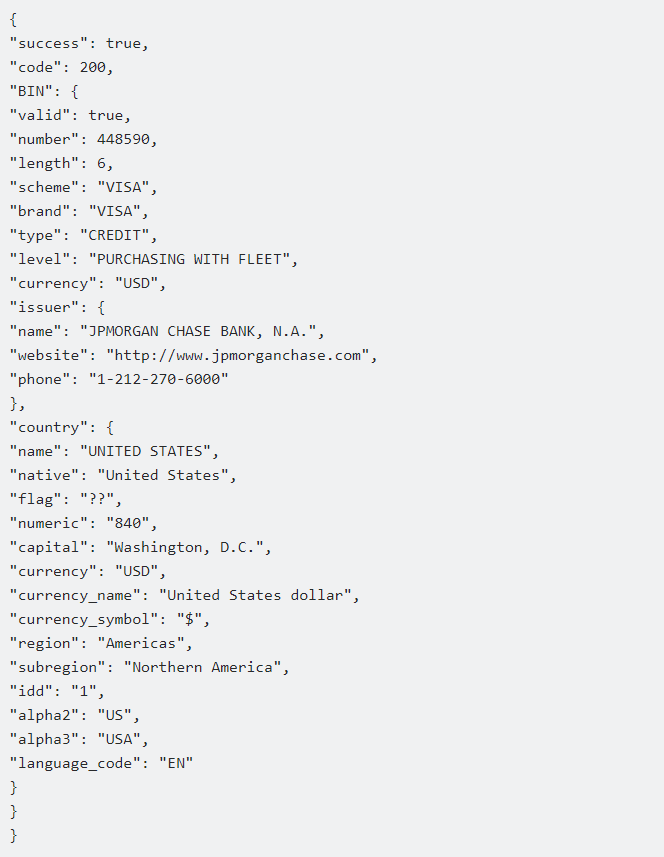

The first six to eleven digits of every credit card are its BIN, and this endpoint will verify them before returning a complete JSON response. Using this API can help you stay away from losing money on fraudulent transactions. This API will respond to your call with a response that looks somewhat like this:

The user will have access to all of the BIN’s details if they merely supply the BIN number. The system will return the complete data of the BIN and IP address together with a risk score if the user provides both the BIN and the IP address of his client.