For metals market participants, wanting to learn the price of a commodity is a never-ending pursuit. And, If you deal with precious metals, an API is the best solution. Read this article and get an insight into this technology.

Spot trading refers to the immediate buying and selling of financial instruments or commodities. In the context of the metals market, this involves the exchange of physical metals such as gold, silver, or copper for immediate delivery. Spot trades are usually settled within two business days, and the price of the metal is determined by the current market price at the time of the trade. Spot prices serve as a benchmark for other financial instruments such as futures contracts and can also be used to hedge against price risk in the metals market.

Nickel is an important metal that plays a significant role in global trade and the metal market. It is used to create coins as well as cellphones, guitar strings, and many other items. It also acts as a catalyst in the production of various chemicals and is a key component in the manufacturing of stainless steel and other compounds, as well as a range of consumer and industrial items. As a result, there are times when the demand for nickel and these products is closely linked.

Nickel is a metallic element that is hard and ductile and belongs to the intermediate group of metals. Its high melting point makes it a commonly used component in the production of heat-resistant alloys for stainless steel and many other alloys. It can be found naturally in the earth’s crust and is often mined for use as ore, or it can be artificially produced by oxidizing nickel oxides with hydrogen or carbon monoxide.

Nickel is traded on various commodity exchanges around the world, such as the Shanghai Futures Exchange and the London Metal Exchange (LME). Its price is influenced by a variety of factors, including changes in supply and demand, global economic conditions, and political and diplomatic events. Nickel can also be used as an investment vehicle, as investors can buy and sell financial derivatives and other instruments based on their price.

Why Use An API To Track Metals Current Price?

APIs (Application Programming Interfaces) have greatly improved business productivity by streamlining various processes and allowing for the management of real-time data from other applications. They establish a continuous connection to an external data source, enabling real-time data to be accessed and queried using various parameters.

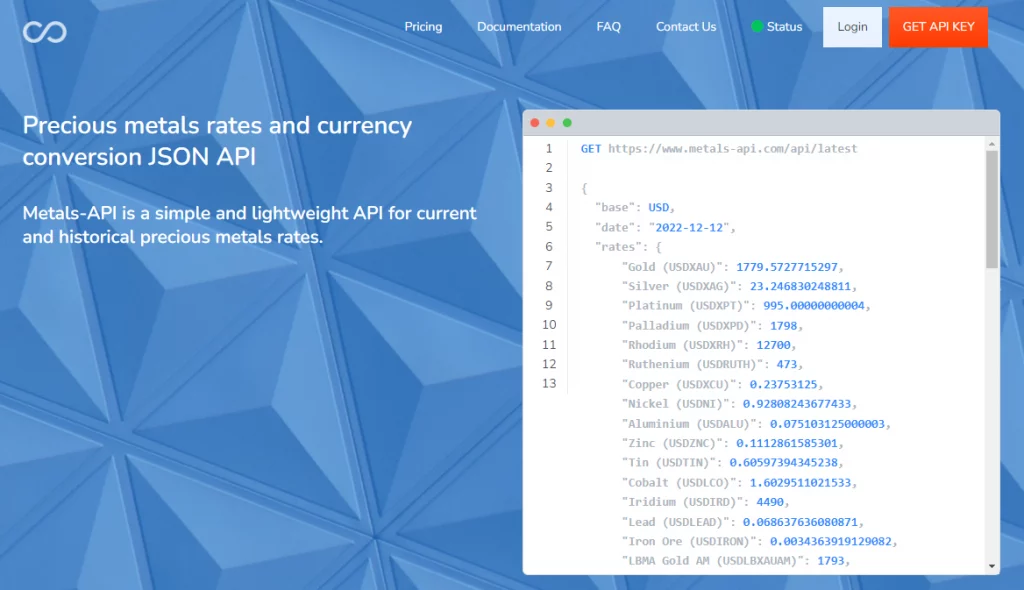

A precious metals API provides connections to lenders and markets around the world, allowing for real-time or historical inquiries for specific pieces of information. Some APIs also offer the ability to compare data and generate reports. While there are various APIs available, one popular option is MetalsAPI.

More About MetalsAPI

MetalsAPI is a technology that allows for real-time data access from any location in the world. By providing connections to major financial institutions worldwide, the information provided is accurate and reliable. This product operates exceptionally well thanks to its use of AI technology and machine learning engines, which enhance search capabilities and make it faster and more clear.

MetalsAPI offers spot prices and pricing for industrial and precious metals, as well as the option to view the data in various currencies and compare information from different dates. It is also easy to integrate into any platform due to its wide compatibility with most programming languages. Consider using MetalsAPI for your data needs.