Time and money are the two most valuable commodities in the changing world of business. Because both are valuable resources, there is an ongoing drive to use them as efficiently as possible. An API is a technological guiding light that aims to unravel the complex interplay between time and money and provide a road to empowered efficiency.

As businesses navigate the intricate maze of transactions, a Bank API emerges as a game-changing solution. It isn’t just another acronym; it’s the embodiment of streamlined operations and enhanced accuracy. This API introduces itself as a catalyst, propelling businesses toward the realm of empowered efficiency.

The Basics of Credit Card Validation: Unraveling the Complexity:

Behind every successful transaction lies the underpinning of credit card validation. In the world of digits and codes, understanding credit card validation is akin to deciphering a complex code. It’s the process that ensures the legitimacy of transactions, painting a vivid picture of security and trust.

Inaccurate credit card validation isn’t just a blip on the radar; it’s a costly misstep. As businesses strive to balance the dual dilemma of time and money, the repercussions of failed validation loom large. Each inaccurate transaction becomes a drain on resources, siphoning both time and money.

Behind the digital curtain, this API operates silently, transforming complexity into simplicity. It’s not a mere piece of code; it’s a mechanism that streamlines processes and orchestrates seamless transactions. This API operates as a conductor, ensuring that every note of validation is in perfect harmony.

Credit Card Validator – BIN Checker API

Using this API, you can spot fraudulent credit card transactions. Start looking for each piece of data on credit and debit cards using BIN numbers. The user needs to input the BIN (Bank Identification Number) or IIN (Issuer Identification Number) of their credit or debit card in order to view all the information.

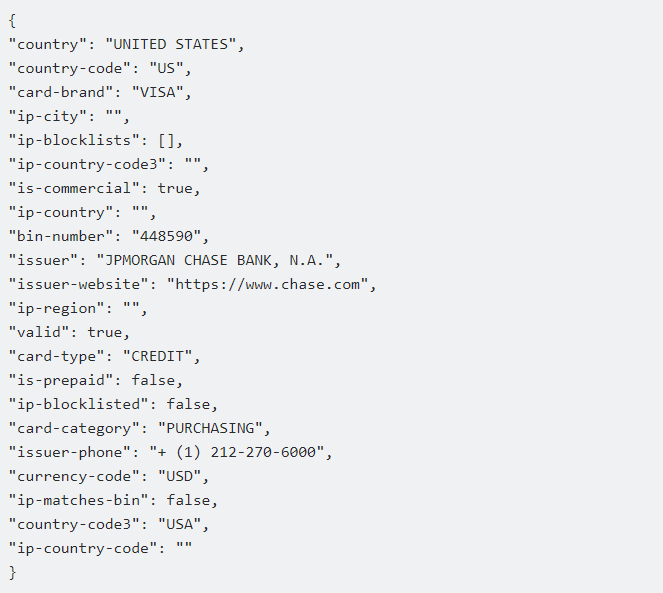

You must input a BIN (Bank Identification Number), which is the first six digits on a credit or debit card, in order to access all of this BIN/IIN information in JSON format. The card’s type (Visa or MasterCard), expiration date, bank, and issue location will all be disclosed to you.

You will have access to the customer’s credit card details, including the issuing bank, the issuing institution (AMEX, VISA, MC), where the card is located, and whether or not it is a legitimate credit card.

The first six digits of the BIN can be used to protect credit card information. There won’t be any security holes as a result. This API merely takes into account the validity of the credit card along with the bank and business information to decide whether to approve the payment or run a promotion. Following your API call, this endpoint will respond to your query with the following message:

Watch the following video to understand how to use the API:

This CC Checker API makes it easier to identify the issuing bank or institution. As a result, whether you can approve the transaction depends on whether you have specific arrangements with a particular bank.