In this article, we discover how a VAT API can help you save time and money using it.

With more than 160 nations using it, VAT has grown to be a significant source of income, accounting for more than 30% of global revenue on average. In low-income developing nations as a proportion of GDP, it ranges from 4% to more than 7% in developed economies. VAT has come under a lot of fire since it is such an obvious source of income.

We can always notice on the receipt after purchasing at a store that the net selling price includes VAT. However, VAT is similar to a turnover tax in that it is applied to all upstream activities in the business-to-business supply chain as well as to sales to ultimate consumers. This would result in a tax cascade (paying tax on tax) if it weren’t changed, which would cause enormous economic inefficiencies.

The fundamental benefit of VAT is that it fosters voluntary compliance since every firm has the incentive to obtain an invoice from a vendor to claim VAT credit on its purchases, even though this may appear onerous. Tax collection along the supply chain. This internal self-monitoring system lowers the possibility of tax avoidance.

The consumer’s home, or location, determines how much VAT is charged. To accomplish this, a border adjustment technique is used, which includes imports but leaves exports out of the VAT base. This guarantees that all internal demand, whether the products and services are bought locally or overseas, is taxed.

Many different lower rates, exemptions, and special programs are frequently used by nations. Some try to make the tax administration process simpler. For instance, several nations exclude microenterprises from paying VAT and related compliance and administration costs by using a minimal registration level depending on turnover.

The majority of exemptions and lower rates are implemented to enhance the distributional effects of VAT; but, by raising the expense of collection and frequently encouraging fraud, they defeat the primary goal of collecting revenue, both directly and indirectly.

Apply An API

Application Programming Interfaces (APIs) are used in programming languages to let programmers create complex features quickly and simply. By removing more complex code, they provide a more understandable syntax. Modern browsers have a substantial number of APIs that enable you to programmatically achieve a variety of goals.

What are APIs’ relations to VAT taxes? Businesses, however, have a large number of VAT numbers to verify and demonstrate their openness in tax payment. However, it might be time-consuming and costly to have to examine each number individually.

With APIs, you can simplify this process, which will expedite your job and lower the likelihood of error. Today, artificial intelligence has been extensively developed to help streamline human work.

In this way, there are stages of production that we humans can save and occupy ourselves with other things. In this way we can save and gain more time and money. With the VAT Validation API, which is compatible with many computer languages, you may accomplish all of this.

Why VAT VAlidation API?

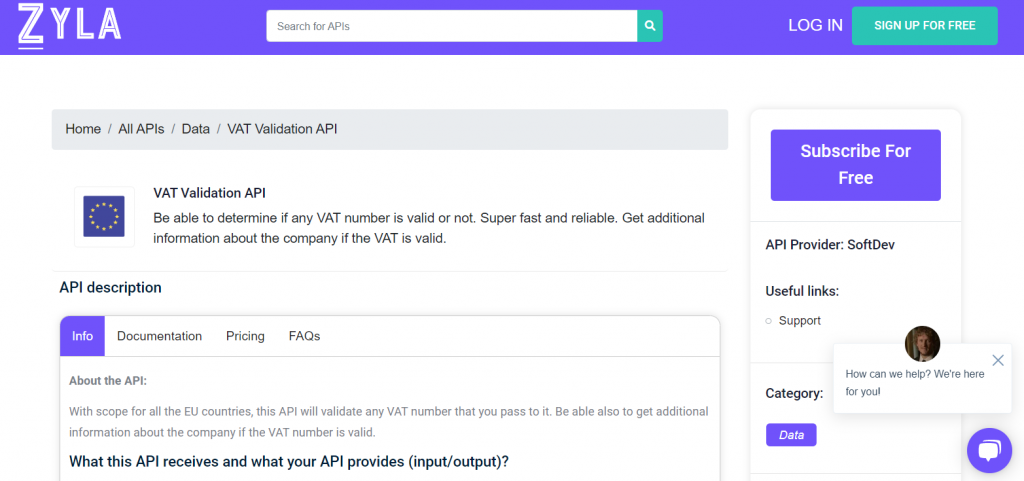

The new tool used by businesses to show that their taxes have been paid correctly is called VAT Validation API. Since customers demand a dependable organization, this API enables openness both about the government authorities and about the consumers of each company.

They also anticipate paying their taxes on time, as is expected of every citizen. Integrating this API into your digital media is quite simple. If the number is accurate, in addition to being verified, it will also provide the name and address of the firm.