In today’s globalized world, international transactions have become an integral part of the business landscape. Whether it’s sending funds across borders or verifying financial information, such as SWIFT codes and routing bank numbers, accuracy, and security are of utmost importance. To streamline these processes and ensure safer international transactions, the integration of an Application Programming Interface (API) that validates financial information has emerged as a powerful solution. In this article, we will explore how a banking information API can enhance the safety and efficiency of international transactions, empowering businesses to conduct their operations with confidence.

An API that specializes in validating financial information acts as a reliable intermediary between businesses and financial institutions. It enables seamless integration into existing systems, offering an efficient and user-friendly interface to verify SWIFT codes and routing bank numbers. By leveraging advanced algorithms and access to comprehensive databases, this API empowers businesses to validate financial information accurately and in real time, minimizing the risk of errors and potential fraud.

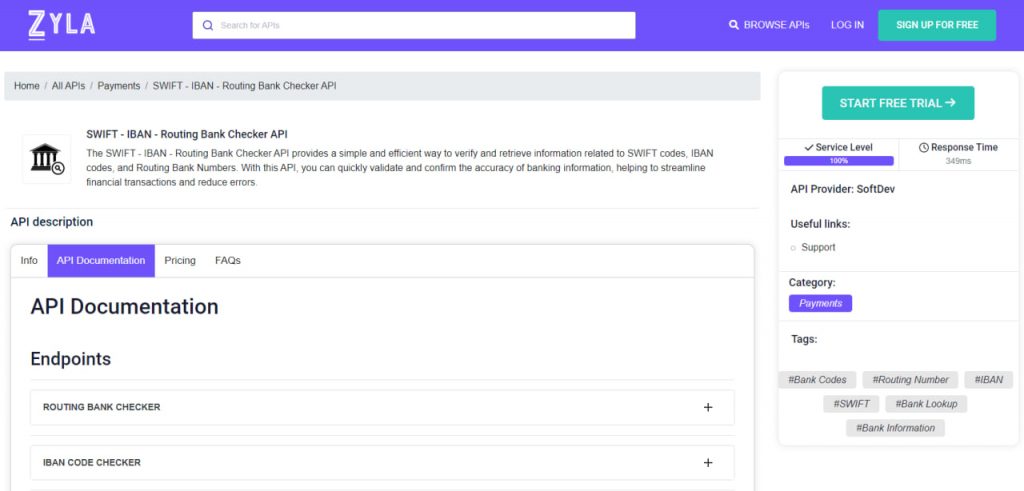

We recommend Zyla’s SWIFT – IBAN – Routing Bank Checker API because it’s a banking information API that can help your business on several ends, which we’ll describe in more detail below.

How Can This API Help Me?

SWIFT – IBAN – Routing Bank Checker API can access a centralized database of verified financial information, enabling it to quickly and accurately determine whether the SWIFT code or routing bank number provided is valid. This can help to prevent fraudulent activity and reduce the risk of errors that can lead to failed transactions or delays.

Furthermore, SWIFT – IBAN – Routing Bank Checker API validates financial information and can provide additional benefits for businesses and individuals engaged in international transactions. It can streamline the verification process, making it quicker and more efficient to confirm the accuracy of financial information. This can save time and reduce the administrative burden associated with international transactions. Additionally, it can help to reduce costs associated with failed transactions or delays caused by inaccurate financial information.

Implementing SWIFT – IBAN – Routing Bank Checker API is a straightforward process. Developers can integrate the API seamlessly into their existing applications, enhancing their financial validation capabilities without the need for extensive manual checks or third-party services. This API provides a user-friendly interface and comprehensive documentation, making it easy to incorporate its features into various platforms, including banking systems, payment gateways, and mobile applications.

How Does This API Work?

SWIFT – IBAN – Routing Bank Checker API is designed to be easy to use. With simple API requests, you can quickly retrieve and validate information about SWIFT codes, IBAN codes, and routing bank numbers.

To provide an example of this API in action, here’s the endpoint resulting from a call to the API where an IBAN code is provided:

{

"status": 200,

"success": true,

"message": "PT50000101231234567890192 is a valid IBAN",

"data": {

"iban": "PT50000101231234567890192",

"country": "Portugal [PT]",

"sepa_country": "Yes",

"checksum": "50",

"bban": "000101231234567890192",

"bank_code": "0001",

"branch_code": "0123",

"account_number": "12345678901",

"check_digit": "92",

"bank_details": {

"swift_code": "BGALPTTGXXX",

"bank_name": "BANCO DE PORTUGAL",

"branch": "SISTEMAS DE PAGAMENTOS",

"address": "AV. ALMIRANTE REIS, 71 EDIFICIO PORTUGAL",

"city": "LISBON",

"zip": "1150-012"

}

}

}

How Can I Get This API?

The integration of SWIFT – IBAN – Routing Bank Checker API offers a powerful solution to enhance the safety and efficiency of international transactions. By leveraging real-time validation, fraud prevention mechanisms, and seamless integration capabilities, businesses can conduct their international operations with confidence.

The use of such an API not only minimizes the risk of errors but also enables organizations to save time, reduce costs, and remain compliant with regulatory standards. Embracing this technology paves the way for safer and more reliable international transactions, empowering businesses to thrive in the global marketplace. You can integrate this banking information API by following these instructions:

1- Go to “SWIFT – IBAN – Routing Bank Checker API” and simply click on the button “Start Free Trial” to start using the API.

2- Employ the different API endpoints depending on what you are looking for.

3- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.