In the dynamic world of commodity trading, the Rough Rice Futures API emerges as a key player. Providing developers and traders with a gateway to a wealth of information on rough rice futures contracts. This comprehensive overview delves into the landscape of commodity trading, specifically focusing on rough rice, the role of Rough Rice Futures, and the benefits of utilizing the Futures API for real-time trading data integration into applications or trading systems.

Exploring The Landscape Of Rough Rice Trading

Rice, a staple food for over half the global population, holds not only nutritional significance but also cultural and economic importance, particularly in Asia. Understanding the historical context of rice is essential, but in the context of modern-day investors, comprehending current dynamics becomes paramount.

Today, rice trading predominantly occurs on the futures market, with the Chicago Board of Trade (CBOT) serving as a major platform. The standard contract unit for rice futures is 2,000 hundredweights (CWT), equivalent to 91 metric tons. Futures contracts play a crucial role for producers and consumers, offering a means to hedge against price fluctuations and manage risk effectively.

The Benefits Of Rough Rice As A Commodity

Rice, categorized into various types such as long grain, medium grain, short grain, and rough rice, holds intrinsic value for investors. It serves as a hedge against inflation, a diversification tool for portfolios, and a speculative avenue for those anticipating increased global demand, especially in regions where rice is a dietary staple.

The Role Of Rough Rice Futures API

In the realm of commodity trading, the Rough Rice Futures API takes center stage. This API provides access to vital data, including pricing, historical trends, and other relevant information. Developers can seamlessly integrate this API into their applications or trading systems, gaining enhanced insights into rough rice futures trading.

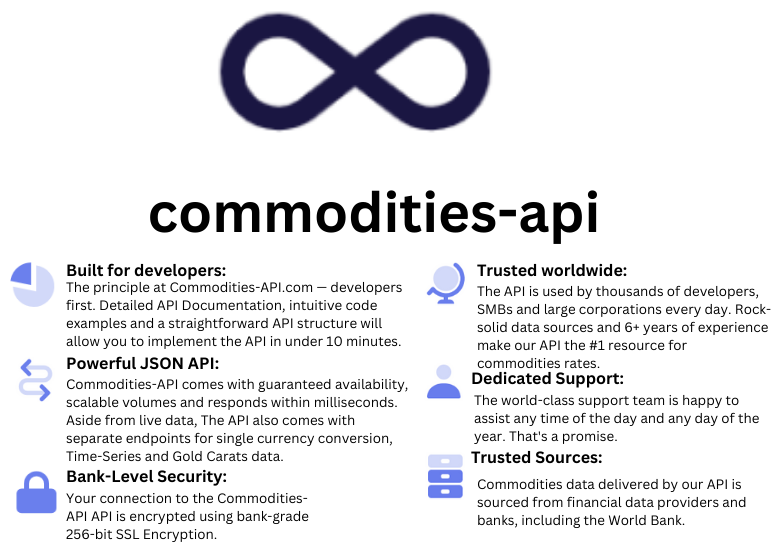

Why Choose Commodities-API

Before delving into the practical aspects of integrating the API, it’s crucial to understand why Commodities-API stands out. This platform empowers developers by offering real-time and historical data on various commodities, including rough rice. Key features include:

- User-Friendly Interface: Commodities-API boasts a user-friendly website, simplifying the onboarding process for developers.

- Secure Access: Upon registration, users receive a secure API key, ensuring a protected and controlled access point to commodity data.

- Symbol and Name Clarity: Understanding commodities is made easy with clear representations. For Rough Rice, the symbol ZRU22 and the name “Rough Rice” are pivotal.

Getting Started With Commodities-API

- Sign Up on Commodities-API: Begin by creating an account on the Commodities-API platform through their user-friendly website.

- Obtain API Key: After successful registration, receive an API key that serves as your access point to the Futures data.

- Comprehend Symbol and Name: Familiarize yourself with the symbol ZRU22 and the name “Rough Rice” for effective API usage.

- API Endpoint for Rough Rice: Construct your API request using the endpoint specific to Rough Rice, Base currency, and the API Key.

- Integration to Your Application: Leverage the obtained data by seamlessly integrating it into your applications or trading systems, making informed decisions based on real-time Rough Rice Futures trading data.

Example

Endpoint: Latest [request the most recent commodities rates data] – Rough Rice

- INPUT

- Base Currency: USD

- Symbols (Code): ZRU22

- API Response:

{"data":{"success":true,"timestamp":1705041660,"date":"2024-01-12","base":"USD","rates":{"ZRU22":0.056947608200456},"unit":{"ZRU22":"per cwt"}}}Conclusion

In conclusion, the Rough Rice Futures API, coupled with the Commodities-API platform, offers an extensive toolkit for developers and traders, unlocking unparalleled possibilities in the world of commodity trading. Explore, integrate, and redefine your approach to Rough Rice Futures with this comprehensive overview.

For more information on Commodities-API read my blog: Corn Mar 2024: A Year Of Opportunity And Growth