If you want to obtain rhodium spot prices, you must use this API that we suggest in this post. With it, you’ll find the best offers of spot values and futures.

Rhodium receives its name from the Greek word “rhodon,” which means “pinkish.” It has substantial value for a wide range of sectors. Being one of the rarest minerals, rhodium is extracted alongside platinum or nickel; there are no rhodium mines. Due to its complexity, it is substantially more expensive than gold and silver.

Rhodium is a malleable silvery-white metal. Although aqua regia and hot, sulfuric acid concentration ultimately force it to break, it is difficult to dissolve in acids. Compared to platinum, it is thicker and has a greater melting point. Rhodium is inert and a transmitter of heat and electricity. Due to its high resistance and reflectivity, it also reduces the discharges of dangerous gasses.

Due to its unique properties, rhodium is frequently used in the automotive industry. You can lessen dangerous emissions from cars, especially carbon dioxide. Additionally, it doesn’t corrode too much and is a strong electrical conductor.

It is further used to protect white gold during galvanizing from abrasion and wear. On the opposing side, it catalyzes hydrogenation. To install the power supply in mirrors and reflectors specialists use it.

Lastly, due to its characteristics and low worldwide distribution, rhodium displays highly significant volatility. Even though this metal offers an obvious solution to several ecological concerns, most businesses around the globe, especially China, its greatest customer, do not want to engage in it.

Condition Of Rhodium

Platinum’s byproduct rhodium, together with gold and silver, has an impact on the stock market. In Particular, it is seven times more expensive than gold. Rhodium’s outlook is bleak because its production is probably going to decline as platinum’s price rises.

Because of the aforementioned, this metal will become scarce and in high demand. Lastly, their market prices may reach record highs. As per the information given by a significant producer of automobile catalysts, rhodium is presently trading at $12,200 per ounce after recovering most of its losses from Covid-19.

Apply An API

Following the price levels of this material and other commodities is crucial if you want to enter this industry. Since there is so much information available online, it may be a simple process for us. Differentiating which information in information is trustworthy and which is not might be challenging at times.

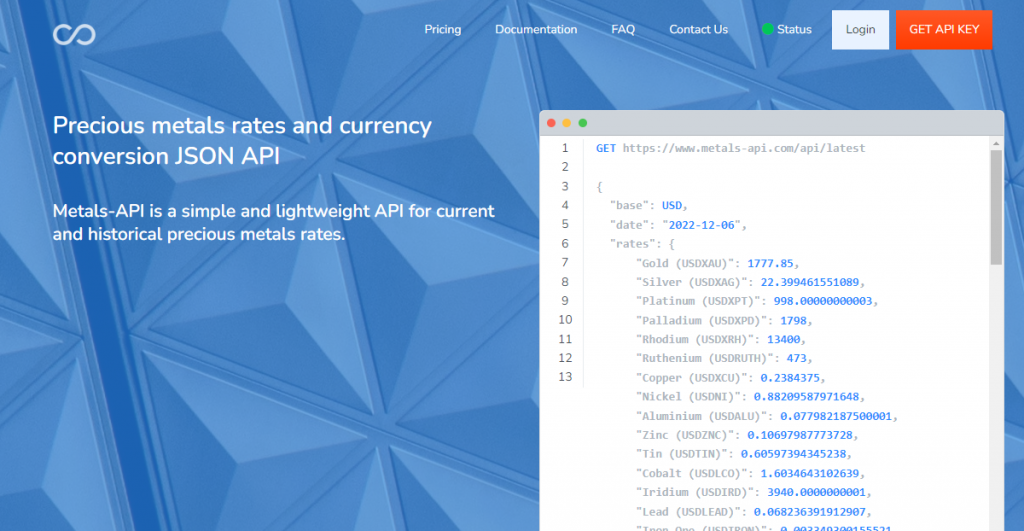

Because of this, it is always practical to choose sources that offer accurate and up-to-date data. Therefore, to have all the relevant data at once, we advise using an API. Different software is connected via an API to send data between various devices. As a result, the APIs grow a variety of features. In this situation, we advise using Metals-API, which enables you to refresh all trade information in real-time.

Why Metals-API?

A lot of data on the metals industry is available in Metals-API. So much so that it contains actual and historical prices for more than 100 metals in its collection. This enables you to examine the various elements that affect how this market behaves.

It appears in your nation’s currency as well. You can contrast all the information to understand the best way to invest. Additionally, the data comes from absolutely trustworthy sources like the World Bank and LBMA. Utilize it in the programming language that you prefer.