The International Bank Account Number or IBAN is used for domestic and international payments in Europe and the world. The International Bank Account Number, made up of a long string of numbers and digits, is often a point of failure when manually entered by customers and carriers. So, keep reading Reasons To Employ A Bank Account Validation API and learn more about it and about IBAN Validator API.

Transfer operations are in common use, especially for payments between professionals, usually between a company and its supplier. However, transfer fraud with false bank details is on the rise. According to data, in 2021, 2 out of 3 companies suffered at least one fraud attempt. Today, checking the IBAN of a supplier or customer is essential.

What is the IBAN?

The IBAN (International Bank Account Number) identifies a bank account and the bank to which it belongs. It is the sine qua noncondition to make transfers. The sender of a transfer must provide the IBAN of the beneficiary in order to carry it out. Thus, the IBAN can take various forms depending on the country of residence of the bank to which it is attached. Its structure can vary between 14 and 34 characters and is made up of numbers and letters. The first two letters represent the country of the bank account, the next two digits are the account control key. The remaining characters are the BBAN (Basic Bank Account Number).

The IBAN is on the bank account certificate, which also includes the BIC code or the SWIFT code as well as the legal data of the beneficiary:

- The BIC (Bank Identifier Code) identifies the bank of residence of the beneficiary account.

- The SWIFT code also makes it possible to identify a financial institution and its country.

Unlike the IBAN which identifies an individual bank account belonging to a single natural or legal person.

Numerous risks of IBAN fraud

More and more companies are falling victim to bank transfer fraud. Scams are becoming more widespread and take different forms depending on the target chosen by the scammer.

Some examples of transfer fraud

- The scammer poses as a provider and contacts the company with a fake IBAN to obtain fraudulent transfers.

- Fake CEO fraud, the scammer pretends to be the president of the company to an employee and urgently asks him to make a transfer with a fake account number.

- Phishing: The scammer infiltrates the email accounts of a company’s customers or suppliers to request payment of an invoice (as in fake supplier fraud) using false bank details, or breaks into internal management systems of the company (ERP, TMS, KYC…) to modify the information and get money fraudulently

The techniques are numerous and allow scammers to steal large sums of money. These are large organizations with extensive resources and a well-defined system, making companies of all sizes vulnerable to these attacks.

It is important to have audit processes in place to protect yourself from the risk of fraud.

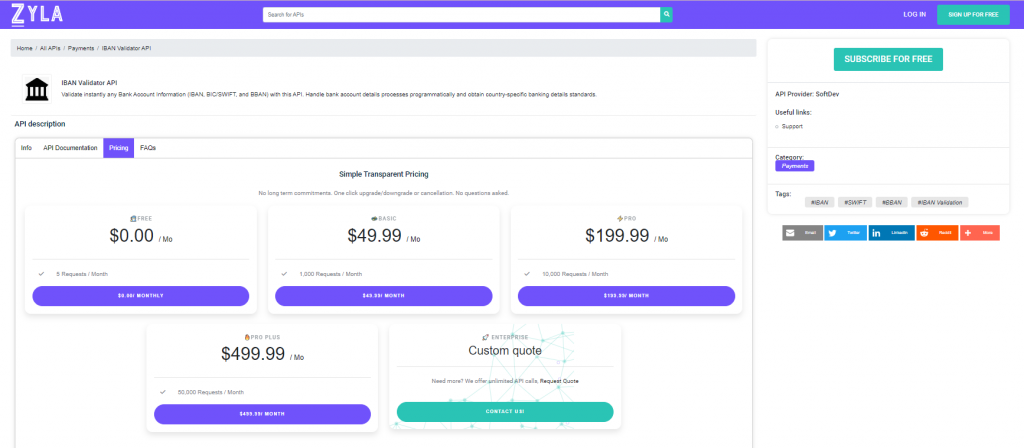

IBAN Validator API: Employ A Bank Account Validation API

IBAN Validator API allows you to validate any bank account information (IBAN, BIC/SWIFT, and BBAN) programmatically. It will validate any number from any Euro country and can also generate IBAN. This API will receive IBAN and perform validation. You will know if the number is correct. It also retrieves additional information about the bank, giving you more information about where the account is located.

What are the most common applications for IBAN Validator API?

Check the IBAN of your provider. You will be able to validate your provider’s IBAN number using this API before making any transactions.

You only need the Bank Account Number to identify the country of the account. Besides, you will be able to determine the location of the account. If any taxes must be applied to your transactions, you will be notified ahead of time.

Dynamically generate IBAN numbers. This API allows you to easily convert BBAN numbers to IBAN numbers. If you need to give someone outside your country your bank information, they will need IBAN, so you will automatically generate these numbers for them.