If you own an EU business-to-business company and want to expand and make cross-border sales, you must read this article. In the following paragraphs, we will explain what a VAT number is and why using a VAT Validator can save you a lot of time. Read it until the end to get deep into the financial issues and the best tool to ensure deals and increase revenues!

B2B companies are growing faster in the last few years thanks to increased international commerce and the help of technology. Online shopping has reached the most unexpected products and you can buy anything from your smartphone, especially after the pandemic. In this context, ensuring your customers’ currency support is as important as providing new products and shipping options.

And the same happens with the companies you got your supplies from, you must know if they are reliable. This could seem suspicious but actually, the EU will ask for your VAT number and it will appear in your invoices. In fact, it must be updated after a short time, to prevent fraud. The EU Commission and Payment Agencies recommend tracking VAT numbers. So, why not be completely sure about your clients’ financial data before the exchange?

A Short VAT Number Explanation For Beginners

In case you are just starting and don’t have a clear idea of what a VAT number is, it represents value-added taxes. This identification number allows an independent business or worker to bill other businesses inside the European Union. You must have it if your goods are going to be sold and shipped to countries that belong to it. That’s why it is so relevant to start the acquiring process right away to allow and make cross-border payments.

But B2B companies also have to be careful when it comes to buying. Hopefully, nowadays there are several artificial intelligence software that can identify VAT numbers. They are called VAT Validators and you won’t need anything else than an account to use them. Most work online or with simple program systems like JavaScript. You just collect your customers’ VAT number and then put it into the checker. The answer could be the company name, its location, and other data that will prove that it really exists.

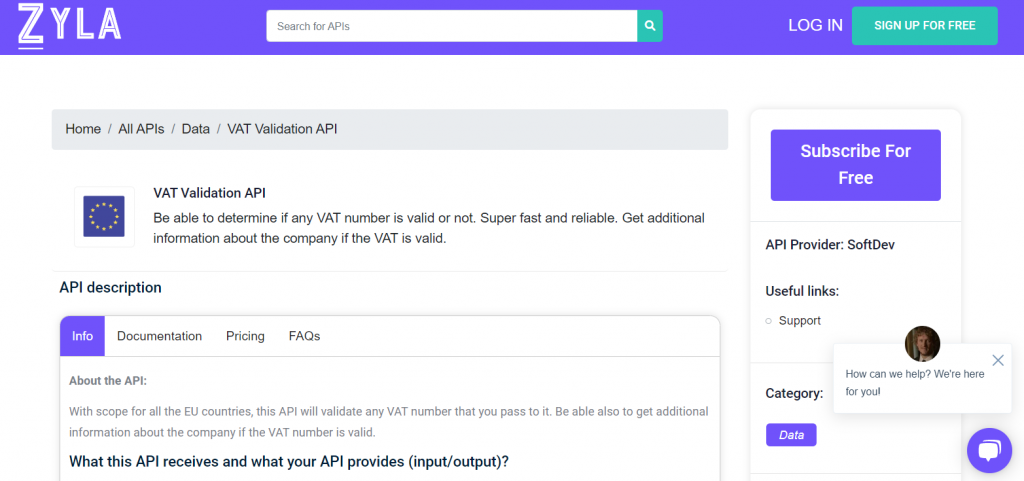

VAT Validation API: Your Best Choice

This VAT number checker is a comprehensive application programming software. That means that you can get access to an extensive online server that is constantly updated. You can provide any business VAT and know if it is valid or not. This will save you time and money invested in fiscal procedures and you will obtain more sales with the right buyers.

If the VAT combination is correct, VAT Validation API will give you a “TRUE” response. You will also receive the country code, the company’s name, and the address. Or you can put the name first and obtain the VAT after. With this tool, verification is simple, easy, correct, and, most importantly, up-to-date. The automated check detects missing or inaccurate VAT numbers at a glance and removes them from your system if required.