Are you in charge of a business and are you looking for a way to protect it from fraudulent transactions? You should read this article because we will tell you how you can do it with an API!

Imagine a checkout process so smooth that customers never second-guess their decision. With the API, this isn’t a distant dream—it’s a reality. The seamless checkout experience offered by the API transforms payment from a process of anxiety into a moment of ease. Moreover, it’s about customer-focused security, where every validated transaction becomes a testament to a business’s commitment to safeguarding their patrons.

In the realm of payment gateways, a Bank API stands as a sentinel, diligently guarding the thresholds of transactions. It goes beyond mere defense; it’s a safeguarding mechanism that ensures each transaction is legitimate and secure. But what lies beneath its protective surface? Let’s delve deeper to understand the intricate mechanism of this API.

Best Practices for Optimal Credit Card Validation

While the API’s prowess is undeniable, ensuring optimal credit card validation requires finesse. Crafting queries for accurate card verification is a blend of science and strategy. Balancing the need for precision with the necessity for performance involves setting parameters that safeguard both data and experience.

The Battle Against Fraudulent Transactions

The consequences of compromised transactions go far beyond financial losses. That’s why the fight against fraudulent activities is an urgent matter. The cost of compromise is far-reaching, affecting not only businesses but also eroding consumer trust. At the heart of this battle lies the BIN, or Bank Identification Number—an often overlooked yet vital component in verification.

Fraud prevention isn’t just about thwarting illegal activities; it’s about upholding trust in every interaction. As the BIN Checker API works its magic, it contributes to the ripple effect of prevention. It’s more than a code—it’s a promise to customers that their security matters. And the impact goes beyond consumer trust; businesses stand to gain financial benefits by reducing fraudulent transactions.

Credit Card Validator – BIN Checker API

Using this API, you can spot fraudulent credit card transactions. Start looking for each piece of information on credit and debit cards using BIN numbers. The user needs to input the BIN (Bank Identification Number) or IIN (Issuer Identification Number) of their credit or debit card in order to view all the information.

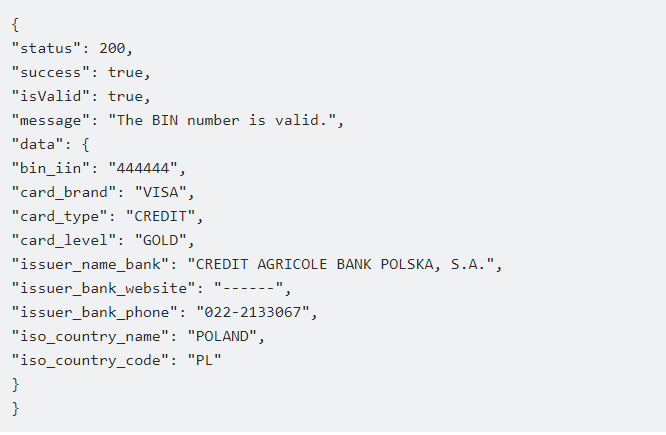

You need to provide a BIN (Bank Identification Number), which is the first six numbers on a credit or debit card, in order to access all of this BIN/IIN information in JSON format. The card’s type (Visa or MasterCard), expiration date, bank, and issue location will all be disclosed to you.

You will have access to the customer’s credit card details, including the issuing bank, the issuing institution (AMEX, VISA, MC), where the card is located, and whether or not it is a legitimate credit card.

Having access to a credit card’s BIN number (the first 6 digits) to verify any credit card. The Credit Card, CC Issuer, Card Type, Card Level, Card Brand, Issuer Country, and more will all send you info. This API merely takes into account the credit card’s authenticity in addition to the bank and business information when deciding whether to approve the payment or run a promotion. Following your API call, the “BIN Checker” endpoint will respond to your inquiry with the following message:

Watch the video below to learn more about how to use the API!

This CC Checker API makes it easier to identify the issuing bank or institution. Therefore, your ability to authorize the transaction may or may not depend on whether you have special agreements with a particular bank.