The banking sector is undergoing a significant transformation fueled by technological advancements and evolving customer expectations. As we look ahead to the future, it is crucial to anticipate the challenges that lie ahead. Furthermore, to identify innovative solutions that can shape the banking landscape. In this article, we will explore the challenges faced by the banking sector. Predict the prominent role of Banking Information API in addressing these challenges and driving the industry forward.

The Challenges Ahead: A Shifting Banking Landscape

In the face of rapid technological advancements and evolving customer expectations. The banking sector must navigate a shifting landscape filled with challenges that demand innovative solutions. From digital transformation to data management and meeting customer expectations. Banks are facing a host of hurdles as they strive to remain competitive in the modern era.

Digital Transformation

The rapid digitization of financial services brings both opportunities and challenges. Banks must adapt to changing customer behaviors and preferences while ensuring the security and privacy of transactions in an increasingly interconnected world.

Data Management

Banks are grappling with the growing volume of customer data. Effectively managing and leveraging this data to drive personalized experiences, mitigate risks, and comply with regulatory requirements poses a significant challenge.

Customer Expectations

Customers expect seamless, convenient, and personalized banking experiences. Meeting these expectations requires banks to provide real-time access to accurate and reliable bank information. Which is a complex task without the right tools.

The Role Of Banking Information APIs In Addressing Challenges

Banking Information API emerged as a powerful tool to address the challenges faced by the banking industry. By providing seamless access to accurate and up-to-date bank information, these APIs enable banks to enhance operational efficiency, improve customer experiences, and stay ahead in an increasingly competitive market. Leveraging the capabilities of Banking Information APIs is crucial for banks to overcome obstacles and unlock new opportunities for growth and success.

Streamlined Banking Operations

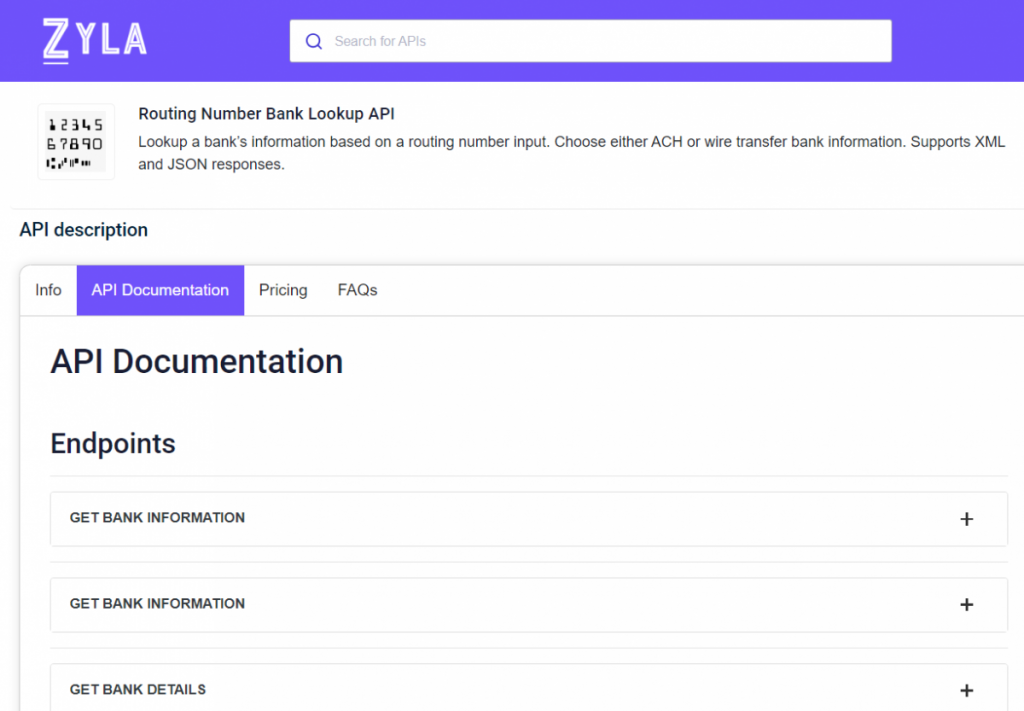

Banking Information APIs, such as the Routing Number Bank Lookup API, provide a streamlined approach to accessing accurate bank information. By integrating these APIs into their systems, banks can automate processes, improve efficiency, and reduce errors in wire transfers and payment processing.

Enhanced Customer Experience

Banking Information API enables banks to offer personalized and frictionless experiences to customers. By leveraging Banking Information APIs, banks can provide real-time account verification, ensure accurate routing information, and simplify account setup and authentication processes.

Improved Security And Compliance

APIs play a crucial role in strengthening security measures and ensuring compliance with regulatory standards. Banking Information API incorporates advanced security protocols to protect sensitive customer data, mitigate fraud risks, and adhere to industry regulations.

Predicting the Future: The Rise of Banking Information APIs

The future of the banking sector will be shaped by the ability to navigate challenges and embrace technological innovations. Banking Information API, with the ability to streamline operations, enhance customer experiences, and ensure security and compliance, will play a pivotal role in this transformation. As banks embrace these APIs and collaborate within a broader ecosystem, they will unlock new opportunities, drive innovation, and position themselves at the forefront of the evolving banking landscape. By predicting the increased use of Banking Information APIs, we anticipate a future where banks thrive by delivering seamless, secure, and customer-centric financial services.

Increased Adoption

We predict a significant increase in the adoption of Banking Information API by banks and financial institutions. These APIs will become a fundamental building block for driving innovation, improving operational efficiency, and delivering exceptional customer experiences.

Ecosystem Collaboration

As the demand for seamless integration and interoperability rises, banks will collaborate with API providers, such as the Zyla Hub, to access a wider range of APIs and create a comprehensive banking ecosystem. This collaboration will enable banks to leverage multiple APIs to address specific needs and deliver comprehensive solutions.

Banking Information API: How It Works

Visit www.zylalabs.com and explore payment APIs, and find the Routing Number Bank Lookup API. On registration with your payment details. You have the opportunity to take advantage of a 7-day free trial and experience the capabilities of the API firsthand. With a user-friendly interface and comprehensive documentation. Zyla Hub makes it easy for developers to discover, evaluate, and integrate powerful banking data API into their banking information needs. Zyla Hub offers flexible pricing plans, allowing developers to choose the most suitable option.

Example

Endpoint – Get Bank Details

INPUT

Number – 121000248

OUTPUT (API Response)

[

{

"status": "success",

"data": {

"routingNumber": "121000248",

"paymentType": "ACH",

"name": "Wells Fargo Bank, Na",

"addressFull": "255 2nd Ave South, Minneapolis, MN 55479",

"street": "255 2nd Ave South",

"city": "Minneapolis",

"state": "MN",

"zip": "55479",

"phone": "800-745-2426",

"active": "Active",

"lastUpdated": "Jan 5, 2023"

}

}

]