Are you thinking about what to invest in 2023? Invested in precious metals through a metals prices API!

You should invest in lithium, aluminum, and magnesium in the upcoming year. The predictions of Bloomberg’s analysts state that gold would dominate other precious metals in 2019. Silver, platinum, and gold are not the only metals, though, that may provide investors solid returns.

Copper, nickel, and cobalt, which are used to store energy from renewable sources, are rising in the middle of the fight to reduce carbon emissions. Even so, they are hardly the most alluring investments for 2022. The three materials that dominate the worldwide technology chains are lithium, aluminum, and magnesium.

- Lithium: The cheapest and most convenient source of lithium for the creation of Li-ion batteries is lithium carbonate. Lithium compound prices are shattering previous highs and are still rising. Batteries for machines and cars are in high demand as the industry is beginning to revive.

- Aluminum: After steel, aluminum is the second-largest manufacturer in the world, and the economic recovery increased demand for metals, particularly aluminum. The cost of energy is rising, and producing aluminum requires a lot of energy; globally, a ton of aluminum typically requires 14 MWh of electricity to be produced;

- Magnesium: Since this metal is required to create light and ultra-light alloys, magnesium shortage is creating a serious dilemma in the automobile sector. Magnesium’s position is extremely comparable to that of aluminum. China is the world’s greatest producer of magnesium, accounting for up to 87% of global production. However, since the nation’s government has been working to reduce emissions, quantities have sharply decreased. Additionally, the manufacture of magnesium uses roughly 40 MWh of power per tonne, which is three times as much as the production of aluminum.

The only ones that can be used to execute these kinds of transactions correctly and keep you informed of all the shifting movements of precious metals from 2022 to 2023 are digital services like Metals-API.

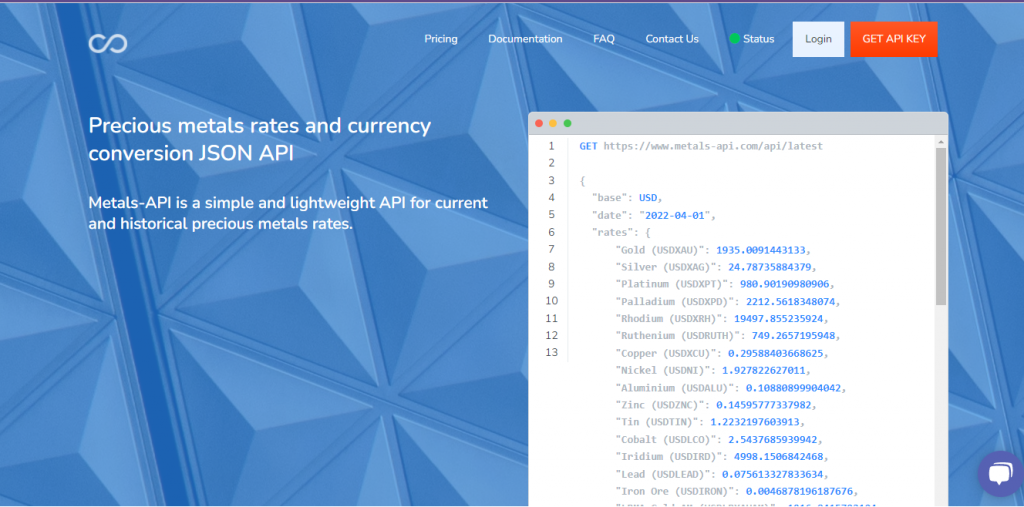

About Metals-API

Metals-API was initially released as a straightforward, lightweight API for banks’ current and historical pricing of precious metals. The Metals-API API may send real-time precious metals data as frequently as every 60 seconds with a precision of two decimal places. Offering exchange rates for precious metals, currency conversions, time-series data, statistics on volatility, and the lowest and highest prices of any particular day are just a few of the features.

Registration Guide

Metals-API Utilizing it is easy. Now all you have to do is follow these instructions.

- Register for a user account on the website.

- get an API Key.

- Make a choice regarding the currency and metal on the dashboard.

- Send a request via the API to the dashboard.

- Wait for the system to return an API response before using it.

Secure Platform

Banks and financial information providers, such as the European Central Bank, are where Metals-API gets its currency data from. Your connection to the Metals-API API is encrypted using bank-grade 256-bit SSL encryption.

The 256-bit encryption technique is used to encrypt and decrypt data or files. It is one of the strongest encryption approaches used by the majority of modern encryption algorithms, protocols, and technologies, ranking third strongest after 128-bit and 192-bit encryption.

Change Currency Endpoints

In addition to live data, the Metals-API includes other endpoints for time series data, currency conversion, and gold karats. Any amount between currencies and metals, as well as between any currency and any metal, and from one metal to another, may be converted using the same API endpoints.