International transactions can be complex and time-consuming to verify. When considering international transactions, it is important to take several factors into account, including the bank codes, routing numbers, IBANs, and SWIFT codes of both the sender and recipient. This information can be difficult to obtain and verify manually, which can lead to errors and delays.

APIs play a pivotal role in streamlining the process of international transaction verification. Furthermore, acting as a conduit for communication between applications, APIs facilitate seamless information exchange. By leveraging the power of International Transaction API, businesses can swiftly and effortlessly access the necessary information to verify international transactions.

APIs For International Transactions Verification

For international transaction verification, businesses can utilize various Bank Information APIs. Some of the most popular APIs include

International Transaction API – SWIFT APIs

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) is a global messaging network that connects banks and other financial institutions. To verify SWIFT codes, businesses can utilize the SWIFT API.

International Transaction API – IBAN APIs

The International Bank Account Number (IBAN) is a standard format for bank account numbers in Europe. The IBAN API can be used to verify IBANs.

International Transaction API – Routing Number APIs

The routing number is a nine-digit code that identifies a bank in the United States. The routing number API allows for the verification of routing numbers. They can also help businesses to comply with regulations and to improve customer satisfaction.

Furthermore, these specific APIs grant access to information about banks and financial institutions worldwide. Additionally, businesses can improve the accuracy, efficiency, and security of their international transaction verification processes. APIs can help to reduce errors, delays, and fraud. They can also help businesses to comply with regulations and to improve customer satisfaction.

Unleashing The Power Of International Transaction API – International Transaction Verification

APIs can be a valuable tool for businesses that are looking to improve their international transaction verification processes. By using APIs, businesses can improve accuracy, efficiency, security, compliance, and customer satisfaction.

Here are some of the benefits of using APIs for international transaction verification

Increased Accuracy

APIs can provide businesses with access to accurate and up-to-date information about banks and financial institutions. This can help to reduce errors in international transactions. For example, if a business is trying to verify a SWIFT code, it can use the SWIFT API to get the most up-to-date information about the code. This can help to prevent the business from making a mistake and sending the money to the wrong bank.

Improved Efficiency

APIs can automate the process of international transaction verification. This can save businesses time and money. For example, a business can use an API to automatically verify the bank codes, routing numbers, IBANs, and SWIFT codes of its customers before making a payment. This can save the business the time and effort of manually verifying this information.

Enhanced Security

APIs can be used to encrypt data and to protect it from unauthorized access. This can help to reduce the risk of fraud. For example, a business can use an API to encrypt the bank codes, routing numbers, IBANs, and SWIFT codes of its customers before sending them to the bank. This can help to prevent hackers from stealing this information and using it to commit fraud.

Increased Compliance

APIs can help businesses to comply with regulations. For example, the SWIFT API can be used to verify SWIFT codes, which is required by some regulations. By using APIs to comply with regulations, businesses can avoid fines and penalties.

Improved Customer Satisfaction

By providing accurate and timely information about international transactions, businesses can improve customer satisfaction. For example, if a business is able to verify a customer’s bank code quickly and easily, the customer will be more likely to be satisfied with the business. This can lead to repeat business and positive word-of-mouth.

Finally, APIs can be a valuable tool for businesses that are looking to improve their international transaction verification processes

A Versatile API For International Transaction Verification.

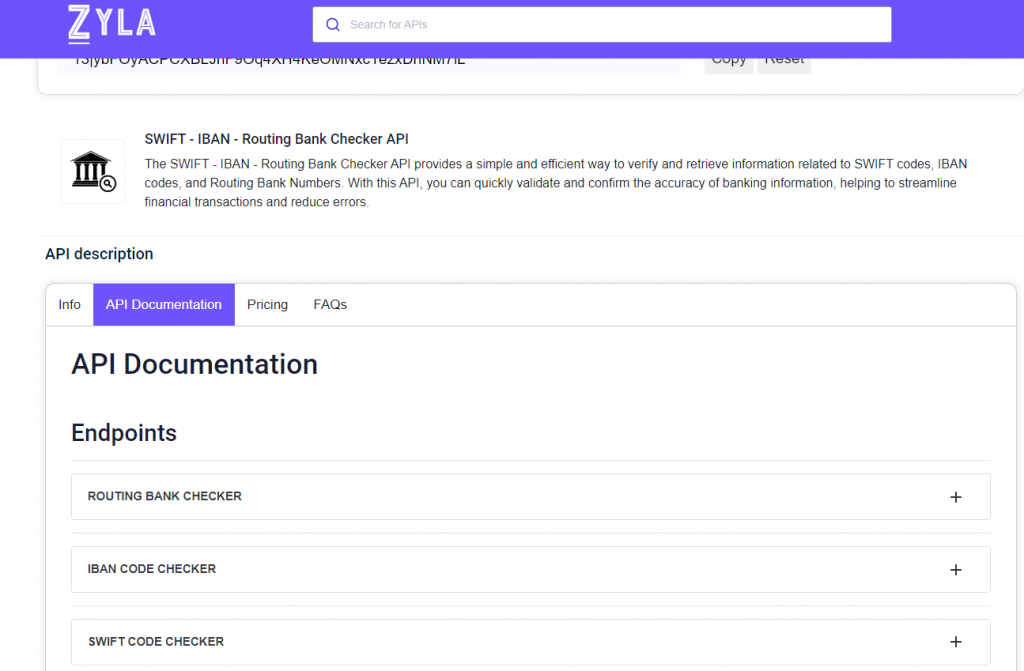

f you are looking for an easy-to-use tool to retrieve information about any bank account in the world, I recommend using the SWIFT – IBAN – Routing Bank Checker API. This API provides a simple and efficient way to verify and retrieve information related to SWIFT codes, IBAN codes, and Routing Bank Numbers. With this API, you can quickly validate and confirm the accuracy of banking information, helping to streamline financial transactions and reduce errors.

The SWIFT – IBAN – Routing Bank Checker API is available through Zyla API Hub, a reputable API marketplace. Visit www.zylalabs.com and select the “Payments” category. From there, you can browse the list of available APIs and select the SWIFT – IBAN – Routing Bank Checker API.

To get started, you need register and select the plan you want, and then can take advantage of the free 7-day trial, allowing you to experience the API’s functionality. Additionally, you can choose a suitable plan based on your monthly call requirements from the available options.

Getting Started.

To start using SWIFT – IBAN – Routing Bank Checker API you need to navigate to the API dedicated page as described above. Then by clicking on the start free trial option on the upper right side of the screen, you need to register after selecting the plan, then you can start your 7-day free trial. You can send API requests using different endpoints based on your interest. Once you selected your needed endpoint, make the API call by pressing the button “run” and get the API response.

Example

INPUT SWIFT Code – MUCBPKKA

OUTPUT – (with endpoint SWIFT CODE CHEACKER)

API response is

{

"status": 200,

"success": true,

"message": "SWIFT code MUCBPKKA is valid",

"data": {

"swift_code": "MUCBPKKA",

"bank": "MCB BANK LIMITED",

"city": "KARACHI",

"branch": "",

"address": "MCB TOWER FLOOR 3 I. I. CHUNDRIGAR ROAD",

"post_code": "74000",

"country": "Pakistan",

"country_code": "PK",

"breakdown": {

"swift_code": "MUCBPKKA or MUCBPKKAXXX",

"bank_code": "MUCB - code assigned to MCB BANK LIMITED",

"country_code": "PK - code belongs to Pakistan",

"location_code": "KA - represents location, second digit 'A' means active code",

"code_status": "Active",

"branch_code": "XXX or not assigned, indicating this is a head office"

}

}

}