Are you looking for a way to optimize your payment process? An API is the solution you are looking for.

In the digital world we live in, the payment process is one of the most important steps in any purchase. It can be very difficult to choose between different options and to know which one is the safest. That is why, many companies are turning to APIs that can help them with this task.

There are many different kinds of APIs, but BIN IP Checker APIs are some of the most popular right now. These kinds of APIs provide information about a specific IP address. This can be very useful for companies that want to know where their users are coming from. This way, they can know where their customers are located and tailor their marketing campaigns accordingly.

An API (Application Programming Interface) is a type of software that allows two applications to communicate with each other. This means that they can share data and functions with each other. This is how many websites and apps work. They use APIs to communicate with other services and retrieve the data they need.

There are numerous benefits to using an API to streamline your payment procedure. It will firstly assist you in providing material in the language that your audience prefers. They will feel more linked to your brand as a result, and you will be able to communicate with them more effectively.

Additionally, it will assist you in determining the preferred payment methods of your users so that you may include them as choices on your website or mobile application. Finally, by being aware of where your clients are, you may reach out to them with exclusive offers or promotions that are only available in their area.

BIN IP Checker

This API was developed with the demands of webmasters who wish to closely examine credit/debit card transactions that take place on their websites. It is a clear illustration of how dangerous the transactions are.

This API has been created specifically for online business owners who want to carefully review credit/debit card transactions that occur on their websites. It paints a crystal-clear picture of just how risky the trades are. However, anyone is free to use this API on any platform in the manner of their choice and subject to their own set of limitations.

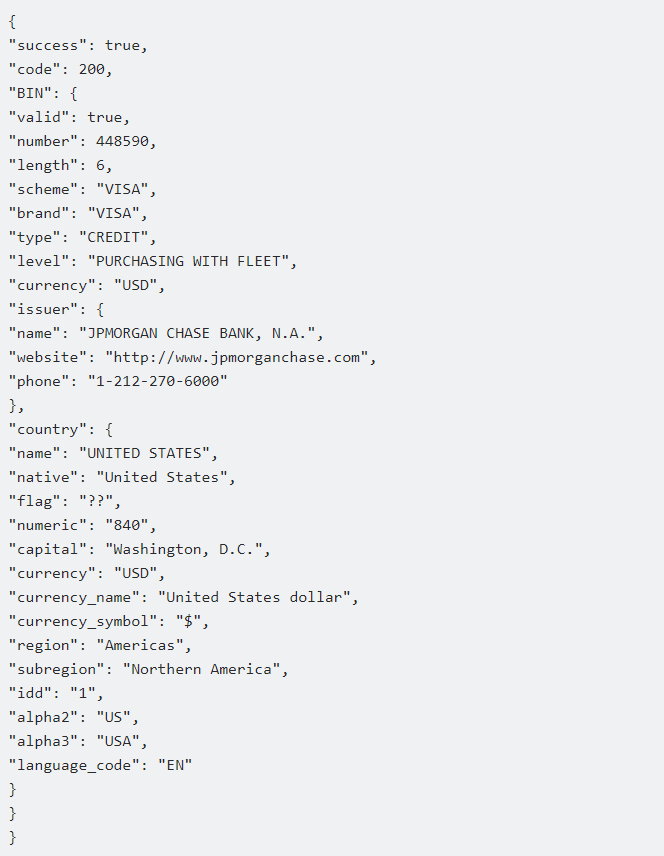

This API will verify both the BIN of the credit card and the user’s IP address who submitted the request. By comparing the BIN and IP information, it will determine whether the country of the IP address and the card’s BIN match. This is a great way to stop fraudulent transactions right where they start. An illustration of the kind of response you will receive from this API is as follows:

You know how difficult it is to stop fraud if your company handles a lot of transactions. However, with the help of this API, you will be able to quickly and easily spot any fraudulent activity in your system. Using cutting-edge algorithms, the Fraud Detection API examines a wide range of data points, including IP addresses, geolocation data, user activity, and more. These data points are also used to construct a risk score that can be used to determine whether a transaction is fraudulent.