Are you extremely concerned about the volatility of the global metals market? Do you fear that the same could happen with the metal of the future (lithium)? Well, it is always better to be prepared, and investing in the futures market is a better idea than the spot market.

The pandemic has shown that the future is anything but predictable. All projections are subject to a series of health, economic, environmental, political, and social variables, among others. Depending on the source and the year of the study, the projections can vary significantly. In general, all the studies agree that the main driver of consumption will be electric vehicles, which could multiply by 14 the demand for lithium carbonate equivalent (LCE) until the end of the decade (2030) in relation to the year 2019. The vehicles’ electricity representing 31% of LCE demand in 2019 could go on to constitute almost 80% of demand by 2030.

However, lithium-ion batteries and electric cars are not just made of lithium. Consequently, lithium demand may be affected by slower development or shortages of other minerals. An electric vehicle requires copper, nickel, manganese, cobalt, graphite, chromium and other minerals. The future of lithium demand also depends on the socio-environmental impacts that lithium overexploitation can produce in different territories where it is found. Considering lithium only as a raw material will lead to reproducing the cycles of extractive suffered by other minerals.

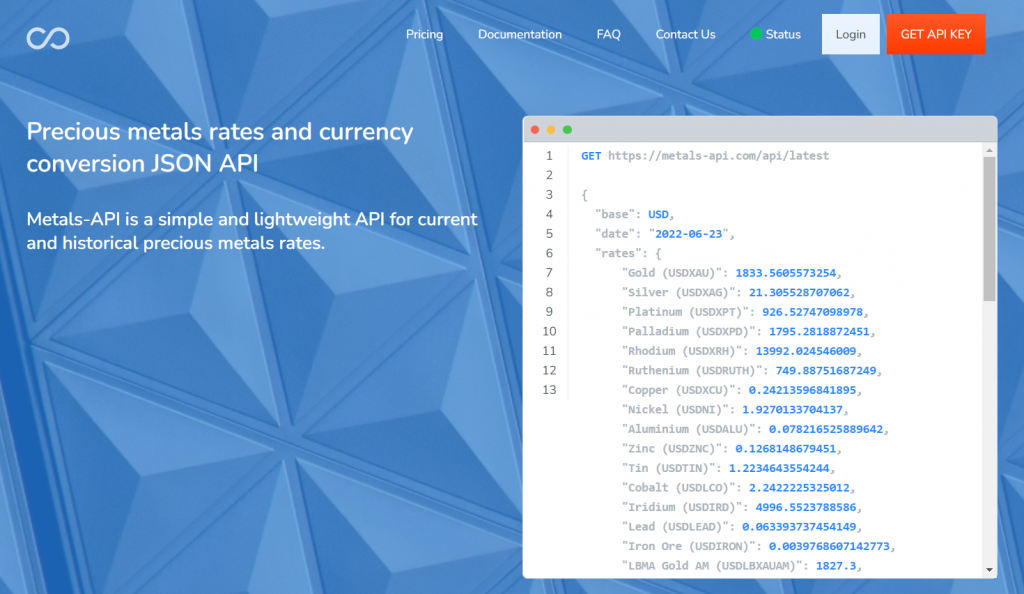

Be that as it may, the world’s scientists predict great expectations with this mineral, since they estimate that future uses will be found in the coming times. But for now, this global crisis will have to be dealt with. Therefore, accessing futures market prices is a much better idea than accessing the spot market. To access these rates, what better way to use Metals-API.

Why Metals-API?

As an open source, lightweight, and straightforward API for current and historical metals rates published by banks or other financial organizations, Metals-API got its start. If you’re curious about where they get their information, you should be aware that the London Metal Exchange (LME) and the New York Mercantile Exchange are among the most well-known in the world (NYMEX). The best LME pricing API is really Metals-API.

Another important detail to be aware of is that lithium prices are obtained in real-time, with a frequency of 60 seconds and a precision of 2 decimal places. Due to the rapid price increase of lithium, it is crucial to monitor prices carefully to prevent financial loss. And if you ask yourself… “but this system only offers spot market prices?”. The answer is no. You will be able to obtain the prices of the spot market, but also those of the futures market. Both are included with Metals-API.

What is the price of this service?

Six of the seven plans offered by this business need annual payments. Choose wisely because every strategy has advantages and disadvantages. You should go to the website and select the “pricing” tab, as recommended. The key distinctions between each plan are there for you to see. If that’s still not enough, Metals-API also provides limitless requests at custom enterprise prices.

And don’t forget, a premium customer service will be available to you when you need it.