Did you know how to invest in gold? Did you have any idea that there is a stock exchange just for metals? In this article we will teach you how to start investing in precious metals and survive the experience through an API!

To put us in context, the London bullion market is an over-the-counter wholesale market for gold and silver transactions. The London Bullion Market Association (LBMA), which is informally supervised by the Bank of England, conducts trading among its members. Major multinational banks, bullion dealers, and refiners make up the majority of the members.

The Good Delivery standard, which is a collection of regulations established by the LBMA, describes the physical qualities of gold and silver bars used in market settlement. It also establishes criteria for refineries to be listed on the LBMA Good Delivery List of authorized refineries.

Now that we know the basics, we all know that Gold is the mostly tradable metal across the world. So to understand how the LBMA mechanism works, you have to understand that they are based on schedules. At 10:30 a.m. and 3:00 p.m., twice a day (local time). The London Bullion Market Association (LBMA) provides the price of gold in US dollars. Gold futures contracts are the name for these forward transactions. Two business days following the trade date, spot gold is exchanged for settlement, with a business day defined as a day when the New York and London markets are open to the public.

Spot gold prices and interest rate differentials influence the gold forward market. This is due to the fact that gold, like currency, is borrowed and slowed in the interbank market by central banks. This stimulates gold lending so that central banks may profit from their vast gold holdings by earning interest. This has historically made it a desirable market for gold miners to sell forward and has contributed to an active and generally liquid derivatives market.

Therefore, if you are interested in trading gold bars or want to sell or buy from the bank, we recommend the use of Metals-API where you can quickly check the monetary value of the bars.

About Metals-API

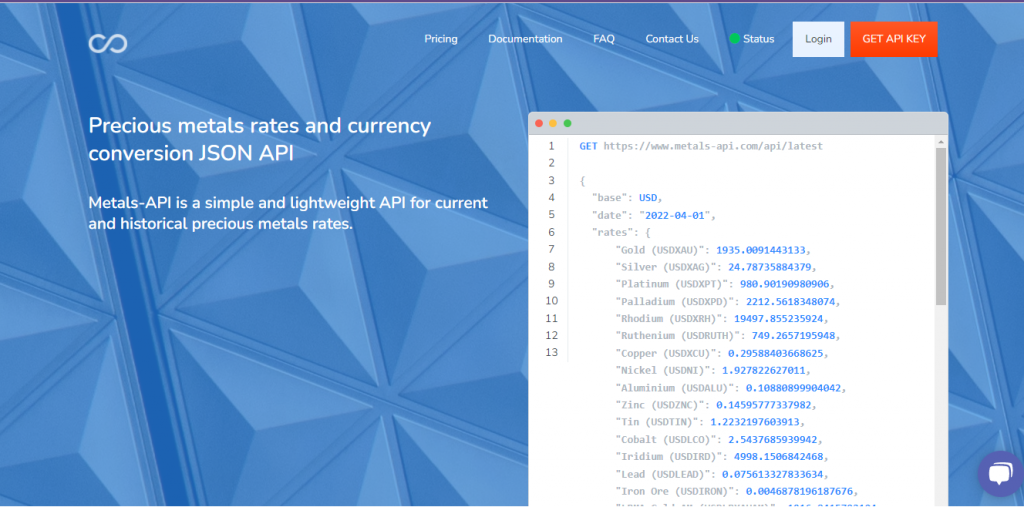

Metals-API It’s a simple and free application interface that gives you access to current and historical precious metals pricing from banks. Indeed, the API can provide real-time precious metals data through API with an accuracy of 2 decimal points and a frequency of every 60 seconds. Delivering precious metals exchange rates, converting single currencies, and giving Time-Series and Fluctuation data are all features of the Metals-API, which is built on top of a solid back-end architecture.

Methods Of Use

Metals-API is unique and quite simple to use. You most follow certain requirements to do so:

- Create an account on the site

- Search for product symbols that match the data you’re looking for.

- Uses the specified currency and product to make an API request.

- Go to your dashboard and wait for a response from the API.

Advantages of a Subscription

The Metals-API package provides unrestricted access to a team of specialists who are solely liable for any faults or problems you encounter while developing or using the API. Check out the following resources if you’re still not convinced if the Metals-API API is correct for you:

- Plans & Features

- API Documentation Sales

- Customer Service