If you require a free API with silver values from reputable sources such as MEX-Nepal data, we propose reading this article.

Silver is a metallic chemical material that is bendable and pliable. Despite its paucity in the continental mantle, it is a superb heat and electrical conductor. In any case, silver has a wide range of applications, including medical wart treatments, deodorants, batteries, motors, glass, 3D printing, the automobile sector, photography, solar panels, coinage, and, of course, investment. Approximately 70% of the world’s silver production is utilized for industrial reasons, with the other 30% used for monetary purposes.

If you wish to invest in this metal, you must stay current on silver prices, which are quite volatile. As a consequence, you can’t trust every provider on the internet. Mex Nepal is one of the most reliable metals exchange data sources, although it is difficult to locate.

What Is Mex Nepal?

Mercantile Exchange Nepal Limited (MEX) is Nepal’s sole exchange that receives technical and business assistance from market players. MEX has consistently contributed to the improvement and expansion of Nepal’s commodities ecosystem since its foundation. The Exchange’s day-to-day activities are managed by experienced and certified personnel with impeccable integrity and skill. They are all uninterested in trade.

MEX’s distinctiveness may be found in a variety of ways. It has embraced globally verified accounting and compliance standards as a zero-debt firm. MEX began futures and spot trading in precious metals, energy, base metals, and agricultural commodities using a pure order matching technology.

Furthermore, MEX’s research desk is continually recognizing the commodities economy’s hedging needs, and the basket of items is expected to expand even further in the coming days. MEX has also made significant contributions to increasing awareness and driving policy improvements in the commodities industry.

If you want to get access to this information, you should use an API. It is a system that connects two or more devices to send data between them. It’s used by the most important firms because they integrate the APIs in their apps or websites. In this case, you need one with silver values.

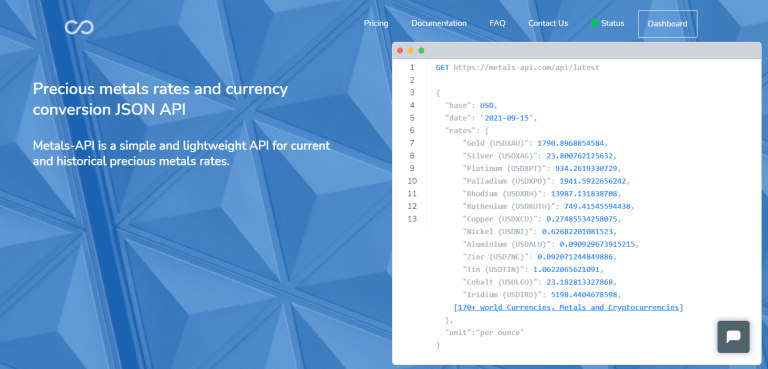

This data will be very useful to you to know the best moment to invest, analyzing the fluctuation of the prices because of several factors along the time. In addition, you can watch spot prices and you can share the information in your network. To afford this purpose, use Metals-API.

Why Metals-API?

To begin, it is an API designed to track metal prices (including silver) with an accuracy of 2 decimal points and a frequency as high as every 60 seconds. Each minute, the Metals-API gets currency exchange data from over 15 reliable databases. Financial institutions’ data providers, such as COMEX/NYMEX rates and the London Metal Exchange, are among the sources.

Second, its technology instantaneously translates precious metal values to 170 different currencies from across the world (you could see the prices in your local currency). Nevertheless, considering the rise in popularity of digital currencies in recent years, Metals-API also supports digital currencies and all currencies worldwide.