Quote your investments in precious metals through a precious metals API that will give you data quickly and live! Read this article to know how to do it!

Precious metals are chemically inert materials that are considered rare. Because they are scarce in nature, they have a high economic value. Precious metals are employed in a variety of applications, including jewelry, industrial operations, and investment vehicles.

Gold, silver, platinum, and palladium are the four major precious metals. There are typical alloying elements that may be added with the major precious metals to improve the qualities of the final product, depending on the use. Other interesting aspects can also be found in non-precious metal jewelry or accessories. Some of the most well-known commodities traded in this category can be used in various industrial operations. The remarkable increase is mostly controlled by the rapid industrialization of the major consuming countries.

An ETF (exchange-traded fund) is a pooled investment vehicle that works similarly to a mutual fund. ETFs often track a certain index, sector, commodity, or other asset, but unlike mutual funds, they may be bought and sold on a stock market just like a regular stock. An ETF can be set up to follow anything from a single commodity’s price to a huge and diversified group of assets. ETFs can even be built to follow certain investing strategies.

An exchange-traded fund (ETF) is a collection of assets that trades on a stock market. Unlike mutual funds, which only trade once a day after the market closes, ETF share values fluctuate throughout the day as the ETF is purchased and sold.

ETFs can hold a variety of assets, including equities, commodities, and bonds; some are limited to the United States, while others are global. When compared to buying equities separately, ETFs have lower expense ratios and lower broker commissions.

Because it is exchanged on an exchange like stocks, an ETF is termed an exchange-traded fund. This is in contrast to mutual funds, which are not traded on a stock exchange and only trade once a day after the markets shut. Furthermore, as compared to mutual funds, ETFs are more cost-effective and liquid that´s why we recommend Metals-API, which it´s a exchange platform.

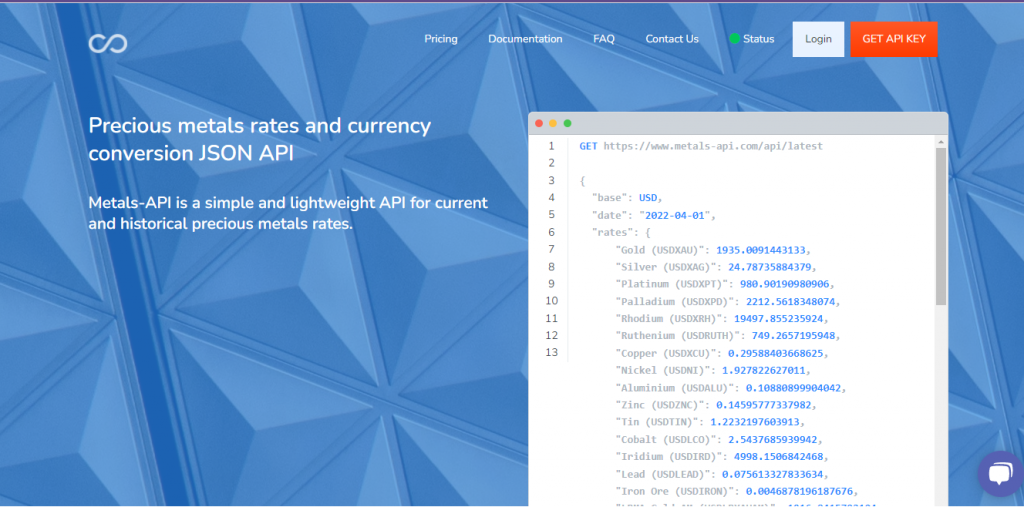

Let´s Explained Metals-API

Metals-API it’s a lightweight program with a basic UI that offers you access to current and historical precious metals pricing from banks. The Metals-API, which is developed on top of a strong back-end architecture, can deliver precious metals exchange rates, convert single currencies, and provide Time-Series and Fluctuation data.

Easy Platform Registration

Metals-API It’s simple to use. All you have to do now is follow the steps below:

- Register for an account and generate an API Key; this code must be kept private as it is necessary to make an API call.

- You must be familiar with the symbols you will be using. You may find them here.

- Make a copy of your API access key and run it again.

- Get an API request to the system to acquire an API response.

A Safe Website

Metals-API uses 256-bit SSL encryption to safeguard the connection from one side of the internet to the other. This sort of encrypted communication is commonly used by financial organizations. This technique protects the connection by encrypting data transit between a web browser and a website (or between two web servers).