Would you be interested in investing in precious metals but don’t know where to get the prices? Do it through this precious metals API!

Precious metals are a good way to protect yourself against market instability. That is reason enough for them to have a minor place in most portfolios. It’s critical to remove emotion from your investment selections. And that’s a terrific place to start a discussion about precious metals investing.

The concept behind precious metals is that they have no association with the stock market. Precious metals, such as gold and silver, also tend to keep their value well in times of market instability. Investing in precious metals, however, is a matter of controversy among many investors, as sensible as those arguments sound. Precious metals account up a significant portion of certain investors’ portfolios. Others feel precious metals have no role in the economy.

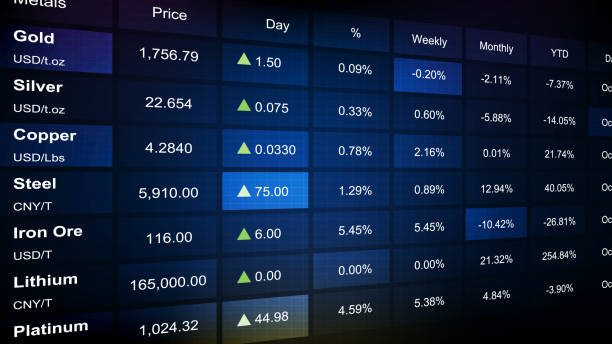

Rare metals with a high economic worth are known as precious metals. Scarcity, high demand in industrial operations, and their function as a store of value all contribute to their high worth. Gold, silver, platinum, and palladium are the four most popular precious metals for investment.

Buy the Physical Metal – Purchasing gold or silver coins, bars, or other tangible assets allows you to hold a physical asset outside of the traditional financial system. It also eliminates the counterparty risk associated with investing. This simply implies that other investments are vulnerable to the failure of a third party to fulfill its obligations.

Invest in a Precious Metals Exchange-Traded Fund (ETF) – Investing in a Precious Metals Exchange-Traded Fund (ETF) is a great way to diversify Purchasing real metal has some drawbacks.

Invest in Mining Stocks – A third approach is to purchase shares in firms that engage in precious metals mining. This is a “picks and shovels” approach to precious metals investing. You are not, however, obtaining actual ownership of the metal, as you would with an ETF.

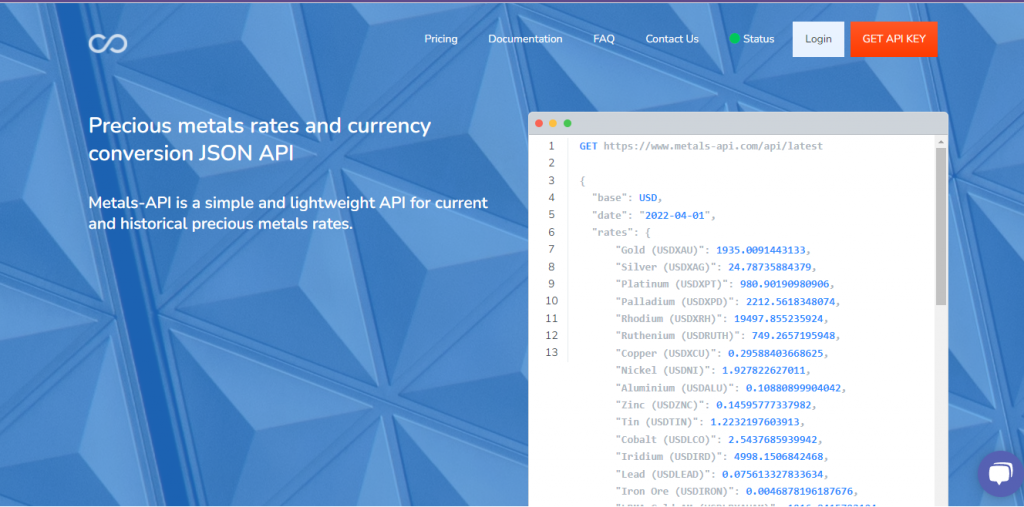

To go along with this business approach, you may use a platform that allows you to trade data on precious metals and currencies, making your task go faster and smoother. A case in point of this is the Metals-API Platform.

What Is Metals-API?

Metals-API gathers market data prices from a range of trade sources and organizations throughout the world in a variety of formats and frequencies. Commercial sources, especially for major currencies and commodities, are also recommended since they give a more realistic reflection of market exchange values.

How Can You Make The Registration?

Metals-API It’s simple to use. All you have to do now is follow the steps below:

1 – Create a user account first.

2 – Generate an API Key; this code must be kept secure because it is needed to make an API request.

3- You should be familiar with the symbols you will use.

4- Finally, make a backup of your API access key and execute it.

Is It Possible To Access Previous Reports?

The Metals-API API platform provides historical EOD / End of Day exchange rates that are only available between 00:05 a.m. and 00:05 a.m. GMT. Only the day before reports are accessible, and they are time stamped to one second before midnight.

Is It Secure?

Currency data is obtained through Metals-API from financial data suppliers and institutions, such as the European Central Bank. Because it is secured with bank-grade 256-bit SSL encryption, the connection is secure to the level of a bank.