Do you live in the Japanese capital? Would you like to get indium prices from Tokyo Commodity Exchange (TOCOM)? If that is your problem, we have good news for you! We recommend you read this article.

Indium is a chemical element that belongs to the boron group, although specifically it is a post-transition metal. It is located between cadmium and tin. Its atomic number is 49, its symbol is In (periodic table) and its atomic mass is 114.818. Indium is one of the least abundant metals in the earth’s crust and, being chemically similar to zinc, is mainly obtained from zinc ore deposits. It was discovered in 1863 by the German chemists Ferdinand Reich and Hieronymous Richter.

Indium compounds such as indium antimonide and indium phosphide are semiconductors with useful properties in the manufacture of high- and low-temperature germanium transistors, in light-emitting diodes (LED) and laser diodes, and in photovoltaic solar cell components. Likewise, indium is used in the manufacture of rectifiers, solders, thermistors and photoconductors. It is also important in making low-melting alloys, which are usually 24% zinc and 76% gallium, and are liquid at room temperature.

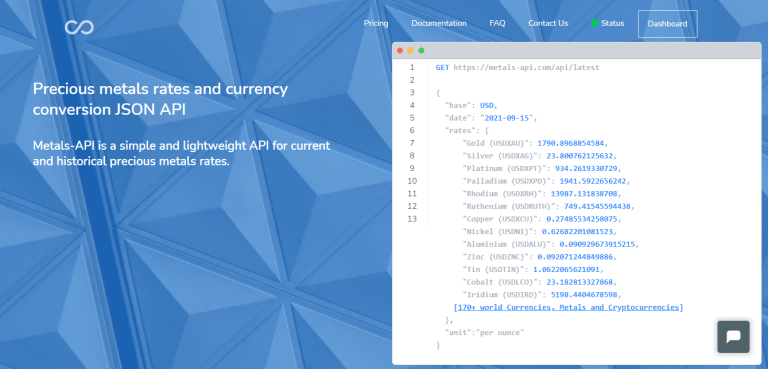

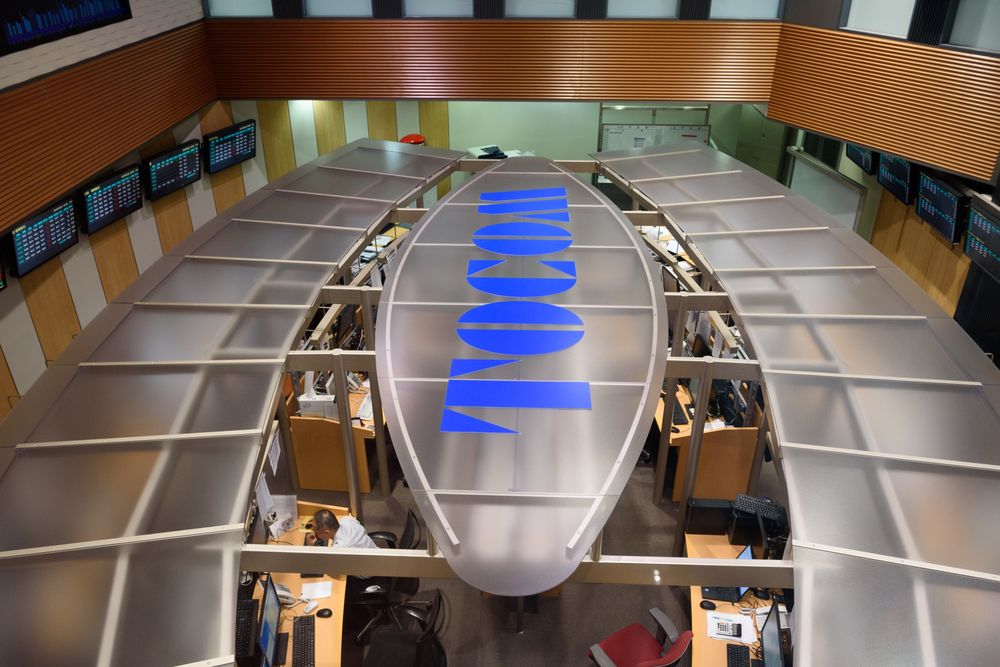

For a country as developed as Japan, it is clear that it must import this metal to meet the needs of its 120 million inhabitants. One of the best options is to check the rates on the Tokyo Commodity Exchange (TOCOM), which is the largest metal futures market in Japan and one of the most prominent in Asia. But, if you want to get these prices faster and easier, one tool we recommend is Metals-API, the best precious metals API.

Why should you use this service?

There are many reasons that justify why you should use this service. First of all, its excellent sources of information explain why Metals-API is synonymous with reliability. One such source is the Tokyo Commodity Exchange (TOCOM), which is a great relief for those Japanese entrepreneurs. And don’t worry about the currency, the Japanese yen is included, as well as 170 other currencies from around the world.

Some of its clients are Metex, Mansour, Chainlink, among other companies. On the other hand, all indium data is obtained in real time, with an accuracy of 2 decimal points and a frequency of up to every 60 seconds. Capabilities include delivering exchange rates for Precious Metals, returning Time-Series data, fluctuation data and lowest and highest price of any day.

Surely you are wondering what the price of this system is. Today is your lucky day. Metals-API has a free version, but this option is only recommended for those who do not need to update the price of indium as often. But if your business is larger, you may be forced to pay for one of six available plans, each geared toward different needs. Prices range from $10 to $1200 per year (not monthly).

If you have any questions, remember that on its website you will find a manual about how this system works. But if there is something you don’t understand, there is a virtual chat, always online from 9 am to 6 pm (GMT+1).