Is gold a good investment in India? Find out in this article about Chennai Gold rates API!

Due to its ability to hold its value when fiat currencies lose some of their purchasing power, gold is frequently seen as an effective inflation hedge. But when interest rates increase, it loses appeal because owning gold does not provide investors dividends or interest payments.

You may purchase gold through coins, bullion, funds, accumulation plans, and, of course, jewelry. Buyers are always eager to pay whatever the gold price is in Chennai right now since gold is the only commodity that is resistant to inflation.

On financial websites, on gold dealers’ websites, and online, you may get the most recent gold price in Chennai. Today’s gold price in Chennai is much higher than the week before but nearly identical to last week’s pricing.

Chennai is home to several prominent industries, and gold is a part of their investment portfolio. Chennai, like every other city in India, depends on the inflow of gold. Each day, the Bullion Association determines the price of gold in Chennai in accordance with the global stock exchange. The current gold rate in Chennai looks to have been steady for the duration of this year, which is good news for buyers.

One of the Indian cities with the largest demand for gold is Chennai, a significant city in the Tamil Nadu state. The precious metal is prized for both its worth as an investment and for its cultural significance. It is obvious that gold is a significant financial commodity in Chennai given the quantity of jewelers from which one may purchase the yellow metal. Because of this, the city boasts India’s largest gold sales and purchases.

In terms of gold usage, India is only surpassed by China. The reason is that Chennai accounts for up to 30% of the country’s total gold demand. The demand for this item has increased as a result of its symbolic value and significant position in South Indian ceremonies and weddings.

It’s worth bearing in mind that many gold dealers nowadays need to be aware of the changes in the price of this precious metal. They employ several platforms, including Metals-API, to do this.

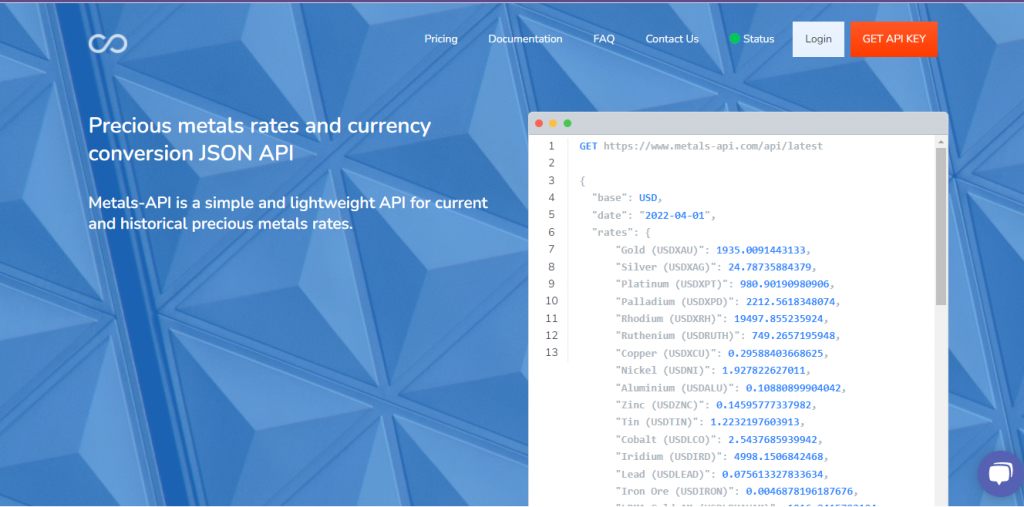

About Metals-API Platform

Metals-API It is a straightforward, compact software program that allows you access to precious metals pricing information from banks both historically and currently. The Metals–API platform offers you precious metal exchange rates and currency conversions and was built on a high technological core.

Registration Steps

The Metals-API website has excellent usability. All you have to do is follow these instructions:

-Make an account and API key.

-Choose the type of metal and currency you want.

– Use the panel to submit an API request, and the software will respond with an API response.

Benefits Of Being Subscribe

You get unlimited access to a group of professionals who are solely responsible for helping you with any issues you may have when constructing or using the Metals-API as part of your membership. Check out these resources if you’re still not convinced if the Metals-API API is the perfect choice for you:

- Options & Features

- Customer Service & Sales

- Documentation About APIs

Safest Site On The Internet

Metals-API obtains monetary information from organizations and financial data sources, such as the European Central Bank. Since the connection is secured with 256-bit SSL encryption of the highest caliber, it is as secure as a bank.