Are you looking for an easy and fast way to obtain COMEX rates API? Then this article is for you!

On the trading floor and through overnight electronic trading computer systems, the COMEX (The Commodity Exchange Inc.) buys and sells billions of dollars worth of oil, energy carriers, metals, and other commodities for future delivery. The prices that people pay for a wide range of commodities across the world are based on market rates.

The National Metal Market, the Rubber Exchange of New York, the National Raw Silk Exchange, and the New York Hide Exchange merged to become Commodity Exchange Inc. (COMEX), the major exchange for silver and gold futures, in 1933. The world’s biggest physical futures trading exchange, COMEX, was formed by the merging of Commodity Exchange Inc. with the New York Mercantile Exchange (NYMEX).

COMEX is a subsidiary of the Chicago Mercantile Exchange and is based in Manhattan’s World Financial Center (CME). COMEX is the world’s most liquid metals market, according to CME Group, with over 400,000 futures and options contracts traded daily. The exchange’s pricing and daily activity have an influence on precious metals markets all around the world.

It’s vital to keep in mind that the COMEX does not sell precious metals. As part of the contract conditions, the seller makes these available. Short sellers who do not have metals to deliver must close their positions at the end of the trading day. The metal, such as gold, must be in an authorised depository for a short that goes to delivery. The possession of COMEX-approved electronic depository warrants or warehouse receipts, which are necessary to make or receive delivery, represents this.

How To Get COMEX Rates

You’ll need the right tools to collect data. We highly advise using an API that gives current copper pricing as well as historical rates that include COMEX data for this purpose. You should also pick one that gives statistics on price fluctuations so that you can consider all of the elements when deciding when the greatest time to buy is.

But, first and foremost, what is an API? The application programming interface (API) is a set of rules that regulate how computers and programs interact with one another. APIs connect a web server to an application, enabling data to be transferred between the two.

It’s a set of ways for connecting applications to other software components, operating systems, and microservices. In a nutshell, an API sends a user response to a system and receives a response from it. For example, when you click “add to cart,” an API informs the website that you have added a product to your shopping cart; the website then adds the product to your cart and updates your shopping cart.

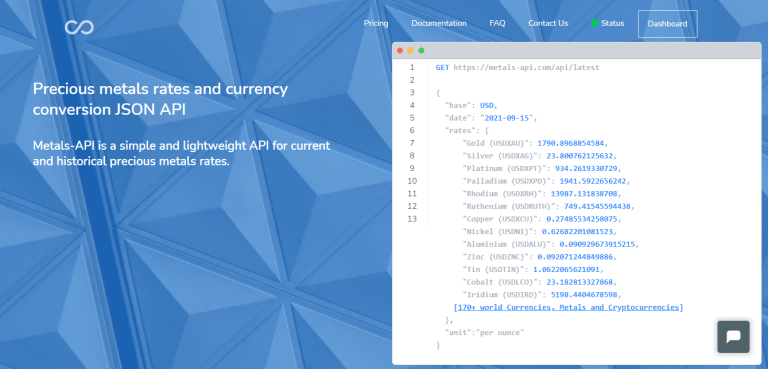

On the internet, there are a lot of them, but they aren’t all the same. As a result, for precious metal values, we strongly advise you to use Metals-API, which is quickly becoming one of the most popular and comprehensive APIs. This application might provide you a variety of metals and currencies to use on your website.

You must do the following to use it:

- At www.metals-API.com, you may generate your own API key.

- You should look for the symbols of the currency and the commodity you wish to check.

- Before terminating the API call, use these symbols to add metal and money to the list. You have the option of specifying the programming language as well as the price range.

- After that, you just hit the “run” button. The rates will be shown in troy ounces by the software.

About Metals-API

Over 15 reputable data sources feed the Metals-API API with exchange rate data per minute. Among the sources are banks and financial data businesses. With an accuracy of 2 decimal points and a frequency of up to 60 seconds, the API can provide real-time precious metals data.

Only midpoint exchange rates are provided by Metals-API. The average median rate of Bid and Ask during a certain period is used to compute midpoint rates. The API can also give accurate exchange rate data for precious metals in 170 different foreign currencies.

Also published on Medium.