Dealing with Zinc prices from CME group has never been easier with a metal prices API

Zinc Prices & Features

Global zinc mine production increased 8% year-on-year in 2021 to 13,000 tonnes of contained metal. Mining intensity is expected to remain high this year, resulting in a surplus between productionand consumption and lower prices. Although some zinc mills in the EU have had to close due to rising energy prices, China’s increased production will help offset the decline in Europe.

Zinc prices are expected to fall after the seasonal increase due to expected overproduction. Between December 2021 and January 2022, the average price of high-grade zinc with a purity of 99.95 percent rose 6 percent to $3,599 per tonne, a 14-year high. This year, costs are expected to fall 4% to around $2880 per tonne.

You need to keep up with advances in the marketplace so you don’t miss out on profit opportunities that come from choosing what’s best for you. If you’re thinking about investing in zinc, or if the price of the metal is affecting a company, the easiest way to find out is to look at price data over time and check how it’s changed. You should only use data from the most reliable sources, such as the CME Group.

What is the CME Group?

The CME Group helps you gain insight into the commodities markets and make better informed decision by providing live, global reference prices.The CME Group Market Data Center offers comprehensive, real-time market data services including agricultural and energy indexes, futures prices, options prices, key economic indicators and real time tickers.

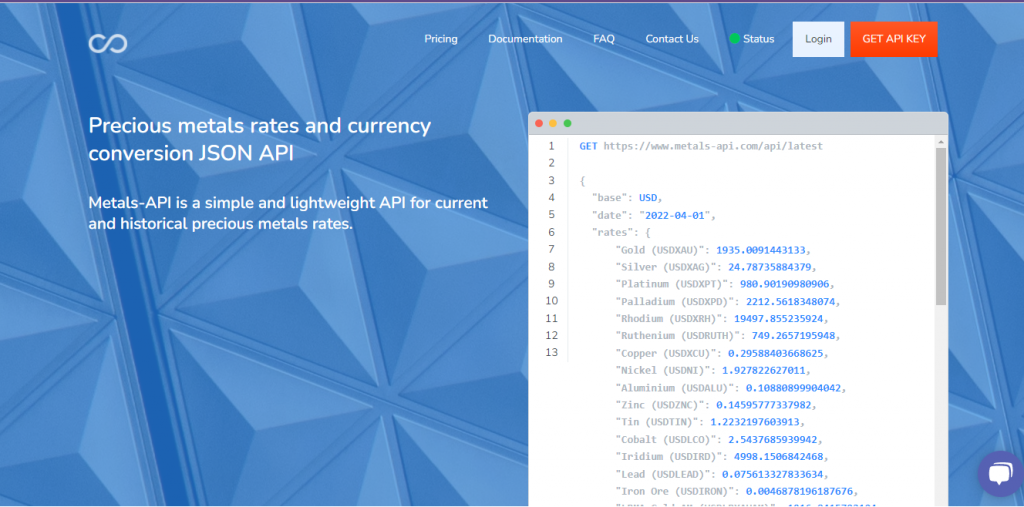

There are various APIs that provide metal data on the internet, but not all of them are the best option to help you to invest. Finding an API is easy. However, finding one that offers Zinc prices from CME group is more difficult. Unfortunately, not all of them use the Shanghai market to transmit rates. Zinc rates may be found at Metals-API.

About Metals-API Features

This API contains information about zinc, gold, palladium, and HRC steel, among other metals. You can also track the values of these metals in over 170 other currencies, such as USD, EUR and BTC. It collects information from well-known financial institutions. COMEX/NYMEX rates are also available. It is also used by companies of different sizes, such as Barrick Gold, a global mining company.

This API provides real-time precious metals data with an accuracy of 2 decimal places and a frequency of 1 minute. Using current and historical prices, you can examine indicators and determine the optimal time to invest. For this purpose, Metals API can also be used to determine data fluctuations.

If you have any questions, remember that you can find a manual on how this system works on the website. But if you do not understand something, you can contact the customer support via virtual chat.

IF YOU FOUND THIS ARTICLE INTERESTING, PLEASE CLICK TO READ MORE:

Step By Step On How To Get Precious Metals Rates With An API – TheStartupFounder.com