Continuous contracts are the cornerstone of futures trading analysis. To navigate the Copper Continuous Contract market effectively, we must first grasp the concept of continuous contracts and their importance. In this article we are going to talk about an API that will give you the information that you need about the copper market!

Day trading involves making short-term trades within the same trading day, while swing trading aims for more extended price swings. Choosing the right strategy depends on your risk tolerance and goals. This is why we recommend trying a Commodities API. Traders can adopt trend-following strategies to capitalize on established trends or reversal strategies to catch price reversals. Each approach has its merits and risks.

What Are Continuous Contracts?

Continuous contracts, in the context of copper trading, are seamless connections between individual futures contracts. They allow traders to analyze price trends over extended periods, smoothing out the gaps that occur when one contract expires, and another takes its place.

Why They Matter in Copper Trading

Continuous contracts provide a more accurate picture of copper price trends. By stitching together various contracts, traders gain insights into long-term patterns, making informed decisions in this volatile market.

The Copper Continuous Contract market has a rich history that dates back centuries. From its early use in barter systems to the establishment of formal exchanges, copper trading has come a long way. Examining significant events and shifts in copper trading, such as the advent of electronic trading platforms, helps us understand how the market has evolved and adapted to changing times.

Copper’s widespread use in various industries, from construction to electronics, makes it a reliable barometer of global economic health. Rising copper demand often indicates economic growth, while declines can signal economic challenges. Economic indicators, such as GDP growth, manufacturing output, and construction activity, directly influence copper prices. Keeping an eye on these indicators is crucial for copper market analysis.

Commodities API

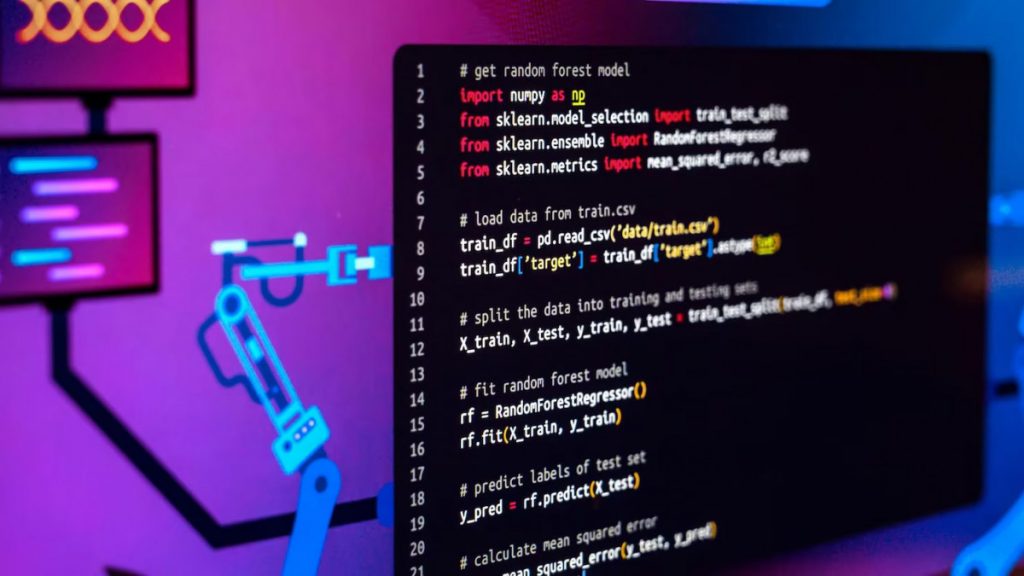

Initially, banks and the stock exchange delivered commodities rates via Commodities-API, a straightforward, lightweight Open-Source API. With a frequency of up to every 60 seconds and an accuracy of up to 2 decimal places, the API can supply real-time commodity data. Offering exchange rates for virtually any good, translating between single currencies, providing time-series data, and producing volatility statistics are just a few of the features.

Internet connectivity is available from 10:00 am to 7:00 pm (EST). The customer service team will assist you if you contact them by email or the contact form. The typical response time for urgent requests is a few minutes.

You can access a variety of data by simply passing your unique Access Key as a query argument to one of the 5 primary API Endpoints. An example of the type of answer you would get from the “Latest Rates” endpoint is as follows:

{"data":{"success":true,"timestamp":1694201040,"date":"2023-09-08","base":"USD","rates":{"XCU":4.3057050592034},"unit":{"HG00":"per ounce"}}}

We can extract the following information from the response, 4.3057050592034 ounces of Copper Continuous Contract (HG00) are equal to one dollar.

The API is used to compile real-time commodity pricing information from over 15 trustworthy data sources. Banks and providers of financial data are some of the sources. Using the same API endpoints, any quantity can be translated between any two commodities, any two currencies, any two commodities, and any other two commodities.