In today’s fast-paced financial landscape, the Market Indices Data API is revolutionizing how traders, analysts, and businesses analyze market trends. This powerful tool offers real-time access to comprehensive market data, empowering users to make informed decisions quickly and effectively.

How to Use the Market Indices Data API

Using the Market Indices Data API is straightforward, making it accessible for both beginners and experienced analysts. First, you need to sign up for an account on the API platform. After you have your API key, you can begin making requests for data.

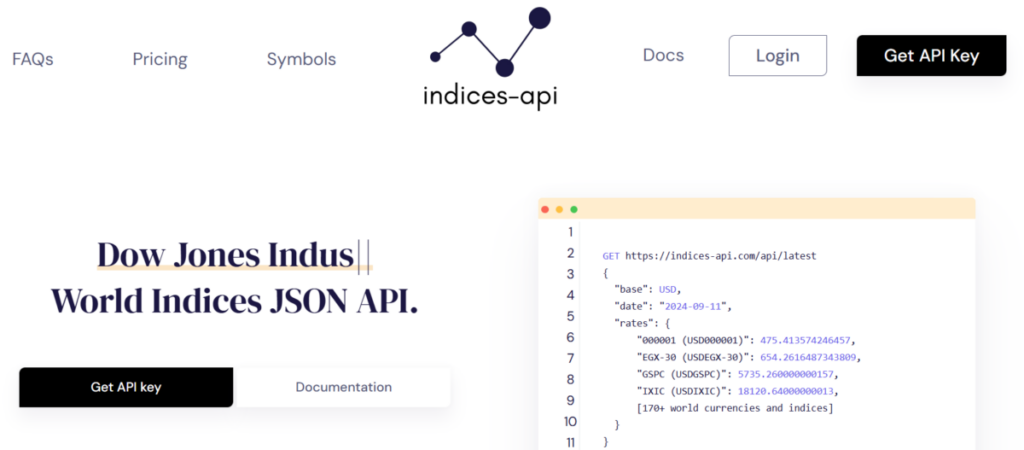

To retrieve market indices data, you’ll typically make HTTP requests to specific endpoints. For example, you can fetch current values for indices like the S&P 500 or Dow Jones by sending a simple GET request. The API will return data in a structured format, such as JSON or XML, making it easy to parse and integrate into your applications.

Moreover, the API supports various parameters, allowing you to filter results by date ranges, specific indices, or data types (like historical or real-time). This flexibility means you can tailor the data to suit your specific analytical needs.

The Impact of Market Indices Data API on Market Analysis

The Market Indices Data API has had a profound impact on how market analysis is conducted. Traditionally, analysts relied on static data reports or cumbersome data scraping methods, which could lead to delays and inaccuracies. With this API, users gain immediate access to live data, which is crucial for making timely investment decisions.

One of the standout benefits of the API is its ability to provide real-time updates. Traders can monitor price movements as they happen, allowing for rapid reactions to market changes. This immediacy not only enhances trading strategies but also minimizes risks associated with outdated information.

Furthermore, the Market Indices Data APIs offers historical data that is invaluable for trend analysis. By accessing years’ worth of data, analysts can identify patterns, assess volatility, and predict future movements. This historical perspective is essential for long-term investment strategies and risk management.

Customization and Integration: Key Features of the Market Indices Data API

Another significant advantage of the Market Indices Data API is its customization capabilities. Users can tailor their data requests based on specific indices, geographical regions, or even time intervals. This level of customization allows for a more focused analysis, enabling traders to hone in on relevant data without sifting through extraneous information.

The API is also designed for seamless integration with other financial tools and platforms. Whether you’re using Excel for spreadsheets or building a custom dashboard, the API can easily plug into your existing systems. This interoperability means you can aggregate data from various sources, enhancing your overall analytical capabilities.

Future of Market Analysis with the Market Indices Data APIs

As technology continues to evolve, the role of the Market Indices Data API in market analysis is only expected to grow. With advancements in machine learning and artificial intelligence, we can anticipate even more sophisticated analytical tools powered by this data. For example, predictive analytics could harness historical trends from the API to forecast future market movements more accurately.

In addition, as more businesses recognize the value of real-time data, we can expect increased adoption of APIs across various industries. This shift will lead to enhanced decision-making processes, not just in finance but also in sectors like retail and manufacturing, where market trends directly influence strategies.

Conclusion

The Market Indices Data API is undeniably changing the way we analyze markets. By providing instant access to critical data and offering customizable features, it empowers users to make smarter, faster decisions. As the financial landscape evolves, embracing tools like the Market Indices Data APIs will be essential for staying ahead in a competitive environment.