A Market Indices Data API plays a pivotal role in providing traders and investors with real-time, accurate market indices. With the help of the Indices API, traders can enhance their strategies by using up-to-the-minute data on market movements. This article will explore how the Market Indices Data API can transform trading by offering accurate, actionable insights for real-time monitoring.

How to Use the Market Indices Data API for Real-Time Monitoring

The Market Indices Data API is a powerful tool that allows users to access live data from global financial markets. With the API, traders can obtain real-time updates on a variety of market indices such as the S&P 500, Nasdaq, Dow Jones, and others, ensuring they have access to the most relevant and timely data for decision-making.

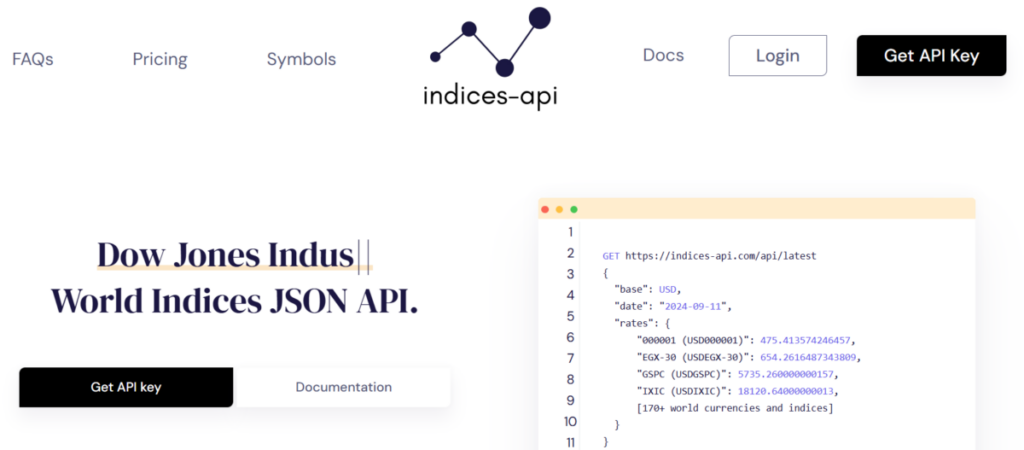

To begin using the Indices API, you first need to sign up for an API key. This key grants you access to the real-time data streams that the API offers. Once integrated into your trading system or application, you can use it to pull data such as current index values, historical data, and market trends. The API allows for seamless integration with various platforms, making it a versatile tool for traders who need to keep a pulse on market movements throughout the day.

By using the Market Indices Data API, you can automate the monitoring process, reducing the time spent manually tracking indices and instead focusing on developing strategies based on real-time data.

Benefits of the Market Indices Data API for Traders

Real-time market data is a game-changer for traders. The Market Indices Data API provides several key benefits that can enhance your trading strategy.

1. Accurate, Real-Time Data

The core benefit of the Indices API is the accurate and immediate access to real-time market data. Financial markets are volatile, and even a few seconds of delay can affect the outcome of a trade. With the Market Indices Data APIs, traders can act quickly and decisively, ensuring they are making decisions based on the most up-to-date information available.

2. Comprehensive Market Coverage

The Indices API covers a wide range of global market indices, offering a comprehensive overview of multiple regions and sectors. This allows traders to monitor indices like the S&P 500, FTSE 100, Nikkei 225, and more, all from a single platform. By tracking different markets simultaneously, traders can identify global trends and correlations that may influence their trading decisions.

3. Customization and Flexibility

The Market Indices Data APIs is designed to be flexible and customizable. Traders can filter data based on specific parameters, such as index type, time frame, or market sector. This means you can tailor the data you receive to match your particular trading strategy or investment goals, giving you more control over how you approach market analysis.

4. Enhanced Trading Strategies

Having access to accurate, real-time data allows traders to develop more effective trading strategies. Whether using technical analysis, algorithmic trading, or just monitoring market sentiment, the Indices API provides the foundation for informed decision-making. Traders can set alerts, track performance, and respond to market conditions as they happen, ultimately increasing their chances of success.

How the Market Indices Data APIs Improves Market Monitoring

Effective market monitoring requires more than just looking at market indices occasionally. Traders need up-to-the-second updates, especially when engaging in high-frequency or day trading. The Market Indices Data APIs ensures traders are always in the loop, offering data that reflects changes in the market as they occur.

Through this API, traders can implement automated systems that analyze market data in real-time. These systems can then trigger buy or sell orders based on predefined criteria, saving time and reducing the chance of human error. Additionally, real-time data can be used to perform technical analysis, track historical performance, and spot emerging trends, all of which are critical for successful market monitoring.

Conclusion

Incorporating the Market Indices Data APIs into your trading strategy is a smart move for any trader looking to stay competitive in today’s market. The ability to access real-time, accurate market indices data is essential for making informed decisions and developing effective trading strategies. With the Indices API, traders can monitor global market movements, adjust strategies quickly, and ultimately improve their chances of success. Whether you are an experienced trader or just starting, leveraging the power of real-time market data is key to staying ahead of the curve.