Do you want to invest in precious metals but need a starting base? Read this article and do it through this precious metals API!

When financial market changes worry investors, precious metals have always been seen as the go-to secure asset. However, throughout 2022, they demonstrated a positive trend that drew investors from a variety of categories. Why is this? why it is advantageous to invest in precious metals.

For years, those wishing to diversify their financial portfolio have been told that buying precious metals is an almost guaranteed bet. Because of their recent increase in behavior, precious metals are an investment plan to consider, even if their profitability is not 100% assured because they are impacted by market swings.

Investors are looking for a haven asset that provides them with a better level of security and peace of mind as a result of the financial market being affected by the times of uncertainty that mankind is going through. The post-COVID-19 years were accompanied by an increase in inflationary tensions that had not been observed since the years preceding the financial crisis. As a result, commodities took center stage, acting as a buffer against the 2020 dilemma and the ensuing structural supply issues. Metals were no different.

With the invasion of Ukraine by Russia in 2022, prices will rise much more. Aluminum, steel, and particularly nickel prices have increased significantly in metals where Russia is a big participant. However, despite all, a lot of people invest in the acquisition of metals, which does not seem like a particularly well-known activity.

Platinum, gold, and silver are regarded as precious metals for the purposes of the applicable rules in this case, as are alloys made of these metals with one another or with other metals in such a way that the precious metal content achieves a specific proportion. lawfully sanctioned. Therefore, in the following, we describe the kinds of metals that are being bought and their prices:

- Palladium: rare metal that few would consider a smart investment, yet it is incredibly precious and has even risen to heights comparable to the price of gold.

- Copper: utilized in the production of jewelry and is employed by all industries even though it is not regarded a valuable metal per se. This is because it is the second-best conductor of electricity after silver. After iron and aluminum, this is the metal that is utilized the most worldwide.

- Silver: Silver is more malleable and harder than gold. It is also more brittle than gold. Although it is also used in electrical circuits, for the photography and chemical industries, and to manufacture coinage, its primary uses are in jewelry.

- Platinum: valuable metal with a high value because of its exceptional purity and beauty. Its catalytic characteristic, which accelerates chemical processes, is one of its key advantages.

- Gold: the priciest metal in the world. It is resistant to the majority of corrosive substances in addition to being an excellent conductor of heat and electricity. Jewelry making and coin production have been two of its principal applications.

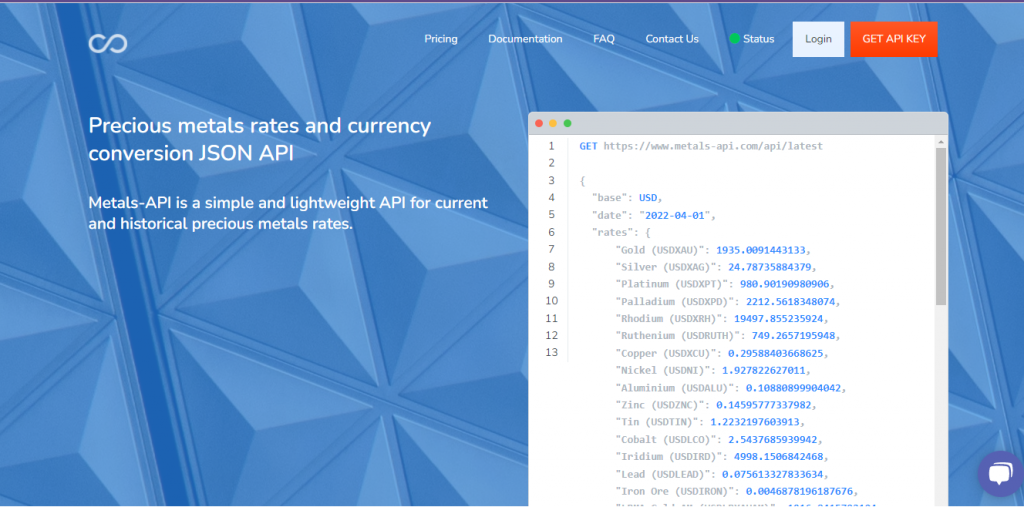

To decide and invest in one of these precious metals, we invite you to use platforms that are dedicated to exchanging financial data for those who live from trading metals. An example of a site like this is Metals-API.

What Is Metals-API?

Metals-API It is a simple software package that is lightweight and gives you access to historical and current precious metals pricing from banks. The Metals-API platform was created with a solid technology foundation and provides you with precious metal exchange rates and currency conversions.

How Simple To Use Is It?

The Metals-API website is very user-friendly. All you have to do is adhere to the following guidance:

-Create an account and make an API key.

-Select the metal and currency of your choice.

– Submit an API request using the panel, and the program will provide an API answer in return.

Is It An Unerring Site?

Metals-API obtains monetary information from organizations and financial data sources, such as the European Central Bank. Since the connection is secured with 256-bit SSL encryption of the highest caliber, it is as secure as a bank.