Are you looking for the copper spot price? In this article, we suggest staying up-to-date with this wonderful API that we propose here!

According to several sources, even in the best-case scenario for copper output, when mines can complete projects as scheduled, there may still be a 6 million tonne copper deficit. The typical ore grade for copper mines has fallen, increasing operational costs.

Social and political pressure to cease or nationalize mining is present in certain copper-mining nations. Miners must invest in supply and seek to overcome these difficulties since demand is expected to increase.

Over the next two decades, the transition to clean energy will be a major factor in the rise of the copper demand, notably in the power and transportation sectors. Due to its electrical and thermal conductivity, copper is a key metal for energy transition.

New mines will need to open, notwithstanding the relatively moderate rise in world production. On the way to net-zero emissions, more recycling capacity will also be required to prevent a supply shortage.

According to some estimates, the yearly demand for refined copper is expected to increase by 53% to 39 million metric tons between 2022 and 2040. The electrification of transportation and the infrastructure sector will be the key drivers of this expansion.

Copper Forecast

China’s share of the world’s demand for refined copper may drop to 44% by 2040 from the current 2021 level of 53%. This reflects increased demand from the economies of the United States and Europe, which have generally had slow development.

If additional funds do not come online, there will be a serious deficit of primary copper output by 2040. A protracted supply shortage might cause prices to rise for a protracted length of time. Increased infrastructure costs and a lack of raw materials, would hinder the rollout and uptake of clean technology.

Over the main economies of the globe, a potential recession is looming. Although a downturn in the economy can happen to reduce the growth of copper demand, it may also lead to more investment in post-recession supply.

Invest In The Metals Market With An API

With what has been exposed here, we can see that there are many issues to take into account when investing in copper. From the global economic situation to the decisions that each country makes, especially if it has significant involvement in the use of this metal.

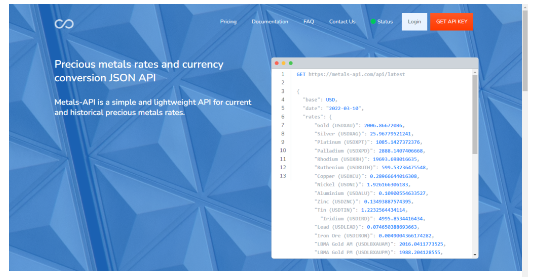

For this reason, it seems important to us that you can see the current prices of copper. In this way, you will have more elements to decide how to invest. With an API you will be able to obtain all the updated information from legitimate sources. Here we recommend Metals-API, whose response is like this:

About Metals-API

Metals-API provides information on current and historical prices, fluctuation data, and futures contracts. It has very complete documentation to observe different types of data on the metals market.

In this way, you will be able to invest better in this industry and advise others to do so. This way you will become a great source of trust for providing important information about this market.

You can incorporate the information in the currency you want into your website and applications. You will not have problems with the integration of the API since you cna use it in different programming languages.