If you want to take into account the lithium price fluctuation you may check all current information on this metal. With this API you can obtain all the information.

The best way to use lithium will depend on everyone’s capacity to collaborate rather than just on each nation. Given that Latin America has the greatest reserves in the globe, it can be claimed that the region has an edge right now. In historical terms, the region’s battle for industrial leadership has just begun, and what lies ahead will help the sector in the years to come.

Production And Consumption Of Lithium

More than 56% of the lithium in the world exists in Latin America. Without including Mexico, The world’s greatest deposits are in Bolivia. There are approximately 89 million metric tons of lithium worldwide.

Only the Salar de Uyuni region in Bolivia is home to 21 million of those people. With 18 million, Argentina is in the second position, ahead of Chile (9.8 million) and Mexico (1.7 million). Peru (880 thousand) and Brazil are listed below (470 thousand). 62% of the world’s lithium deposits exists in these five nations. In addition, Bolivia, Argentina, and Chile concentrate almost 90% of the world’s lithium, if just the lithium derived from brines is taken into account.

However, the truth is different when it comes to manufacturing. In Latin America people only produce 31% of the total. With 24,3% of the total, Chile, 5.8% from Argentina, and 1.4% from Brazil all contribute. The world’s greatest producer, Australia, accounts for 51.5% of the total and has the fifth-largest reserve (6.3 million metric tons).

Over the past ten years, the average annual increase in the demand for lithium for the production of electric batteries was 10.6%. It accounted for at least 74% of the total in 2021. The world’s demand for strategic minerals will gradually and significantly rise. It will happen as a result of the so-called “electromobility” and the energy transition that the planet will go through in the coming decades.

Argentina has seized 28% of the economic money produced by mining businesses that mine lithium in the previous 10 years. This is according to data on the region’s income from lithium exploitation. This is where Chile comes in at 36%. In the upcoming years, the States may be able to take home a larger portion of the profits generated by mining companies: 63.7% in the case of Bolivia, 57.4% in Chile, and 44.3% in Argentina.

Get Lithium Price Fluctuation With An API

To invest in both this and other metals, it is necessary to be aware of prices moment by moment. It is important to get them from legitimate sources and follow them second by second to get a clear picture of the metals market.

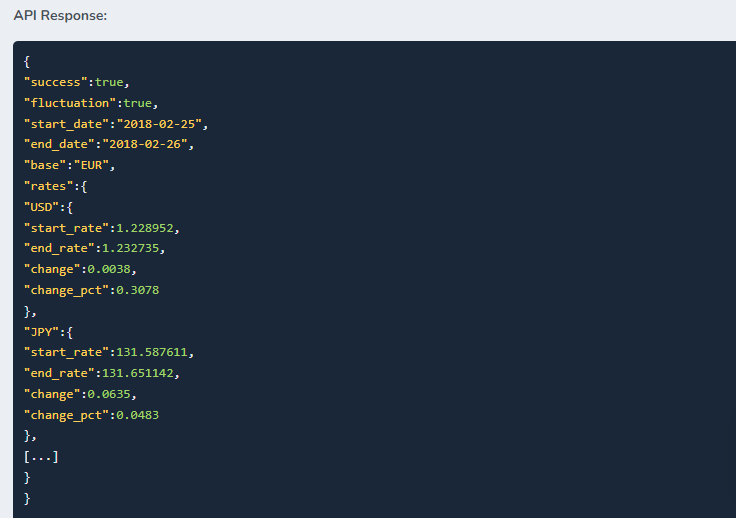

This also allows you to analyze the fluctuation of metal prices. With all this information, you will be able to better evaluate all the factors that influence this market, and thus decide the best time to invest.

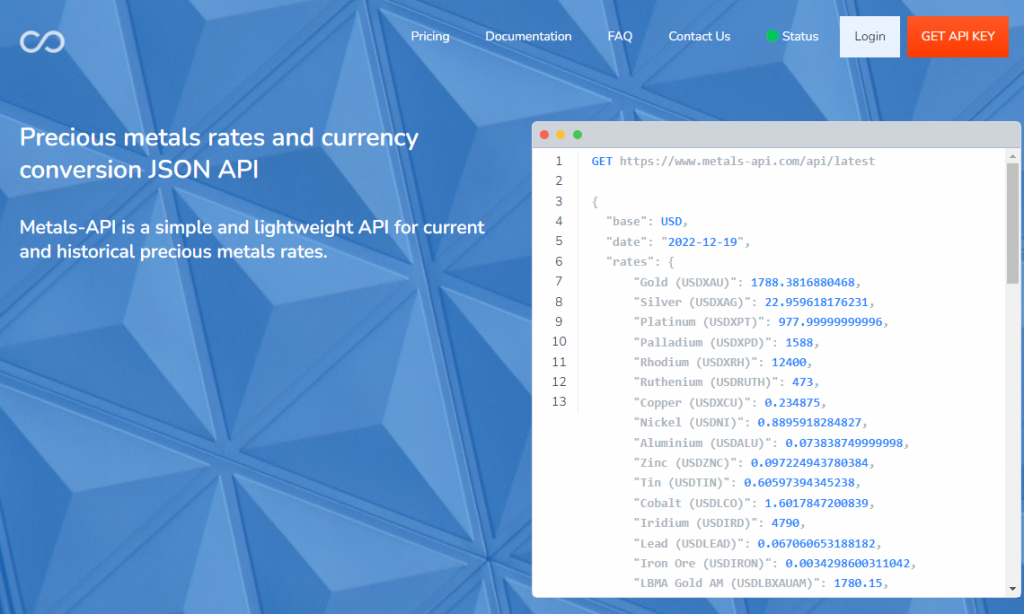

If you want to be a market expert, you have to use an API that constantly updates prices and provides you with all the necessary information. Metals-API will help you do this. One type of response that gives the same is like this:

About Metals-API

Metals-API obtains information from the World Bank and LBMA. That is why it is one of the companies with the most accurate data regarding the metals market. In addition, programmers use it to include their information on pages that advise investors very easily.

They can include all the information in the programming language they want. In this way, they will get new clients and retain the old ones since they will trust that you will guarantee them all the necessary information to invest.