Are you looking to have real-time information about metals’ prices? Read this article to learn why APIs are the easiest and most reliable way to do it.

The price of precious metals has a profound impact on the value of world currencies. Although the gold standard has been abandoned, precious metals, as a commodity, can act as a substitute for fiat currencies and can be used as an effective hedge against inflation. There is no doubt that precious metals will continue to play an integral role in the foreign exchange markets. Therefore, they are important metals to track and analyze for their unique ability to represent the health of local and international economies.

An upward movement in precious metal prices can help exporting countries reduce economic deficits. While importing countries may see their capacity for economic growth reduced. It is common to find that nations maintain reserves of precious metals as a preventive measure against adverse macroeconomic situations in order to ensure their stability. The healthier an economy is, the less need it has to accumulate and invest in precious metals, thus reducing the impact of adverse fiduciary changes on its economy.

Economic reports from central banks, development indicators, adoption of new technologies and trade agreements, and exchanges of precious metal reserves. As well as new national and regional economic legislation, in addition to the price of oil, are usually the main elements that influence the price of precious metals. The main use they have had over the years has been to serve as indices of wealth and stability. However, nowadays, their unique properties and characteristics have become more important.

Their value is also influenced by not-so-positive events, such as regional tensions, the threat of armed conflicts, natural disasters, economic recessions, inflation, and unemployment rates. This increases their value as negative events increase and have a greater impact. However, the trend can change when periods of economic and social stability occur. An even greater influence on the price of precious metals is the sense of security and confidence that investors feel in the viability of the market to remain stable.

Use An API

Markets are a fundamental part of the functioning of the global production chain. Fluctuations in the value of currencies, or precious metals, define the value of a large part of products and the course of many businesses, so it is important to be able to capture exactly where the market is, where it has been and where it is likely to go.

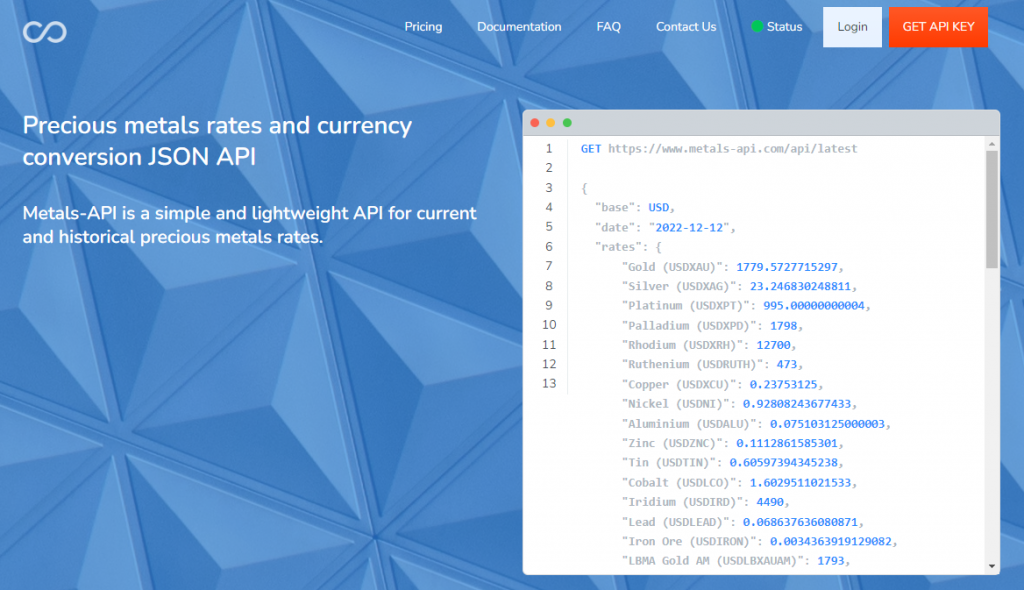

In order to have deep monitoring of market variations, many companies choose to integrate this information into their own digital platforms with the help of programmers. Tools such as Metals-API make it possible to achieve this in a simple way, integrating real-time information from the major markets.

Why Metals-API?

Metals-API is a tool that provides you with a wide variety of options to accurately track the metals market. This API has a high performance as it works with Artificial Intelligence, improving its performance continuously. It is also very flexible and can be adapted to most platforms as it supports most programming languages.

This API has a large database that provides a connection with the most important financial markets in the world such as World Bank or LBMA. It also has a wide variety of endpoints that provide you with many tools for an exhaustive analysis. An example is the possibility to compare exchange rates, or to see the Daily exchange rates, as well as the fluctuations. For easy access to historical and current metals data in the shortest possible time, try Metals-API!