The KOSPI Composite Rates API offers traders real-time, reliable data on the South Korean stock market, specifically the KOSPI index. This API is a vital tool for anyone involved in trading or analyzing South Korean equities, as it provides up-to-date market information, including index movements, trading volume, and historical data.

How to Use the KOSPI Composite Rates API

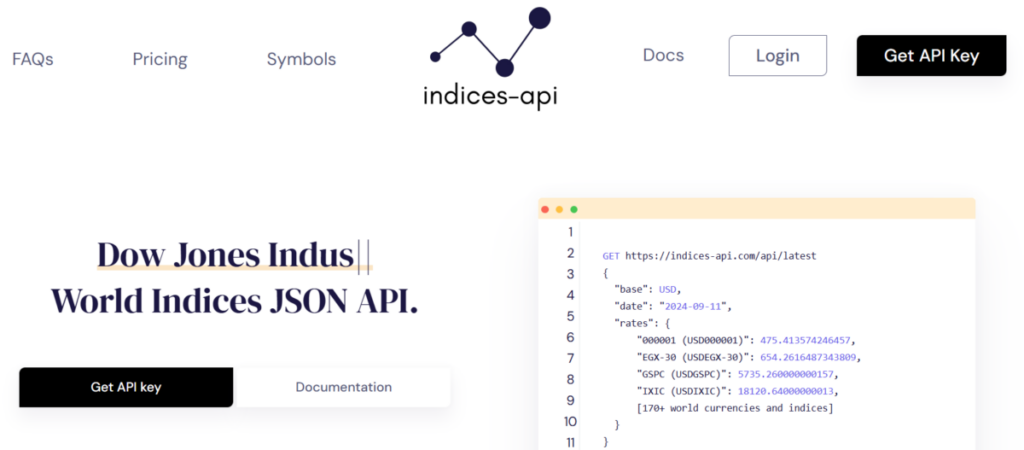

To start using the KOSPI Composite Rates API, you’ll first need to sign up for an API key from the provider. This key grants you access to real-time data and makes it possible to integrate the KOSPI Composite rates into your trading platform or analytical tools. Most APIs, including this one, use RESTful architecture, meaning you can easily send requests to retrieve the data in a straightforward, easy-to-understand format, usually in JSON.

Once you have access, you can request KOSPI index data by querying specific endpoints. These might include daily price movements, historical data, or real-time price updates. Depending on the features offered, the API can provide additional insights, such as market sentiment and trends, that help refine your trading strategy.

For example, if you’re using the API to track KOSPI movements throughout the day, you can monitor key changes in the index, including real-time gains or losses. This helps traders react quickly to market fluctuations, which is critical for achieving success in stock market investing.

The Importance of Real-Time Market Data

In today’s high-paced stock market environment, real-time data is essential for traders. The value of having access to up-to-the-minute market data like the KOSPI Composite Rates API cannot be overstated. This access allows traders to respond immediately to any market shifts, making it a crucial tool for anyone involved in day trading, swing trading, or long-term investments.

With accurate data from the KOSPI Composite Rates API, traders can adjust their strategies, avoid costly mistakes, and capitalize on opportunities they would otherwise miss. For example, if the KOSPI index suddenly experiences a sharp decline due to global events or local economic factors, traders using the API can react fast—either by adjusting their portfolios or pulling out of the market before losses grow too large.

Benefits of the KOSPI Composite Rates API for Traders

The KOSPI Composite Rates API is designed to offer several benefits for traders. By providing access to accurate, live data, it helps improve decision-making and risk management. Here are some of the primary advantages:

Accuracy and Speed: The API delivers real-time data, ensuring that you always have the most up-to-date market information.

Customizable Data: Depending on your needs, you can pull data for specific time frames, historical trends, or even forecast future market movements.

Enhanced Trading Strategies: By using accurate, live data, traders can adjust their strategies based on current market trends rather than relying on outdated or incomplete information.

Risk Mitigation: With access to real-time data, traders can react quickly to market changes, potentially avoiding significant losses.

Global Market Insights: The KOSPI index reflects broader economic trends in South Korea, which can influence global markets. The API offers valuable insights that can help you spot emerging trends early.

For example, if the KOSPI index shows signs of a downward trend due to geopolitical events, traders can adjust their positions before other market participants. This quick access to actionable data is key in today’s global, interconnected markets.

Why the KOSPI Composite Rates API is Essential for South Korean Stock Traders

South Korea’s KOSPI index is a significant indicator of the country’s economic health and the performance of its largest companies. For investors looking to tap into this market, the KOSPI Composite Rates API is a critical tool. It provides a precise and fast way to monitor South Korean stocks, ensuring that investors can make informed decisions that are based on real-time market data rather than outdated information or guesswork.

Additionally, the API allows traders to track both short-term fluctuations and long-term trends, making it useful for different types of traders. Whether you are a day trader looking for immediate market changes or a long-term investor seeking to understand broader market trends, the KOSPI Composite Rates API is an indispensable tool.

Conclusion

The KOSPI Composite Rates API is an invaluable resource for anyone involved in trading South Korean stocks. By providing real-time access to the KOSPI index, it enables traders to make smarter, quicker decisions, enhancing trading strategies and improving risk management. With its accuracy, speed, and flexibility, the API ensures that you always have access to the most current market information, allowing you to stay competitive in a fast-moving global market.