Did you know that you could make investments in Kolkata gold? Do it through this Kolkata Gold rates API!

Gold has traditionally been the most secure sort of investment. Following the worldwide trend, the price of gold has dramatically climbed in Kolkata in recent years. If prices were to drop as a consequence of a more optimistic view for the global economy, it would be prudent to invest in gold now. The commerce of gold has traditionally centered significantly in Kolkata. Due to the city’s affinity with metal, there are many options for buying and selling.

Due to a number of factors, including its high liquidity and potential to combat inflation, gold is among the most preferred assets in India. There are numerous ways to invest in gold, including buying gold jewelry, coins, bars, exchange-traded funds, funds, and sovereign gold bonds.

The great liquidity of gold is another advantage of investing in it. Whether you buy gold physically or through an online investing account, selling it is straightforward. When you need money right away, it may be challenging to sell tangible assets like real estate, but selling gold is simple. It is straightforward to find buyers for both physical gold and gold that you have in the form of gold ETFs or digital gold.

You should think about how inflation may affect your profits while making investments. Gold investments offer protection from inflation. Inflation lowers the currency’s ability to buy things. A negative real return on investment occurs when inflation in India exceeds interest rates on occasion.

Your investment risk is reduced with a diversified portfolio. When developing your savings plan, include products that are not closely related in your portfolio. The total risk and volatility of your portfolio are reduced when you invest in gold.

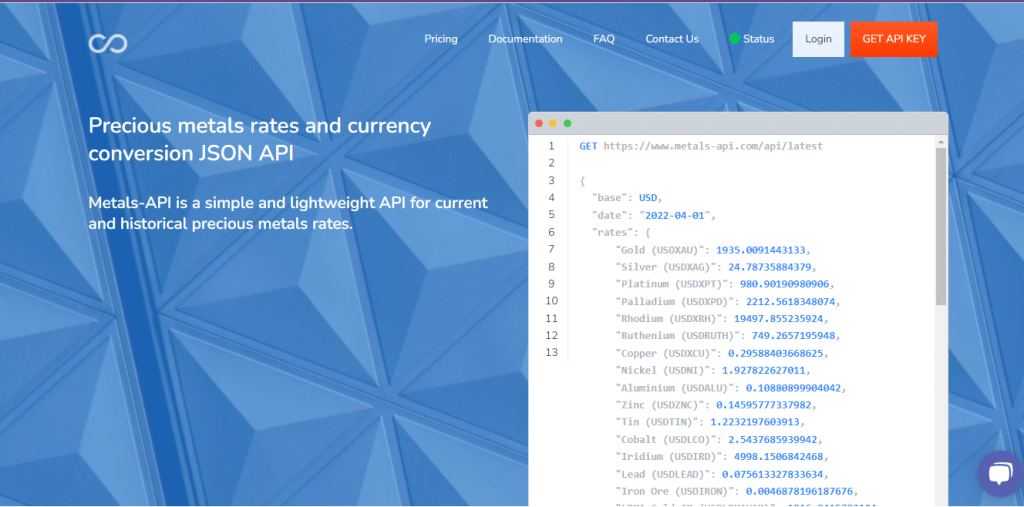

You may invest in gold without buying any physical gold. You may choose to purchase gold online as well. In addition to physical and virtual holdings, there are a variety of asset kinds accessible for investing in gold. You may buy gold physically in a number of ways, including as jewelry, coins, and bars. If you wish to invest in gold online, your choices include digital gold, gold ETFs, and gold mutual funds. These types of transactions can only be carried out correctly with platforms that give you fluctuating movements of precious metals such as Metals-API.

What Is Metals-API?

Metals-API began as a simple, lightweight API for current and historical precious metals pricing provided by banks. With an accuracy of two decimal places, the Metals-API API may provide real-time precious metals data through API at a frequency as high as every 60 seconds. A few of the functions include giving precious metal exchange rates, currency conversions, time-series data, volatility data, and the lowest and highest prices of any given day.

How Does It Work?

Metals-API It is simple to use. Now all you have to do is adhere to the guidelines listed below:

- Make an account on the website

- Obtain an API Key

- Then, chose your symbols you’ll be using on the dashboard.

- Make an API Call to the dashboard.

- Wait for system give you a API Response and use it.

It is Recommended Platform?

Yes, thousands of programmers, small and medium-sized businesses, and significant organizations use Metals-API.com every day. Due to its trustworthy data sources and more than six years of experience, Metals-API is the greatest source for up-to-date precious metals rates.

Is It Safe?

Banks and financial information providers, such as the European Central Bank, are where Metals-API gets its currency data from. Your connection to the Metals-API API is encrypted using bank-grade 256-bit SSL encryption.