If you’re an entrepreneur and you’re thinking about making a profit in commodities trading, you’ve come to the right place. Here’s why.

Silvery-white and glossy, nickel has a little golden hue. Nickel is a hard, ductile metal that belongs to the intermediate group. It is frequently employed as a heat-resistant alloy in the manufacturing of stainless steel and other alloys due to its high melting point. It occurs naturally in the crust of the earth and is frequently extracted for use as ore. Additionally, it can be created artificially by reducing nickel oxides with either hydrogen or carbon monoxide.

Although nickel is typically thought to be a non-toxic element, certain persons may have an allergy to it. Some people may have skin irritation and other health issues as a result of exposure to nickel or nickel compounds. To reduce the risk of exposure, it is crucial to handle nickel with caution and adhere to the right safety practices.

In the world economy and the metal market, nickel is a crucial metal with a big role to play. In addition to batteries, electric guitar strings, and numerous other things, it is utilized in the fabrication of coinage. Additionally, it serves as a catalyst in the synthesis of a few compounds. Along with the manufacture of different consumer and industrial goods, the production of stainless steel and other compounds also depends on it. As a result, the demand for these goods and for nickel is sometimes tightly related.

This metal is traded on a number of metal markets across the world, including the Shanghai Futures Exchange and the London Metal Exchange (LME) (SHFE). Numerous factors, including supply and demand dynamics, global financial conditions, and geopolitical and diplomatic developments, all have an impact on it. Investors can purchase and sell derivative contracts and other financial tools depending on the price of nickel, which is another way that nickel is utilized as an investment vehicle.

Why Use An API To Track Metals Current Price?

Today’s APIs have made a huge variety of tasks easier to perform, increasing corporate efficiency. When managing actual information from other software, they are very helpful. These tools establish an ongoing connection to an external source, enabling access to and querying real-time information.

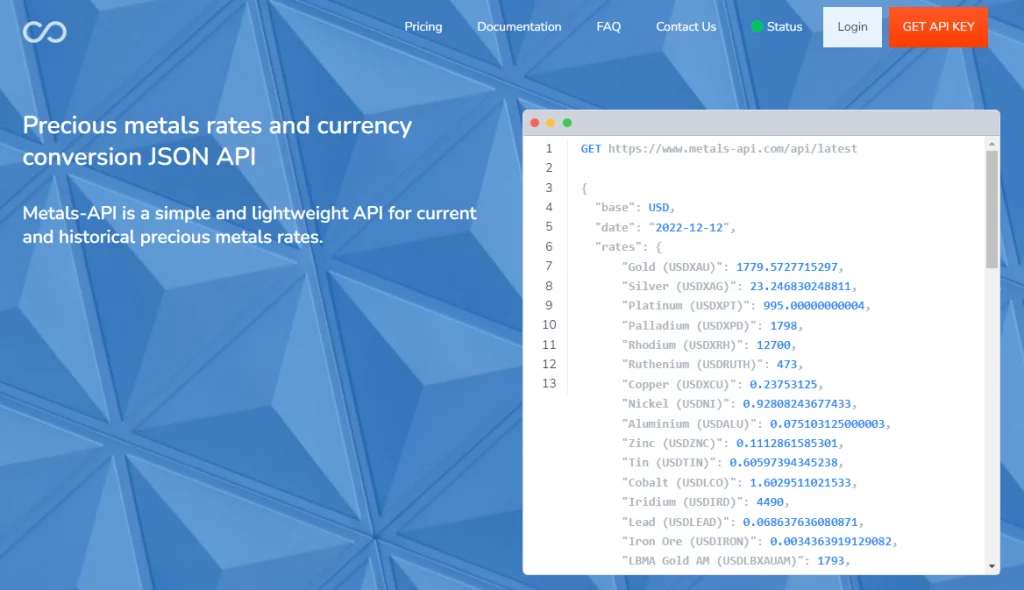

Connections to banks and marketplaces around the world are made possible by precious metal APIs. You can do a real-time or historical query for specific information using various parameters. You can compare data and obtain reports using some APIs. Since there are many other APIs available, we advise you to try MetalsAPI, a well-liked product on the market.

More About MetalsAPI

A platform called Metals API offers real-time data from anywhere in the world. It has precise and trustworthy information because it offers connections to major financial institutions around the world. This tool performs admirably thanks to its AI technology, which enables machine learning engines to get the most out of it. It also enhances its search functionality, making it quicker and clearer.

The spot price and pricing of industrial and precious metals are provided. You can select the sort of currency in which you want the information to be displayed, which is only one of its many excellent features. You may compare data from various dates with it as well. Due to its broad interoperability with the majority of programming languages, it is relatively easy to implement into any platform. Work with MetalsAPI right away.