Does your company work directly with the trading of metals? Incorporate this Metals API and be always in the know.

Metals & Companies

In daily life, we have a large number of tools, technologies, and artifacts that use metals to a greater or lesser extent. This is part of their conformation, as support for the different structures, as well as to be able to provide a utility to their operation. Due to this reason, its extraction and use are important, much more than we think.

Metals are extracted from rocks by different techniques, hardly found in their Pure State, which is also known as Elemental Metal. So, its application in industry is based on the use of combinations that are known as Metal Alloys, which allow its application in different forms and designs.

One of the main applications of metal is linked to its Electrical Conductivity, which is why all electronic and computer articles have different types of metals in their electrical circuits, forming part of the different Power Cables or even for data transmission.

As you can see, metals are essential for the creation and use of a number of artifacts. For this reason, the trading of materials is a popular activity. But, it is important to keep in mind that their prices can fluctuate a lot depending on external factors like wars or economies. Hence, implementing a metals price API is essential.

Thanks to tools of this kind, companies can be up to date and in touch with metals worldwide prices. Therefore, they can know where the market is lower, or higher, when to buy, sell, and so on.

The Fluctuation Of Metals

After the peaks reached in the first part of the year, there has been a significant drop in commodity prices due to various factors. The increasing concern about a possible recession in the main economies of the world; as a consequence of the negative impact of higher inflation on purchasing power; the acceleration in the rate of monetary adjustment of the United States Federal Reserve (FED); the lockdowns in China due to the outbreak of COVID-19; and the risks of energy crisis in Europe, are among them.

This fall in commodities was mainly due to a deterioration in global demand prospects, but also to a mood risk-off (lower risk appetite) in global financial markets

The prices of copper and zinc move according to the expectation that the market has about global economic growth; especially that of China since it represents 50% of the demand for copper in the world. Gold prices move more based on expectations of future inflation, the weakness of the dollar, and geopolitical problems, among other ‘heritage defense’ mechanisms against potential economic and financial crises.

Because of all of these ups and downs, companies must catch any metal price fluctuations. To do so they must work with Metals-API.

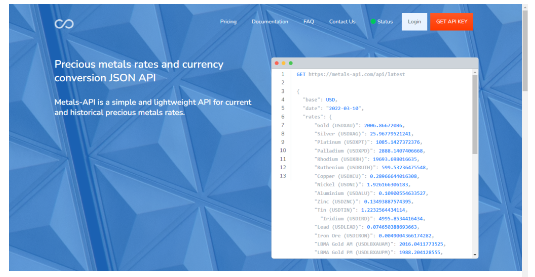

Metals-API

Metals-API is a respected and trustworthy interface for trading businesses. This API makes accurate and reliable pricing possible from anywhere in the world. Due to its global footprint, it will supply metals pricing and updates from all nations.

This metal API also provides consistency, security, and assistance. The source of the price data is a reliable one that also provides financial information. Additionally, Metals-API offers hundreds of unique commodities: gold, cobalt, aluminum, and more

Metals-API offers information on price trends, historical data, all-time highs and low prices, and so on. Additionally, it supports and accepts the majority of currencies, making it perfect for a variety of needs and transactions.